2011–2012 Industry Measurement Survey: Commercial and Industrial Mechanical Insulation Market Moving Forward

The

mechanical insulation industry, and the economy as a whole, continues to

rebound from the recent recession. The recovery is slow and varies by region,

market segment, and even within states. The good news is that the industry is

slowly recovering and the signs are there, although fragile, for continued

moderate growth. The industry is moving forward.

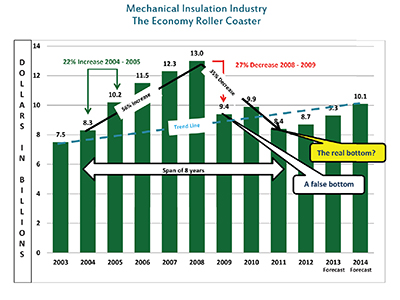

After

years of significant growth (2003–2008), the commercial and industrial

mechanical insulation market saw a decline in 2009 of over 27%. The 2010 survey

indicated that the industry had potentially bottomed out and was beginning to

recover. Like many other industries, we soon found that optimism was unfounded

and we had encountered a false bottom. 2011 yielded a 14.7% decline from 2010,

which—for all practical purposes—erased the gains of 2005–2008. Margin erosion

represented a significant portion of the 2011 decline. It does appear, however,

that the bottom has been reached, with 2012 showing 3.5% growth over 2011.

While the growth in 2012 is encouraging, it is

unfortunately beginning from a smaller base, and the general economic recovery

is still tenuous and subject to sudden change. Thus it is not a question of

whether the recovery has begun, but at what pace it will continue. For the

first time, the industry survey asked respondents to provide information

relative to growth expectations for 2013 and 2014. The respondents were

confident about the recovery and indicated they were expecting, on average, a

total of 7% and 8.9% growth, respectively.

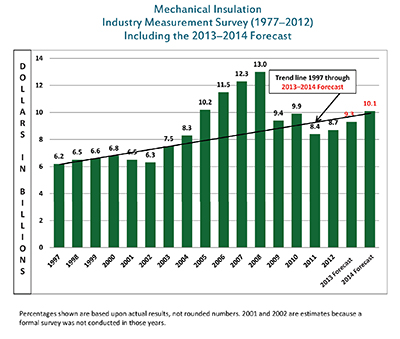

The survey was sponsored by the National Insulation

Association (NIA) Foundation for Education, Training, and Industry Advancement

(Foundation). The goal of the survey is to obtain valuable data regarding

sales, market size, and growth for the U.S. commercial and industrial

mechanical insulation market. Since the first survey was completed in 1997, the

market has shown a net growth that equates to a 2.4% annual compounded growth

rate. While that compounded growth rate may not seem overly impressive, you

must consider that the recent recession drove an industry decrease of over 35%

from 2009 through 2011. Over the 16-year period in which the survey has been

conducted, the range of growth has varied from over 22% in 2005, to a decrease

of more than 27% in 2009. That is a severe variance in a relatively short

period of time.

While

survey results are always subject to individual interpretation, the following

takeaways have been generated through discussions held both before and after

the tabulation of survey data.

- The survey is based upon dollars, not units, and a consistent approach

has been utilized over the 16-year period. Based on the survey methodology, the

results should reflect conservative numbers. The survey does not include data

related to metal building insulation; heating, ventilating, and air

conditioning (HVAC) duct liners; original equipment manufacturer products; building

insulation; refractory products; other specialty insulations; or insulation

products or technologies not currently encompassed in NIA’s scope of mechanical

insulation products. The value added by fabricators and laminators has not been

accounted for, nor has the potential impact of imported products from outside

North America. - The survey is meant to be a national picture for the respective calendar

year. Based upon observations and feedback, there are significant geographical

and product variances in the survey results. This is consistent with any survey

of such a broad nature. - The growth exhibited in 2010 could have been created by a simple spike,

or by completion of backlog carried over from 2008, which would indicate the

decline in 2009 was potentially deeper than originally reported. - The industry declined from its peak in 2008 ($13.0 billion) by 35.4%, to

what we assume/hope is the bottom of the recession ($8.4 billion) in 2011. - Every channel experienced some degree of margin reduction in the 2009

and 2010 reporting period. On average, it is estimated that the decline was 1.5

points. Over 28% of the decline in 2011 is attributable to the margin decline

in the distributor and contractor segments. The margin decline in the

manufacturing segment is not known, but it is expected to be in the same range.

In all likelihood, the decline in 2011 was closer to a 60:40 ratio—60% in units

with 40% margin erosion. The growth in 2012 appears to be substantially all

unit growth. - Accessory products on a dollar

comparative basis to core insulation materials declined similarly in 2011 as in

2010, at 11.2% and 11.9%, respectively, while core insulation product growth in

2012 over 2011 was significantly higher, at 5.0% versus 0.9%, respectively. The

breakdown of the 2011 decline is not known, but it is thought to be reasonably

split between unit decline and margin erosion. The 2012 growth seems to

indicate that growth in interior mechanical insulation systems, generally used

in the commercial market, was greater than in the industrial market, which can

require more extensive finishing systems. - Over 78% of the survey respondents provided input to the 2013 and 2014

growth expectation questions. For 2013, the growth expectations ranged from 3%

to 15%, with the average being 7%. For 2014, the range was 3% to 17%, with an

average of 8.9%. If one omits the overly modest and confident respondents, the

averages are 6.6% and 8.9%. Those expectations seem to be reasonably in line

with the overall commercial and industrial construction market forecast.

However, that also begs the question: has the mechanical insulation industry

forecast taken into consideration the lag time between construction starts and

mechanical insulation installation requirements? The industry forecast does not

differentiate growth expectations between new construction, retrofits, or

maintenance. Historically, forecasts of this nature include a blend of each,

with new construction being the largest percentage. Regardless, the forecasts

are optimistic and refreshing after four rollercoaster years. - Approximately 50% of respondents

separated their growth expectations between unit and dollar growth. Based upon

their responses, it appears that 60% of the growth for 2013 and 2014 will come

from unit growth, and the balance in dollar growth. In other words, an increase

in unit cost—or sales price, depending upon your point of view—is expected to

represent 40% of growth expectations over the 2-year period. The ratio between

unit and dollar growth is good news, as unit growth is important to sustained

growth. - Unfortunately, the survey methodology does not allow for interpretation

between the commercial and industrial market segments. As noted in previous

surveys, the unit increases or decreases were probably led by the commercial

segment, while the dollar increase may have been somewhat equivalent between

the two markets. The decline in export product sales created by global economy

issues would have contributed to the 2011 decline. - The survey readership always requests more information by segment,

region, and a host of other meaningful categories. Obtaining that type of

information, however, is dependent upon survey respondents choosing to disclose

it.

The

last several years have been difficult; although signs of recovery were evident

in 2012, it was a challenging year. All

segments—manufacturing, distribution/fabrication, and contracting—responded to

the challenges, as they have in the past (although it is much easier, and more

fun, to respond to the challenges of growth versus decline). Though the economy

has been problematic in the past few years, the future is looking much brighter,

with the potential for sustained growth.

We

should not undervalue the impact the industry’s educational and awareness

initiatives have had. Without those efforts, the bottom may have been deeper

and the recovery even slower. I would like to extend a sincere thank you to

NIA’s Associate (manufacturer) Members who participated in the survey, the

individuals who contributed to the informal survey supporting data, and to all

the contributors to the NIA Foundation for Education, Training, and Industry

Advancement. The Foundation and your support are making a difference in the

industry.