Recession Readiness: Value Protection Strategies for Contractors

Construction contractor optimism for 2020 is high, and backlogs are strong, but the question on every contractor’s mind seems to be, “When is the next recession?” Former Federal Reserve Chair Janet Yellen believes “there is always some chance of recession in any year.”1 Based on reports from multiple national construction economists, 2020 is forecasted to be a year of continued, yet slowing, growth.

An outlook of slowing growth is supported by FMI Corp.’s projection2 that U.S. construction spending for all sectors will increase from $1.35 trillion in 2019 to $1.46 trillion in 2022. This will be a much more modest growth rate than the national nonresidential increases of 21.1% over the last 5 years, primarily led by strong growth in lodging, office, and amusement and recreation markets. Private office, education, hospital, and warehouse markets are forecast to lead nonresidential construction growth through 2020.

Protecting Asset Value Is Not Limited to the Balance Sheet

Being prepared for a potential recession is more pertinent now than ever. To ensure stability during different economic cycles, contractors should always be focused on protecting the value of their assets. Value protection is a holistic and enterprise-wide effort to protect your strategic resources/assets and is not limited to your financial balance sheet. Your most valuable asset is your human capital—employees are responsible for your ability to make (or lose) money on every project. With workforce challenges topping the list of every industry’s concerns, contractors must formalize their strategies to recruit and retain human capital to succeed in the rapidly changing marketplace.

This is the first in a series of articles on human capital in Insulation Outlook, beginning from a wide viewpoint to address the critical need to have a well-defined strategy in place. In this article, we answer the questions:

- What is strategy?

- How do you evaluate the potential for success?

- Why does strategy matter in a discussion on human capital?

A Well-defined Strategy Is the Starting Point for All Value Protection

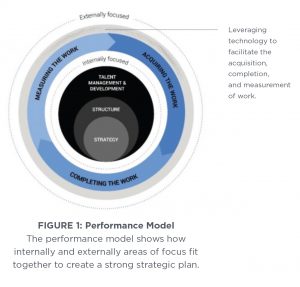

Baker Tilly has developed a performance model that provides a framework for best-in-class business practices (see Figure 1). At the center of the performance model is strategy. In an industry that is rapidly changing due to new technologies, owner demands, tighter project timelines, and workforce shortages, strategy addresses how you will succeed. Having clearly defined strategic initiatives allows your company to be successful in the competitive marketplace. Without defined strategic goals, it is impossible to build an organizational structure and hire or train employees to meet the organization’s

changing needs.

By looking at new markets and diversifying their portfolios, insulation companies can better prepare themselves for an economic downturn. Growth opportunities are unique to each company and may include any of the following:

- Revenue growth,

- Geographic expansion,

- New service lines,

- Merger or acquisition, and

- Bottom- versus top-line growth.

Economic Indicators and Construction Outlook

Economists monitor many different economic indicators when preparing outlooks (consumer price index, interest rates, unemployment, etc.). All market segments experience a continuous cycle of expansion and retraction, the depth and length of which signal a recession.

Contractors should watch changing trends in the markets in which they work and strategically diversify into expanding markets to successfully ride the tides of growing markets.

Strategic diversification happens when you redirect your sales and marketing efforts to align with growing markets, and move away from those in decline. For example, ITR Economics’ ITR Trend Report for November 2019 indicated that both education and hospital spending will experience accelerating growth in 2020, while office and warehouse construction spending is forecasted to significantly slow.3 Companies can take this data and strategically diversify toward education and hospital markets, away from those on a decline. Diversifying your markets can help stabilize your company so that when one market turns, you have others to rely on.

Building a Framework for Strategic Growth

Improving profitability starts with a clear picture of what you want your company to be and answering these key questions:

- Which markets or service line offerings are we pursuing?

- Which customers do we want (or not want)?

- What advantages do we bring to this market?

- Is growth focused on the top line or bottom line?

Answering those questions can give you a better idea of what kind of growth you want to see in the future and where you want your company to be before an economic downturn hits. When you think about your company’s growth plan, making a strategy framework can be a helpful way to keep your vision, mission, and values at the forefront of your mind while including all the different components that go into your plan.

The first step of a diversification decision is looking at the markets that have an accelerated growth on the horizon and deciding which have potential for your company to enter. This process evaluates current competitors and purchasers in that market in order to decide if it is the right fit for your company.

Before you can enter into a new market, it is critical to assess both your internal strengths/weaknesses and external opportunities/threats. This process can give you a better understanding of how your company can compete in the market so you can be more prepared to make decisions about your future growth strategy.

Managing the Risk of Profit Potential

Do you remember the loveable children’s cartoon Bob the Builder? His signature yellow hard hat and red toolbox are as recognizable as his famous saying: “Can we build it? YES, WE CAN!” When presented with a project opportunity, many contractors quickly respond with enthusiasm like Bob’s before thoroughly considering whether taking on the project makes sense for their business.

Thomas C. Schleifer, Ph.D., former Professor at Arizona State University, wrote, “many construction professionals believe they can design or build anything. The pertinent question is, can we build or design it at a profit. Construction isn’t that hard. Construction at a profit is.”4

Being awarded the project often results in the famous adage, “the good news is, we won the project; and the bad news is, we won the project.” Fortunately, there is a better way to evaluate projects that balances the excitement and optimism of a win with the practical need to make a profit.

When in a tough situation like this, many organizations utilize a go/no-go test to evaluate the viability of a potential project, applying criteria such as:

- Prior experience/relationship with the client,

- Geographic location,

- Payment history, and

- Other likely bidders.

However, this test does not include a risk assessment of profit potential. If profit potential is not already a criterion in your business development efforts, consider incorporating a risk matrix into the discussion before saying yes to the next opportunity.

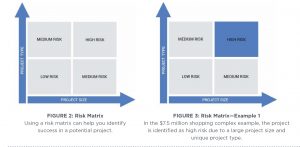

A classic risk matrix such as that shown in Figure 2 is an effective tool for examining a project’s potential success.

Many criteria can impact project profitability; however, the 4 most important parameters relate to how well the project aligns with your previous project success.

- Project size

- Project type

- Geographic area

- Project owner

Consider the following example of how to use the matrix to evaluate the potential risk of a new opportunity. An insulation contractor is asked to bid on a new 60,000 square foot, $7.5 million shopping complex in a nearby Chicagoland suburb. The majority of the contractor’s project experience is negotiated high-end manufacturing construction (average project size of $3.5 million) with an area general contractor, who is the driving force behind the new complex. This is a perfect win-win opportunity for both the client and the company. Now is the time for the company to ask itself, can we build it? Before saying yes, it is

important to evaluate the risk.

To evaluate the 4 aforementioned critical experience criteria that compare profitability and risk, use the risk matrix. Based on the previously described scenario, project size and type are the 2 key criteria to consider because they differ from the contractor’s experience.

Project size: In volume, this opportunity is almost double the company’s average project size. A standard rule is to consider a project high risk if it is more than 10% larger than past profitable projects. The key word here is profitable. A project twice as large as past profitable experience is high risk.

Project type: This project is not comparable to the type of work the company has profitably completed in the past.

Without profitable experience with projects of comparable size and kind of work, this project has a high risk of being unsuccessful or highly unprofitable (see Figure 3).

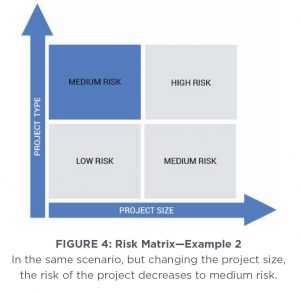

Using the same scenario as above but changing the project size to $4 million (closer to the 10% acceptable increase) results in a considerably different analysis. With the change in the project size, it is much lower in risk (see Figure 4), and other factors—such as relationship with the owner, project complexity, and available resources (manpower, equipment, etc.)—can be taken into consideration when making the go/no-go decision.

While you should consider many factors when pursuing a project, evaluating the risk of the 4 critical experience criteria should be part of the process. It is always exciting to think about new opportunities for your company, but keep Tom Schleifer’s advice in the back of your mind: Rather than considering whether or not you can build it, consider if you can build it at a profit.

Organizational Structure that Supports Strategy

It is critical to have your strategy mapped out before you determine the best structure for your company. A strategy is successful when supported internally by standardized processes and procedures. Management and employees both need to be on board for the new strategy and understand how the company is going to get there. Components of the organization’s structure to review for alignment with future growth include:

- Value-added business systems and process,

- Predictable project outcomes through standardized execution,

- Measurable outcomes, and

- Incentivizing long-term behavior.

Business processes can either help or hinder an organization’s ability to achieve its goals. By assessing current practices, identifying problem areas, redefining the process, defining new measures, and training your employees, you are supporting strategy with predictable and scalable practices.

Defining measurable outcomes is a critical component of change. Measurements could be the number of new prospects contacted, annual revenue, or profit margin. It is hard to know if you have achieved your goal if you cannot measure, and you cannot improve what you do not measure. A future article in this series will address compensation trends and the increased use of performance-based compensation. Defining the measurements that evaluate success is important when considering implementing this compensation strategy.

Diversifying your company’s portfolio can help you stay ahead of the game when an inevitable economic downturn occurs. Remember to align your company’s vision, mission, and values with the strategy. Review the plan on a regular basis to ensure it remains pertinent to your changing business and adapt accordingly—in good times and bad.

Now that we have thoroughly explained the reasoning behind a well-defined strategy being at the core of all business decisions, we will further develop this knowledge in future articles, discussing organizational structures that support strategic goals and the protection and enhancement of human capital.

Sources:

1. Cox, Jeff. “Yellen on Negative Rates: ‘We Wouldn’t Take Those off the Table.’” CNBC, February 11, 2016. www.cnbc.com/2016/02/11/fed-chair-yellen-theres-always-some-chance-of-recession.html.

2. Caulfield, John (February 1, 2019). Building Design and Construction. “Construction spending is projected to increase by more than 11% through 2022.” https://www.bdcnetwork.com/

construction-spending-projected-increase-more-11-through-2022

3. ITR Economics (November 2019). https://www.itreconomics.com

4. Schleifer, T. C. (December 5, 2016). “Go by Your Experience.” Viewpoint. https://fullcircle.asu.edu/wp-content/uploads/2016/04/ENR_Project_Sel_Link_11_28_16.pdf