2012 Construction Outlook

FMI,

a large provider of management consulting and investment banking to the

engineering and construction industry, recently released the

second quarter 2012 Construction Outlook Report. Here are excerpts of

the report’s findings on the construction industry.

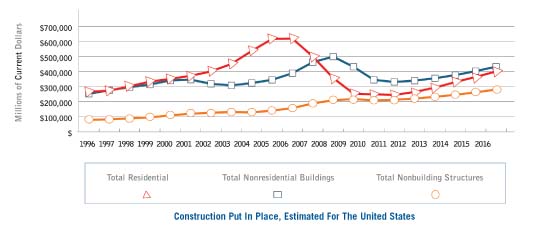

There are some brighter spots in construction, and, overall,

we expect there will be 5% more construction put in place [CPIP] than in 2011,

or around $826 billion. Yes, that is only around the levels reached in

2000-2001, but CPIP will again be more than a trillion dollars by 2014?.

We are slowly seeing signs of improvement in some

fundamentals with housing and even manufacturing scratching out a comeback.

Power construction is also a very active area and not just in shale gas

production. Gasoline prices are down for the moment, helping businesses and

consumers alike… Natural gas production presents both good news and some

challenges as more production helps keep the cost to the consumer down.

However, if the price continues to decline, natural gas use will affect the

growth of alternative fuels and slow down new natural gas mining projects.

Construction Forecast

If 2012 does turn out to

be the turning point for construction, it will be a long, slow turn. That may

prove to be a safer road to recovery than a sharp V or U curve. At this point,

we expect CPIP to grow 5% (to $826 billion) and as high as 7% in 2013 (to

$882.4 billion).That improving growth rate includes a solid recovery in

housing, especially multi-family units, and strong growth in power

construction. Other areas, like commercial construction, will awaken from a

long slumber to resume slower than traditional growth rates but somewhat ahead

of national GDP growth. This is more reflective of population demographics than

a rapid recovery.

Office Construction

After falling for three

years, growth in office construction should be 4% by the end of 2012 and

improve to around 6% for 2013 through 2014. Still, these levels, at around

$35.7 billion to $40.1 billion in 2014, are just returning to levels last seen

in the late ?90s. Reflective of the general insecurity in the economy and new

hiring, the national outlook for office construction is continued slow growth.

Trends

- Vacancy rates changed little,

with the expected release of shadow inventory to keep them high as companies

holding onto office space now look to downsize. - Sustained low growth in rents

make it difficult to justify or finance new office space. - Green construction and energy

savings will be the focus of renovation and new buildings.

Commercial Construction

A slow recovery in

commercial/retail construction has helped to keep vacancy rates from rising,

which is good for building owners collecting rent. Despite a number of ongoing

challenges, commercial construction is beginning to grow again, as we expect 5%

growth in CPIP this year, followed by 8% growth in 2013 to around $49 billion.

Growth will be marred by setbacks as currently some big-box retailers like

Sears, JC Penney and Best Buy are rethinking strategies and closing

money-losing stores. Online retail continues to grow as traditional stores move

online. Even in areas ready to grow again, credit may be hard to find as around

$1.73 trillion in commercial real estate loans mature in the next five years.

Trends

- Lower gas prices will help raise

discretionary spending. - Upscale urban power centers with

name-brand anchor stores show continued strength and grocery-anchored malls

become competitive. - Continued slow growth in

residential construction will help retail stores.

Health Care Construction

Health

care construction growth has taken a bit of a breather in the last two years,

but the market will recover, thanks mostly to the growing needs of aging baby

boomers. While only 3% growth in 2012 is expected, it will strengthen to

double digits by 2015, achieving record highs around $52.6 billion. Uncertainty

and conservatism in financial markets as well as political decisions concerning

the health care bill’s future have put a chill on new construction, but

renovation continues strong. Much new construction will focus on ambulatory

facilities and consolidation of small physician-owned facilities, in part due

to reduced payments for Medicare.

Trends

- Health care construction dropped

10% in 2010 and was flat in 2011. The forecast for 2012 has been revised to

just 3% over 2011 levels. Stronger growth will return from 2014 on. - Aging U.S. population, new

technologies, increased single-bedroom demand and increased health care

consumerism are shaping decisions about new hospital design and location. - According

to the American Society for Healthcare Engineering, seventy-three percent of

construction is currently for facility renovation and modernization to be

greener and more patient friendly and to update IT infrastructure. - Health

care construction will use more modern construction techniques such as

prefabrication, BIM and IPD (integrated project delivery).

Educational Construction

State tax revenues are

again on the rise. According to the National Governors Association and the

National Association of State Budget Officers Survey, “Total state tax revenue

is forecast to rise 4.1% to $690.3 billion in the 2013 budget year.” That news bodes

well for embattled school budgets but doesn’t mean education construction will

be revived right away. FMI’s forecast calls for just a 1% increase in CPIP in

2012 and a slight rise of 2% in 2013. At this point, improving budgets may help

to keep school construction from declining even more, but states also have a

number of other “hungry mouths” to feed, including medical bills, pensions,

roads and bridges to repair and high unemployment.

Trends

- Funding

is increasingly a local responsibility as states cut support and local

government budgets will need to increase property taxes. - Greener schools or renovating

existing schools for improved energy use continues to be a strong trend and

many major universities have announced they will only build LEED-certified

facilities. - Use of prefabricated/modular

school construction will increase. Not to be confused with the “temporary”

classroom units filling playgrounds and parking spaces in growing communities,

manufactured modular school construction has gained in acceptance for school

systems looking to save time and money and improve their green footprints. - Distance learning and online

courses are on the rise. Online degrees from universities specializing in

distance learning are becoming more accepted, especially in a world where

knowledge workers spend most of their time working in the online world. - It will be hard to justify new

schools for states that have laid off large numbers of teachers.

Manufacturing Construction

Manufacturing

construction is demonstrating sound growth after a sharp drop of 33% in 2010

and a weak 2011. The forecast is for manufacturing construction to rise 3% in

2012 and show steady increases to 2015. Although growth has been uneven,

manufacturing production, led by automotive production, has been on the rise.

At 79.2% in April, capacity utilization is returning to normal levels.

Production for utilities has also seen positive gains, especially for natural

gas. Lower natural gas prices will also help manufacturing energy inputs.

Growth spurts have been difficult to sustain, so manufacturers will be cautious

before adding capacity and employees.

Power Construction

Power construction has

been one of the stronger areas throughout the recession and will continue to

grow faster than all but residential construction over the next five years. In

part, that growth will be because of an anticipated gain in residential

construction due partly to population growth and a growing need for power. Even

though homes and industrial needs are becoming more power efficient, we are

increasing the number of devices, such as the potential for more electric

vehicles that will need electric power generation. Our forecast is for a 10%

rise in construction for 2012 and another 10% in 2013 to $108 billion.

Power-related construction is also in flux as to the type of fuel plants will

use, with the rise in shale gas mining and the demise of outdated coal plants.

Nuclear energy is slow to make a comeback due to regulatory concerns for safety

as well as cost. Alternative energy growth will slow as subsidies are removed.

Trends

- Emergence of shale gas supply

fundamentally alters the U.S. energy landscape. - U.S. Environmental Protection

Agency regulations are expected to halt new coal construction, drive premature

retirement of existing coal-generating capacity and support the shift to

natural gas power generation. - The U.S. nuclear renaissance is

on hold outside of regulated markets, as the low price of natural gas redirects

investment. The once foreseen renaissance is now limited to two new reactors

each at Southern Company’s Vogtle plant in Georgia and South Carolina Electric

& Gas Company’s Summer plant in near (sic.) Jenkinsville, South Carolina.

Industry experts anticipate nuclear to retain its near 20% share of generation

going forward, which will spur future investment. - The power transmission and

distribution market remains robust. - Renewable energy is likely to

stall, as incentives are set to disappear. Extension of the Federal Production

Tax Credit (PTC), which makes economics of renewable energy favorable for

producers, is uncertain. The credit is set to expire at the end of the year. As

of April 3, 2012, the Senate voted not to extend the PTC on four separate

occasions in 2012.

Conclusion

Despite the constant

confusion of news from Europe and uncertainty and inaction in the U.S. Congress,

there are some positive signs in the economy. As one might expect, improving

housing construction is helping to lead the way, especially multi-family

housing. However, power construction is another strong point, and even

commercial construction will show signs of rising from its slumber.

Nonetheless, slow growth may be even more challenging than large market drops

or boom times, because it requires improved management, precision market

research, and creative business development.