2012 Strategic Directions in the U.S. Electric Utility Industry

Executive Summary:

Everything Changes While Staying Relatively the Same

In

the 12 months since the last Black & Veatch electric utility industry

report, the industry has seen its primary fuel choice challenged and natural

gas prices drop to levels not seen since 2001. A historically warm winter

across much of the country drove down consumption (and hence revenue), creating

a cash crunch for many utilities. Further, the industry’s hopes for some

progress on the regulation of carbon continue to wax and wane in a U.S.

Congress unable to make a decision.

Yet for all of the changes across political, economic, and

cultural lines, results from this year’s report are strikingly consistent with

those of the past three years in terms of concerns, worries, and the potential

impacts of regulation and other requirements. Perhaps it is the historic focus

of the industry on reliability and safety; perhaps it is a return to

back-to-basics management approaches; or perhaps it is the generally

conservative nature of the industry, which results in this remarkable

consistency from year-to-year.

Black & Veatch conducted its sixth

annual electric utility industry survey from February 22?March 23, 2012.

Analyzed survey responses are from qualified electric utility industry

participants. Statistical significance testing was conducted, and the

represented results have a 95% confidence level.

Utility respondents represented a broad cross section of the

industry and country. The eight mainland regional reliability councils, under

the North American Electric Reliability Corporation, were represented in this

survey. Responses were also grouped by four geographic regions to give

additional insights into geographic differences.

Key Survey Findings

The

industry, according to the survey, continues to hold fast to some fundamental

beliefs: that there will be some certainty on carbon; that prices for

electricity will continue to rise; that, while coal has a future, renewables

have a growing but limited one; and that water is a critical environmental

concern. There is also significant agreement in several areas, and this is

interesting because, typically, a survey of the general public, regulators, and

legislators on the same topics would yield different results. When it comes to

“viable clean energy” technologies, for example, the “big three” that electric

utilities project for 2020 are natural gas, hydroelectric, and nuclear. It is

doubtful that the general public would rate any of those choices as

particularly “green” technologies.

More than 90% of utility respondents believe, however, that

renewables will increase prices for consumers anywhere from 5 to 30%, with the

largest percentage (38%) assuming a 10% increase for their customers. This may

tie to the 65% of utility respondents who reported rate increases during the

past year, and the 92% who reported that the cost of regulations will cause

prices to rise for consumers. More than 60% of utility respondents believe they

will hit their renewable energy targets?but a surprising 25% of utility

respondents stated they do not know if it is achievable. One has to wonder

whether the pending increase in rates, due to renewables, and the potential

demise of the production tax credit are behind this uncertainty.

Reliability, aging infrastructure (not workforce), and the

environment continue their reign as the top industry concerns, followed closely

by the need for long-term investment. Interestingly, security and technology?inextricably

linked in terms of deployment?are tied in the fifth position. While water did

not make the Top Ten Issues list, it did come in second only to carbon

emissions legislation, in terms of environmental concerns. In fact, when water

supply (second) and water effluent (sixth) are combined, they rise to the top

of environmental concerns.

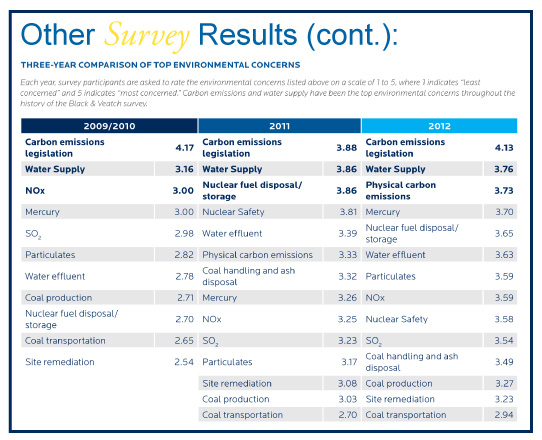

The hope for certainty in carbon emissions legislation is

common across all regions and, as it has been since 2008, leads the ranking in

environmental concerns, followed closely by water supply. Interestingly, when

broken down into the four geographic regions, Northeast respondents rank

disposal and storage of nuclear fuel as their top concerns?an issue that does

not even make the top three in the Midwest, South, or West. The concern over

nuclear disposal, overall, jumped significantly since 2009 when it was near the

bottom of industry issues?likely due to the lingering influence of the

unfortunate incidents at Fukushima, as well as the abandonment of plans for a

national geologic storage facility at Yucca Mountain.

The potential impact of environmental regulation continues to

be a primary focus for utility survey respondents. It is interesting to note

that the survey’s timeframe in March pre-dated, and yet predicted, the U.S.

Environmental Protection Agency’s (EPA) and Department of Interior’s new

hydraulic fracturing rules issued in May. More than 80% of respondents saw this

coming in their crystal balls. Of course, 93% of survey respondents believe

these new rules, and any subsequent rule additions, will have a significant or

slight upward pressure on the price of natural gas. Respondents’ prediction on

the price of natural gas in 2020 showed a virtual tie between $4-$6 per one

million British Thermal units (MMBtu) and $6-$8 per MMBtu. More than one-fifth

of survey respondents (22%), perhaps those who have been around to watch

historical gas price fluctuations, reported not knowing what the price will be

in the same period.

Regulations are also causing concern

regarding the operational effectiveness of utilities as well as concern for

increasing rates. A full 86% of respondents believe there will be impacts on

operational effectiveness, with 16% believing it will be “significant.”

Regulatory impacts are also key drivers in investment, the development of

sustainability plans, and the perception of utilities on Wall Street?either for

stock prices or bond ratings. Concern over whether or not utilities will be

able to recover adequate returns on investment?or any costs for that matter?for

smart grid investments weigh on the minds of utility respondents. This is

especially true now that American Recovery and Reinvestment Act dollars are

almost gone.

Smart grid, which burst onto the survey

scene several years ago, continues to struggle from “a lack of customer

interest and knowledge,” which utility respondents view as the single greatest

impediment to investment programs. Yet, when pressed further, more and more

companies are investing in systems to improve customer communications, which

are driven by smart systems. More than three-fourths (76.9%) will be building

customer self-service websites, expanding their web presence, social media, and

potentially implementing variable rates?all areas in which the smart grid is a

key component or at least a primary enabler. It may be that the grudging

acceptance of intelligent infrastructure is part of the historically

conservative nature of the business, where even “fast followers” are viewed as

radically different and risk-takers.

Regulation at the federal and state/local level is also

influencing the market for merger and acquisition (M&A) activity. The

2011/2012 timeframe has seen three significant mergers and acquisitions and,

for the first time, the Black & Veatch survey looked at the impacts of

these activities. With Exelon/Constellation, Duke/Progress, and Northeast Utilities/Nstar

each at some stage in the M&A process, all utilities are considering their own futures and what these mergers

really mean. The vast majority see financial scale, rather than operating

synergies, as a driving force of profitability in this area moving forward. The

benefits of scale are particularly apparent when considering that regulators

require most utilities to either hand over, or at least share, cost-cutting and

operational savings with customers?especially in light of continued slow load

growth or declining kilowatt hour sales.

Looking at the numbers, the industry has changed remarkably

in some capacities, while remaining steady in its core function. For example,

58% of utility respondents believe, “When fiscal realities are fully considered

in the United States,” there is still a future for coal. This is a significant

drop from the 81.5% who indicated this to be the case in last year’s survey. As

noted within, the industry is taking more environmental concerns into account

than ever before, even though nearly a third (29.2%) believe that global

warming is still “speculative.” It is not unexpected that an industry that

prides itself on reliability, safety, and long-term investment focuses so

intently on certainty, potentially at the risk of missing dynamic changes. It

could be as Voltaire once noted, “Doubt is not a pleasant condition, but

certainty is absurd,” as many more surprises are to come in this rapidly

changing, energy market.

Sidebar: Implications of Domestic Natural Gas

By Greg Hopper

North American natural gas reserves, once thought to be

high-cost and diminishing in nature, have reversed course and now are expected

to serve as a baseload energy source for decades to come. Driving this change

are the technological advances in the exploration and production of

non-conventional reserves, most notably shale gas, which has rejuvenated the

gas industry. The massive scale and accessibility of North American shale gas

has many implications for consumers and businesses, particularly in the

electric industry.

Though the industry is more than 10 years into the

development of shale gas resources, estimates of economically recoverable North

American natural gas have increased year-over-year. Recent estimates by the

Energy Information Administration indicate that technically recoverable gas

resources in the United States exceed 2,200 trillion cubic feet (Tcf). At

current consumption levels, this equates to approximately 90 years of supply to

meet market demands. While the question concerning the adequacy of available

gas resources is now of less interest to industry stakeholders, the location of

specific resources, the cost of extracting them, and the construction of

pipelines to deliver them to market, are now key issues facing gas market

participants.

Finding and development costs for shale resources are heavily

influenced by the properties of the specific shale rocks and the costs of fully

completing a producing well. Technology and improved understanding of shale

formations have cut the cost of production nearly in half in the last 5 years.

Notwithstanding, rising environmental costs are expected to impart upward

pressure on the price of gas over time. The extent to which regional

environmental costs add to price increases may cause shifts in the location of

shale production.

Low gas prices stimulate new markets. In 2008, natural gas

prices at the Henry Hub in southern Louisiana, a primary price reference point

for the global natural gas market, topped $13 per MMBtu. During the price run

up, power generators?driven by emissions concerns, fiscal pressures, and the

need for reliable fuel stocks?pivoted their capital investments for future

generation needs to the development of renewables, nuclear, and clean coal

technologies.

Since that time, rapid shale gas production growth from

multiple supply basins has created a supply “bubble” that dropped the spring

2012 prices below $2 per MMBtu. The drive to produce highly valuable natural

gas liquids in tandem with shale gas has subsidized the cost of producing

natural gas. However, few industry watchers expect prices will remain this low.

Black & Veatch’s most recent energy market forecast projects the price range

will be between $4-6 per MMBtu through 2020. Survey responses align with this

projection, with 37% agreeing that gas prices will be $6 per MMBtu or lower by

2020. In contrast, only 12% expect prices will be $8 per MMBtu or higher.

Lower prices and increasing energy industry confidence that

shale resources are large and sustainable, have positioned the gas industry to

capture the lion’s share of new generating capacity builds for the foreseeable

future. Although renewables and nuclear investments will continue to be part of

the fleet, natural gas is clearly the preferred technology to replace coal as

North America’s primary energy source. In addition to natural gas’ low price,

the decreased price volatility that accompanies its plentiful production

further increases the attractiveness of gas to utility and merchant generators

alike.

Risks center on safety and environmental concerns. Although

the energy industry has gained confidence in the geology and technology

underlying the economics of shale and non-conventional production, concerns

remain about the risks of environmental and political opposition. As noted in

the survey results, more than 80% of utility respondents expect that the EPA

will impose regulations to regulate hydraulic fracturing activity as it relates

to water. In particular, concerns about hydraulic fracturing safety have risen

as numerous federal and state government agencies, as well as public watchdog

groups, have reacted to the rapid growth of shale-gas fields. The opposition

has been greatest in locations such as New York, where there is little or no

prior experience with petroleum resource developments. Common objections have

centered on potential impacts to drinking water supplies, air emissions, and

road traffic.

The most frequent issue cited by opponents of hydraulic

fracturing is the large volume of water required for the process, added

chemicals, and whether the use of these supplies threatens the adequacy of

water needed by other types of users. A report commissioned in 2009 by the U.S.

Department of Energy, the Ground Water Protection Council, and ALL Consulting,

LLC found that a typical shale-gas well requires at least 3 to 4 million

gallons of water for drilling and completion, including hydraulic fracturing.

Water transportation, handling, and the precautions taken to prevent wastewater

spills can be a logistical challenge?especially in Pennsylvania where geology

and regulations do not support injection wells. As such, the transportation of

wastewater to disposal wells in Ohio generates a significant cost.

Research conducted by Black & Veatch showed that shale

gas water costs are higher than those for industrial water in the 50 largest

U.S. cities. As of 2010, shale-gas developers paid at least 1.4 cents per

gallon for source water, and another 11 to 16 cents per gallon to handle the

wastewater. By contrast, the most expensive industrial water associated with

municipalities was 0.7 cent per gallon for source water and 1.7 cents per

gallon for wastewater. This research is consistent with the survey results, in

which 70% of utility respondents expect EPA regulation of hydraulic fracturing

and water use will influence natural gas prices but not substantially. However,

shale gas developers are highly motivated to reduce water costs and have moved

toward recycling and on-site treatment to reduce total volume and

transportation needs.

Evolving Pipeline Infrastructure Needs

The

North American natural gas pipeline grid was primarily built to move natural

gas from the Gulf Coast, southwestern United States, and western Canada, to

consumer markets throughout North America. The emerging shale basins in the

Northeast, predominantly the Marcellus basin located in Pennsylvania, New York,

and West Virginia, have created substantial changes to the movement of gas

supplies across the country. Pipelines constructed to transport gas from Texas

and Louisiana to the Northeast are now experiencing substantial drops in

volume, as Marcellus production grows. In some cases, gas is now being shipped

from the Northeast back to Louisiana to avoid bottlenecks in Pennsylvania and

access the more liquid Gulf Coast gas market.

This shift of supply has in turn created the resurgence of

pipeline rate cases to redesign rates or establish new billing determinants.

Pipelines and their customers are both considering innovative ways to

reapportion cost and fairly allocate risks, as contracting and shipping volumes

change. As increased gas is used for power generation, concern is growing as to

whether adequate pipeline infrastructure will exist to deliver supplies to

power plants on a reliable basis. Numerous studies are underway by various

parties to assess the compatibility of the electric and gas grids and the need

for additional infrastructure investments.

Impacts to the

Electric Industry

Overall, the shift towards natural gas and the growing

resource base in North America are creating price stability and long-term

assurance of natural gas as a generation fuel. Natural gas is now viewed as the

clear leader among clean energy technologies to address greenhouse gas

emissions (natural gas has only 42% of the carbon output of coal) in the United

States. Natural gas is now tied with nuclear when it comes to environmentally

friendly technologies that the industry should emphasize. In addition, nearly

80% of all survey respondents, representing utilities and non-utility

organizations, viewed natural gas as an economically viable technology without

portfolio standards, credits, or subsidies. Comparatively, just over half of

respondents indicated this will be the case for nuclear.

This shift will require different

approaches in obtaining and managing natural gas as fuel to a growing North

American gas-fired power generation fleet. To take advantage of gas supply

resources, utilities must first reevaluate their existing gas supply

portfolios. It is important to learn where flexibilities exist in order to

reconfigure the fuel portfolio to lower costs and to reach shale resource

supply basins. Within the gas supply portfolio, utilities will need optionality

through transportation, storage, and delivered supply. This will allow

utilities to reposition supply access as opportunities arise. Finally,

utilities should explore participation in the natural gas supply chain as an

investor, by bringing demand and capacity commitments to fund additional and

needed infrastructure.

This report was reprinted, in part, with permission

from Black & Veatch. The full report is available at http://bv.com/docs/management-consulting-brochures/2012-electric-utility-report-web.pdf.

Black

& Veatch is an employee-owned, global leader in building Critical Human

Infrastructure? in Energy, Water, Telecommunications, and Government Services.

Since 1915, they have helped their clients improve the lives of people in over

100 countries through consulting, engineering, construction, operations, and

program management.