As The NIA World Turns

The “NIA World” encompasses the commercial and industrial insulation market segment, which includes all facets of mechanical insulation; a significant portion of commercial building insulation; metal building insulation; and a part of the heating, ventilating, and air conditioning (HVAC) market. It is generally accepted that the NIA World does not include the majority of insulation-related activities in the HVAC, residential, original equipment manufacturer, automotive, appliance, aerospace, and other specialty markets. This article explores some of the significant opportunities and challenges the NIA World faced in recent years, as well as the opportunities, challenges, and potential fundamental changes the industry may expect for the current year and beyond.

Recap of the Recent Past—How Did We Get Here?

In 2005, the industry was rebounding from the two catastrophic fiberglass manufacturing facility fires that occurred in 2003, facing concerns over whether there was sufficient manufacturing capacity to sustain long-term demand. The instantaneous loss of industry capacity disrupted supply not only for the fiberglass segment, but for manufacturers of alternative materials as they stepped forward to fill the supply void. The entire industry felt the financial and operational impact of those fires, and lessons were learned: The availability of insulation materials never may be taken for granted, and many changed the way they view supply-chain alliances.

In 2006, there was an increased focus on rising energy costs and the burdens and opportunities they created, with a spotlight on the environment and the sustainability movement. Simultaneously, frustration grew over insulation being the “Rodney Dangerfield” of energy conservation and emission reduction initiatives, garnering little respect.

In 2007, the industry dealt with issues that included acceptance of foreign-manufactured materials, product innovations, the erosion of the mechanical insulation knowledge base, a changing investment portfolio, the shortage of qualified and experienced field labor, and the need for industry benchmarking.

Over the past three years, the NIA World has demonstrated its resolve in recovering from the industry-changing events of 2003 while confronting the challenges of daily business, embracing available opportunities, and creating others. The NIA World has grown stronger than it has been in many years.

2008: A Time To Panic or Hold the Course?

The last three years had a common denominator: an expanding market in a confusing but stable or growing economy. Although 2005 through 2007 were not without their challenges, it was hard to find an industry participant who was not enjoying a good year. People were generally optimistic about the coming years. This article will look at some of the factors expected to affect the industry—positively and, potentially, negatively—in 2008.

This year began with an uncertain economy in an election year. How will that affect the industry? Some profess doom and gloom, while others confront the challenges directly. All will want to take full advantage of the opportunities and generate an acceptable return—the definition of which varies greatly—to their shareholders. One source for this article suggested the subtitle, “My crystal ball is foggy.” To some, a potentially slower growth rate, or a flattening or slight decline in the market, may be a reason for panic. Others see it as an opportunity to strengthen their company for the next surge. There are a host of differing opinions on expected industry growth rates—or lack thereof—for 2008 and 2009. The degree of variance depends on market segment, geography, product line, and whom you ask or what market projections you endorse.

The industry has never been particularly good at projecting growth rates. Regardless of historical perspective, the process for predicting the future is the same: Absorb and dissect all the information available; look at the customer base, backlog, and pending projects; and make an educated guess. Best estimates are submitted to management, where they are assessed as either “sandbagging” or overly optimistic (rare) before being adjusted and released. No one, whether manufacturers, contractors, and distributors—is immune to this process.

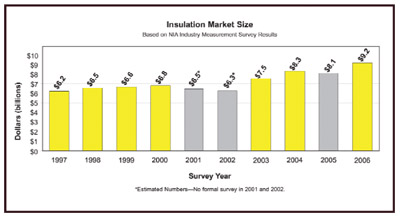

One might ask if mechanical insulation market discussions have become part of the feeding frenzy driven by the decline in the U.S. housing industry, the high cost of energy, and the weakened dollar. These discussions must sound familiar to industry old-timers. For instance, consider the National Insulation Association’s (NIA’s) industry survey for 1997 to 2006. There were some tough times in those years, but the industry continued to expand and improve over time.

The following are a few reasons the overall mechanical insulation market may be stronger than some predict.

- The industrial market is forecast to remain strong through 2008 and the first half of 2009 (potentially through 2009 into 2010).

- The maintenance segment is slowly regaining momentum. Facilities cannot delay needed maintenance forever without creating much bigger problems.

- The commercial sector traditionally lags 6 to 12 months behind the residential sector. Many projects are in varying phases of design and construction. A slower commercial market may not develop until the second half of 2008.

- Health-care facilities and school construction in some geographical areas may not suffer from the effects of a slower economy.

- Although single-family housing starts are down, multifamily housing is up in many areas.

- Opportunities will be generated by higher energy costs bringing renewed focus on the environment and the continuing demand for more power.

- The demand for alternative fuel sources is expected to continue.

- The sustainable building movement is growing, not declining.

- Export opportunities are strong for U.S. products and systems.

- People and companies are beginning to think about insulation differently.

Will growth come from increased units or dollars? Most would agree that in 2008, dollar growth probably will exceed unit growth.

The NIA World is not immune to the effects of the overall economy, and it has its own set of challenges, but it remains a great industry. Two years from now, what will the NIA industry survey reveal about 2007, 2008, and 2009? If historical patterns are relevant, then the industry should trend upward.

Fewer “Feet on the Street” Telling the Insulation Story

While there are always exceptions, overall it appears that manufacturers have fewer “feet on the street.” What’s more, those may not be “happy feet,” given expanded territories, increased responsibilities, and the pressures those developments create. It also appears that they are younger, which is great from one perspective but may be less desirable from an insulation market and product experience perspective.

What is driving this trend? The first thought is cost reduction, but there may be other fundamental changes.

- Ninety-five percent or more—some estimate 98 percent—of all materials flow through the distribution channel. As this percentage has steadily increased and distributors have become more sophisticated in sales, manufacturers have shifted more of the sales responsibility to the distributor.

- Market share among manufacturers of similar products has not changed greatly over the years, especially at the contractor level. If Contactor 1 likes product X, the company more than likely will continue to favor that product. Combine that with distributor relationship preferences, and not much change in market share is driven by increased manufacturer presence on the street.

- The industry has not seen significant shifting of market share among the various product groups (filtering out the impact of major projects).

- Manufacturer product quality and customer service continue to improve, which equates to fewer field problems.

- Experienced “peddlers” are retiring and not being replaced. Their responsibilities are being distributed among others.

- The Internet and other technologies play more of a daily role in the dissemination of information.

- Designers, specifiers, and end-use customers seem to have less time to discuss new products and systems; at a minimum, it is harder to get to see the right person.

The younger generation is bringing fantastic new life into the industry. They are talented and proficient at multitasking. The concern, though, is that they are often spread too thin. As such, their contribution is not what it could be. Overall, product and application experience comes from on-the-job training. The industry has been less than tolerant of that approach, especially when the personnel turnover rate seems to be increasing. Could fewer experienced feet on the street compound the problem created by the eroding knowledge of mechanical insulation at the engineering, architectural, and facility-owner levels? It is something to think about.

Industry Consolidation: Will it Continue and How Will it Affect the Industry?

All indications are that consolidation will continue in all segments, but not at the pace experienced from 1995 to 2005.

Consolidation has changed the industry’s profile and will continue to shape the industry. Insulation industry participants primarily drove consolidation until a few years ago. Now, industry consolidators are competing with investment banking firms that find the industry attractive. Characterizing the mechanical insulation industry as consisting of a group of small to midsize family owned and operated business, sometimes second and third generation, may not be accurate anymore. One thing has not changed, however: The industry is very much relationship based. Consolidation will have a hard time changing that.

One of the most recent notable changes is in the contracting segment. Fueled by the injection of capital from investing firms, “roll-ups” are emerging. Contracting services that encompass mechanical insulation are an example. Larger firms are developing that offer an array of services including scaffolding, painting, insulation, abatement, cleaning, demolition, and mechanical maintenance. Although this strategy appears to have the greatest impact in the maintenance sector, it also will affect new construction. The diversity of services can offer advantages to the end customer. However, some caution customers not to jump to that conclusion too fast.

Can this strategy yield the expected returns to the company’s shareholders and to the ultimate customer? The future will answer that. There is no question it will change certain aspects of the industry. Consider this: Does your company specialize in mechanical insulation and refractory applications, or does it offer those services among many others? If you are a facility owner, would the answer influence your purchasing decision?

Influx and Acceptance of Foreign-Manufactured Materials: What Changed?

The acceptance of foreign-manufactured materials in all product groups has grown since the 2003 fiberglass manufacturing facility fires. Specific information was not available to confirm whether or not the level of imports changed. The general feeling is that direct imports into the United States decreased; however, the wild card is determining the level of product coming in from the U.S. northern border.

One core question still concerns quality verification. This is not to suggest that imported materials are inferior to those manufactured in the United States. This discussion is not focused on manufacturers that are major contributors to the U.S. market and have plants elsewhere; it is focused on materials imported through a variety of other channels.

Companies considering the acceptance and use of foreign-manufactured materials should ask some core questions before making their final decision, beginning with whether the materials are tested and performance measured on the same basis as U.S. manufactured materials. The burden of proof and ownership of the material ultimately lies with the end user, but all participants in the decision-making process will shoulder some degree of responsibility if a failure occurs. A failure of any magnitude, regardless of cause, is detrimental to the industry. Assumption of material equivalence and warranty support could be costly.

Many codes, regulations, and/or specifications require that materials be evaluated in accordance with a variety of tests. However, most do not specify third-party testing or verification. Industry consumers see the tests listed on the data sheet and take for granted that the material was tested correctly and the results are current and based on the material they are receiving. Maybe it is time for the industry to consider the value of specifying recognized third-party testing. The industry has historically self-policed, and that process has worked well. However, times have changed. No one wants to openly challenge another’s test results. When suspicions occur, the resulting discussions are unofficial, take place in quiet corners, and basically are an avenue to vent frustrations without taking any official action. That is probably not the best solution for the industry.

Technology: Is the Industry Embracing Change?

There is no question that the Internet has become the primary communication and information source within the industry. Contractors are receiving more inquiries and drawings via the Internet and on discs. There is some movement toward the Building Information Modeling (BIM) approach. However, other uses for technology (such as online ordering) have not gained the momentum once predicted. Standardized industry bar coding has so far failed to materialize, and vendor-managed inventory systems have not been generally embraced. There are also other examples of how technology has not had the impact and influence in the mechanical insulation industry that it has in other industries.

It appears that companies are implementing varying forms of technology primarily for internal efficiencies and/or cost-reduction purposes. There seems to be reluctance to push for an industry-wide approach to embracing technology for other purposes than improved communications. There are varying opinions as to why that is; however, given the fast pace of technology, that will change over time.

Does a lack of industry-standardized bar coding, nomenclature, units of measure, packaging, and similar items create a barrier? Or is technology simply not being driven from the top down or bottom up, and between market channels? This is a subject worth exploring. Who will take the lead?

The Value of Insulation: Why Not Just Do It?

Industry participants understand the value of insulation, the return on investment (ROI) opportunities, and all of the other advantages that properly designing, installing, and maintaining an insulation system can provide. Why is it so hard to relay that message and convince others to take action?

The problem can likely be summarized into the following broad topics:

- Reduced knowledge base

- Competing initiatives

- Lack of oversight by some governing organization

- Limited available capital

- The need for continually and consistently marketing the value of insulation

Reduced knowledge base. The engineering, architectural, and facility-owner knowledge base of mechanical insulation systems has been eroding for years. This is being driven by multiple developments, including rightsizing, multitasking, attrition, and retirement. In addition, insulation system technology is not being taught; it is merely touched upon in engineering universities, colleges, etc.

As discussed previously, the manufacturing segment of the industry has less experienced feet on the street. Historically, they were the primary industry educators. The Internet is being used extensively for information gathering, but is that sufficient to replace the eroding knowledge base? There is no single recognized and accepted industry standard, guideline, specification, approach, etc. The reduced knowledge base also has yielded fewer “insulation champions” within companies to fight for insulation initiatives, which further compounds the problem.

Competing initiatives. Especially in the field of energy conservation, insulation systems are competing with dozens, if not hundreds, of other initiatives, such as lighting, solar panels, motors, steam management, controls, and equipment efficiency. The insulation industry must compete for maintenance and capital dollars.

As has been said many times, “Insulation is not a sexy subject.” Many would prefer to discuss shiny moving parts, lights, and fancy equipment. The industry needs to understand it has competition and fight for its fair share, combating lack of knowledge and helping people understand the ROI to sell insulation over competing initiatives.

Lack of oversight by some governing organization. Energy codes have not had the impact some had predicted. Some would argue that they are not being enforced. Regardless, energy or other codes do not address many mechanical insulation applications in the commercial building segment and address few, if any, in the industrial segment.

Lack of codes or regulations—or not understanding and enforcing what is there—does not help foster insulation discussions. Codes or regulations should not be the primary driver for increased use of mechanical insulation, but they certainly help draw attention to the opportunity that insulation can provide, increasing the knowledge base and, accordingly, the use of mechanical insulation. Industry participants need to pool their resources and address this matter on a non-biased basis.

Limited available capital. Insulation competes with other initiatives and must fight for capital, whether for maintenance, renovation, or new construction. The selling approach should be modified to include not only the normal expected benefits and simple ROI calculation, but also all of the other financial attributes, such as present value of money, asset appreciation, and cash flow. Mechanical insulation can provide an unrivaled investment opportunity. All industry participants need to demonstrate that story time and time again. They can do that by choosing not to participate in what some refer to as a flat market and by making their own opportunities.

Marketing the value of insulation. Relatively few marketing dollars are expended by industry in explaining the value of insulation. The majority of the marketing dollars, especially on a national scale, is expended by the manufacturers. Some may be sharing a bigger burden than others. Regardless, those marketing dollars focus on creating product specifications or preference, rather than on spreading the message about the value of insulation at large.

Those in the insulation industry should consider whether they subscribe to the philosophy that making the pie bigger and better will ultimately make their slice bigger and better. Or do they want to focus on making their slice bigger and better, regardless of whether the pie grows? What scenario would yield the industry the biggest bang for the buck?

Is it easier to grow the industry with a collaborative approach or an individual company–focused approach? There are many components to this question, but it seems that pooling resources—within all legal and protocol parameters—to promote the value of insulation in an unbiased fashion would allow the industry to compete better with other initiatives, tell the insulation story more effectively, and help stop the erosion of the mechanical insulation knowledge base. Perhaps more companies would look at insulation differently and “just do it.” The industry pie becomes bigger, and everyone’s piece should grow and be more profitable. Maybe the industry should examine a generic, industry-wide marketing program to simply sell the value of mechanical insulation.

It’s All About People

The need to recruit people into the industry, at all levels, has never been more important. Several of the bigger companies have recruitment programs primarily geared toward sales, estimating, and management. Has the industry reached the point where NIA, in conjunction with its members, should have a recruitment program geared not only toward these areas but also toward recruiting tradespeople to consider the insulation industry as a career choice? The NIA World can be a good career choice.

Looking Forward

The NIA World remains strong. Opportunities greatly outnumber challenges, and many challenges are really disguised opportunities. The U.S. economy will affect the insulation industry. But when, to what extent, and for how long?

The industry is expected to post moderate, low-single-digit growth in 2008. Predictions for 2009 do not project any major directional change. Without a doubt, it will be more difficult to manage business and deliver the expected returns, but when has that not been a problem in a troubled economy? The mechanical insulation industry has been there before and demonstrated its resolve to succeed time and time again. Industry members should expect nothing less in 2008, 2009, or 2010.

Several years ago, the industry embarked on multiple outreach initiatives to stimulate growth through education and awareness programs. At the time, industry members had no way of realizing the importance of those initiatives today. Supporting and expanding the scope of those initiatives is more important than ever. That could be one of the greatest industry challenges over the next five years. During struggling economic times, many companies tighten their belts as the first and potentially only line of defense versus strengthening their sales and marketing efforts. With a reduced knowledge base of specifiers and purchasers, the opportunities being driven by higher energy costs, and the increased focus on the environment, traditional approaches may not be the best solution. Now may be the time to invest. Industry members could make their own opportunities, rather than blaming the economy.

Many end-use customers are searching for ways to lower their cost of manufacturing or operations, increase cash flow, and comply with regulatory requirements. This sounds like a good audience and a perfect time to tell the insulation story. The industry must compete for maintenance and capital dollars, and create opportunities.

The Bottom Line

Even with all of the potential challenges, this is an exciting time for the NIA World. It continues to be a promising industry with opportunities that make it a great career choice for the next generation and an investment opportunity for all those who act on it.

SIDE BAR

Other Opportunities and Challenges

Looking to the future, other areas that warrant monitoring for their affect on the NIA World in both the short and long term include the following:

- Vertical integration in the manufacturing sector

- Contractors and distributors increasing their examination of “Greenfield” expansion opportunities, which may create complexities for manufacturers and ongoing industry consolidation

- Product price increases driving the investigation of alternative products

- Sustainable design (“thinking green”) continuing to gain momentum

- The nuclear power industry expanding, with new plants on existing sites

- Product innovation and application techniques to lower the installed cost, and their influence on the market

- The importance of safety continuing to be emphasized throughout the industry

- Crossover strategies being initiated as concerns for the economy continue

- The suggestion that the “Value of Distribution” be revisited—especially the role of the manufacturer and distributor in the channel (what are their mutual expectations and roles in the market?)

- Asset management—capital utilization continuing to be a major focus in all segments

- Electronic forms of training continuing to increase as employers seek to provide affordable education and training

- Expense control possibly taking center stage for many companies in 2008 and potentially 2009

- Succession planning continuing to be of major importance

- Events overseas possibly affecting the U.S. market (especially the mechanical insulation sector) in today’s global economy

- Project scheduling continuing to be compressed, and the percentage of incomplete drawings not being expected to change; some estimate that projects are being bid with only 60 to 70 percent of the drawings complete (and possibly less)

- “Big Box” distributors continuing to struggle to successfully participate in certain industry segments, but probably not aborting their exploratory efforts