Energy, the Environment, and an Optimistic Perspective in 2021

In many ways, the more times change, the more they stay the same. This statement may raise more than a few eyebrows, considering the seismic shifts our world has experienced since I contributed an article to Insulation Outlook in 2019.

Just months after I authored my article about bright prospects for the industrial insulation sector, COVID-19 triggered a severe market shock felt in energy markets and virtually every other segment of the economy. Industrial production was disrupted across sectors, idling assets and leading to historic levels of unemployment. Social distancing and Zoom culture transformed workplaces, bringing travel to a near halt and turning many of our homes into offices. The arrival of economic stimulus checks, coupled with so much time at home, drove consumers to take on long-delayed home renovations, while new home buyers spurred a housing boom not seen in 2 decades. At the federal level, a new administration entered office with a very different agenda for the environment compared to the preceding administration.

So, as we head into the second quarter of 2021, what prompts me to write that times stay the same? Below, I share perspectives on how the energy landscape is likely to change in 2021—and the overriding objective that remains the same.

Energy Conservation Remains a Priority

Despite all the changes brought about by the pandemic and subsequent market shocks, our industry remains in the business of conserving energy. Energy conservation is our purpose, regardless of how that energy is generated. As industry discovers and introduces new technologies to the market—ranging from liquid hydrogen fuels to advances in solar and wind technologies—the challenge of responsible energy use remains. As I have written in these pages before, the cheapest form of energy is the energy you don’t use in the first place. Whether we are talking about homes, commercial office buildings, or industrial operations, insulation is all about the business of helping reduce energy consumption. While alternative technologies focus on ways to generate energy more efficiently, the insulation sector remains focused on how to conserve energy and utilize it more efficiently. And do not forget, insulation is about much more than just saving on utility bills. Insulation also provides acoustical benefits; helps protect pipes from freezing; supports fire safety; and, in these sustainability-minded times, helps contribute to a reduction in greenhouse gases and carbon footprint.

How cool would it be to see a push for building codes that would drive higher levels of pipe insulation or greater R-values on ductwork? Codes that would potentially increase demand for insulation in industrial applications, commercial buildings, and residences. Not only are energy advocates pushing for higher thermal requirements, but efforts to increase levels of acoustical insulation are also underway. Before dismissing this thought as overly optimistic, it is worth reflecting on how far we have come as an industry in positioning insulation as a natural practice in homebuilding. When I joined the insulation

industry in 1980 as a young salesman for Owens Corning, we were pushing for R19 (6 inches of fiber glass) insulation in the attic. An advertising campaign at the time encouraged homeowners to “spend a day in your attic” because “insulation is cheaper than oil.” For those old enough to remember, the price of WTI Crude jumped from $16 a barrel in April 1979 to $39 a barrel in June 1980.1 As awareness of the value that insulation delivers has increased, energy codes have risen accordingly. Today in Ohio, for instance, the U.S. Department of Energy recommends an R49 to R60 for attics.2

The opportunity is there to think about how we use energy across every segment of the insulation landscape, including commercial buildings and industrial applications. As a simple example, take a 1-foot section of 3” pipe with no insulation running at 350°F. If the cost of natural gas is $3/MCF, the cost is $25 per foot per year in energy cost if there is no insulation. If we add just 1” of fiber glass pipe insulation, the cost per year per foot drops to around $3! This reduces the energy spent by roughly 88%. And these savings go on year after year. Now that is a math problem we can all appreciate.

A Look at the Outlook for 2021 and Optimism for Renewables

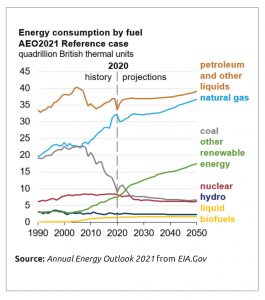

Presented February 3, 2021, the U.S. Energy Information Association’s (EIA’s) 2021 Annual Energy Outlook noted that the industrial market segment and electric power production likely will drive most of the increase in U.S. energy consumption through 2050. Delivered energy demand decreased to 90% of its 2019 levels due to the market shock brought on by COVID-19 in spring 2020.3 Considering different growth scenarios, the energy market could return to pre-2019 levels of consumption in as little as 5 years. Viewed through the lens of a slower economic recovery, the rebound could take as long as 30 years.3 The EIA report noted that renewable energy incentives and falling technology costs will support robust competition with natural gas, as coal and nuclear power decrease in the electricity mix.3 Much of the growth in electric-generating capacity will come from solar, wind, and natural gas. Prices for natural gas will influence its competition with renewables.

While the events of the past year demonstrate that speculation can be futile, indicators suggest a bullish optimism for the clean energy sector. And while the stock market is inherently volatile, the performance of equities and exchange-traded funds early in 2021 supports this optimistic outlook. Things are more uncertain in the oil and gas industry. As of this writing, with the arrival of a new administration, there is a freeze on new oil and gas leases on federal lands.4 Additionally, federal agencies are being asked to look at eliminating fossil fuel subsidies, and the Biden administration issued an executive order to make all federal vehicles electric as part of the “Made in America” Executive Order.5, 6 This takes me back to the point I made earlier—the most cost-effective energy is the energy that you don’t use in the first place.

Environmental, Social, and Governance (ESG) Considerations—Areas Where Insulation Adds Value

Another bright spot when it comes to the future of insulation relates to a higher interest in ESG. BlackRock CEO Larry Fink wrote in his letter to CEOs around the world earlier this year about the opportunity of the Net Zero Transition: “There is no company whose business model won’t be profoundly affected by the transition to a net zero economy—one that emits no more carbon dioxide than it removes from the atmosphere by 2050, the scientifically-established threshold necessary to keep global warming well below 2°C.”7

Further, he writes:

“Assessing sustainability risks requires that investors have access to consistent, high-quality and material public information. That is why last year, we asked all companies to report in alignment with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB), which covers a broader set of material sustainability factors. We are greatly encouraged by the progress we have seen over the past year—a 363% increase in SASB disclosures and more than 1,700 organizations expressing support for the TCFD. TCFD reports are the global standard for helping investors understand the most material climate-related risks that companies face, and how companies are managing them. Given how central the energy transition will be to every company’s growth prospects, we are asking companies to disclose a plan for how their business model will be compatible with a net zero economy—that is, one where global warming is limited to well below 2°C, consistent with a global aspiration of net zero greenhouse gas emissions by 2050. We are asking you to disclose how this plan is incorporated into your long-term strategy and reviewed by your board of directors.”

Some companies are developing alignment to the United Nations Sustainable Development Goals (SDGs). Two of those SDGs—affordable/clean energy and climate action—are positively impacted by the insulation industry.

As energy consumption declined during 2020, the reduction led to a tremendous drop in carbon emissions. Projections shared in the 2021 Annual Energy Outlook suggest carbon emissions will fall further in 2021 before leveling off or slowly rising in the future. Again, the insulation industry can play a big role in helping restrain emission levels.

On January 1, 2021, Canada and several U.S. states began enacting new regulations mandating a decrease in global warming potential (GWP) associated with blowing agents used in extruded polystyrene (XPS) insulation. The mandates are driving manufacturers to introduce new materials to the marketplace, such as an insulation with a blowing agent that reduces GWP emissions by 90%.

Reducing emissions ties in nicely with the energy reduction message that has always been part of our industry’s conversation. Today, the dialog is evolving beyond recycling, and insulation is viewed as something that may contribute to an emerging concept: the circular economy. Companies are looking ever more closely at how products—including energy—can be recycled and reused, extending the cradle-to-grave concept so that products may turn up in the cradle yet again.

A valuable statistic in our industry comes from the North American Insulation Manufacturers Association: A typical pound of insulation saves 12 times as much energy in its first year in place as the energy used to produce it. That means the energy consumed during manufacturing is saved during the first 4 to 5 weeks of product use.

Our industry has done a remarkable job of talking about and addressing the thermal properties and savings we bring to industrial facilities and commercial buildings. A few NIA initiatives reflecting our work in this area are noted below, and you can read about these and other educational opportunities on page 48.

- NIA offers classes addressing energy savings in its Insulation Energy Appraisal Program™ (IEAP). The IEAP is a 2-day course that teaches students how to determine the optimal insulation thickness and corresponding energy and dollar savings for a project. The program is designed to provide participants the necessary information to give facility managers a better understanding of the true dollar and performance value of their insulated systems while outlining the potential savings and emission reductions that mechanical insulation can provide—a concept illustrated in the bare pipe example mentioned earlier in this article.

- NIA also offers its Thermal Insulation Inspector Certification™ Program, which teaches participants how to inspect and verify that the materials and insulation system have been installed in accordance with the mechanical insulation specifications.

Our Industry Can Help

As an industry, we have a positive message to share. Many companies have established ambitious, quantifiable goals to reduce their environmental footprint. Companies are evaluating metrics like energy use, toxic air emissions, particulate matter, and waste. Our industry can help. The new administration is placing renewed focus on environmental responsibility. Our industry can help there, too. China, Japan, South Korea, and the European Union have all made commitments to achieve net-zero emissions. Again, our industry can help.

As 2021 gets underway, the industry is at a moment to claim our role in helping effectively and efficiently manage energy utilization.

References:

1. www.macrotrends.net/1369/crude-oil-price-history-chart

2. www.energy.gov/energysaver/weatherize/insulation

3. bipartisanpolicy.org/event/eias-annual-energy-outlook-2021-

release/

4. www.wsj.com/articles/whats-the-impact-of-president-bidens-oil-drilling-freeze-on-federal-lands-11611677934

5. www.whitehouse.gov/briefing-room/presidential-actions/2021/01/27/executive-order-on-tackling-the-climate-crisis-at-home-and-abroad/

6. www.whitehouse.gov/briefing-room/presidential-actions/2021/01/25/executive-order-on-ensuring-the-future-is-made-in-all-of-america-by-all-of-americas-workers/

7. www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

8. www.reuters.com/article/us-amazon-environment/amazon-vows-to-be-carbon-neutral-by-2040-buying-100000-electric-vans-idUSKBN1W41ZV

9. www.aepsustainability.com/performance/report/docs/CAR_MID-YEAR%20UPDATE2020.pdf

10. corporate.exxonmobil.com/News/Newsroom/News-releases/2020/1214_ExxonMobil-announces-2025-emissions-reductions_expects-to-meet-2020-plan

11. www.wsj.com/articles/gm-sets-2035-target-to-phase-out-gas-and-diesel-powered-vehicles-globally-11611850343

12. www.wsj.com/articles/shell-hits-its-own-peak-oil-plans-to-reduce-output-11613042962