North American Engineering and Construction Outlook

Background

Last quarter, FMI altered its base case assumptions for our forecasts to include a 12- to 18-month recession in 2022 and 2023. As with historical cycles, the impact on the construction industry will be longer lasting. FMI’s recession assumptions, along with various better and worse-case scenarios, are highlighted in our companion white paper, “How Bumpy Is It Going to Get? Mapping Recession Scenarios” at https://tinyurl.com/b6fz93jr.

Economic factors influencing this forecast include the domestic and foreign impacts of COVID-19; shortages of key materials and labor across various industries; ongoing strain on global logistics infrastructure; volatility across real estate, financial, and equity markets with additional Federal Reserve rate hikes through 2022 and 2023; and continued inflationary pressures tied to heightened living expenses, elevated energy costs, strength in the U.S. dollar, and rising wages. We also considered wartime and economic turmoil in various countries (e.g., Russia, Ukraine, China) adding to strain and uncertainty on each of the items listed above.

It is important to recognize that FMI anticipates the U.S. economy will fare better than in most countries, as reflected by strong demand for labor and the long-term commitment to infrastructure investments. As a result, the engineering and construction industry is expected to play a major role in our economy’s foundational strength over the coming years, offering a combination of both challenges and opportunities.

U.S. Key Takeaways

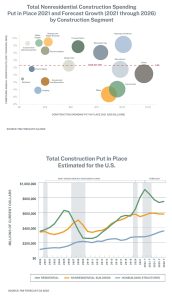

Total engineering and construction spending for the United States is forecast to end 2022 up 8%, or roughly the same as 2021.

Strong investment in residential, commercial, manufacturing, and water supply infrastructure will drive industry spending through 2022, each with year-over-year growth rates greater than 10%. Additionally, health care, amusement and recreation, communication, and highway and street segments are expected to remain stable with growth rates in line with historical rates of inflation, between 0% and 4%.

Year-end 2022 growth will be tempered by ongoing spending declines across various nonresidential building segments, including lodging, office, educational, religious, public safety, and transportation.

Residential construction spending is expected to decline beginning in 2023, due to softening economic conditions and rate hikes. Nonresidential segments are expected to see related declines beginning in the second half of 2023.

The latest Nonresidential Construction Index suggests ongoing difficulties through the remainder of the year, at 46.3, up slightly from 45.2 in the previous quarter. Sentiment this quarter was slightly improved, as respondents reported materials and labor costs stabilizing. The index remains below the growth threshold of 50 and indicates declining engineering and construction opportunities ahead.

FMI is a leading consulting and investment banking firm dedicated to serving companies working within the built environment.

Our professionals are industry insiders who understand your operating environment, challenges, and opportunities. FMI’s sector expertise and broad range of solutions help our clients discover value drivers, build resilient teams, streamline operations, grow with confidence, and sell with optimal results. Reprinted with permission. Find out more at www.fmicorp.com.