Preparing for the Economic Recovery: Strategies to Help Contractors Succeed in a Changed Business Environment

The COVID-19 pandemic has affected many industries across the United States. Even though construction was deemed an essential business in many states, most contractors found that business was anything but normal. Whether dealing with remote employees, documenting pandemic-related harm, or navigating the rapidly changing terms of the Paycheck Protection Program (PPP) and the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the last few months have been a period of rapid change. Many organizations are now focused on defining new business practices that are necessary to succeed in a changed business environment.

While there is still a lot of uncertainty about what the economic rebound will look like, focusing today on organizational stability allows contractors to minimize further disruption, protect their workforce, and strategically prepare to succeed in the recovery. There are 6 areas where you can take steps to secure your future.

The 6 key areas of business that contractors should assess and stabilize today include:

- Operations, profitability, and revenue;

- Client relationships and branding;

- Human capital and succession;

- Financial resilience and business optimization;

- Information technology (IT) infrastructure and cybersecurity; and

- Stabilization of subcontractors and suppliers.

Operations, Profitability, and Revenue

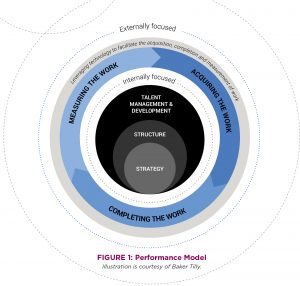

In “Recession Readiness: Value Protection Strategies for Contractors,” (https://tinyurl.com/ycw4oeqx) which I wrote for the March issue, I stressed the importance of having a well-defined strategy as the starting point for all value protection. The performance model (see Figure 1), has not changed due to the pandemic—strategy still must be the core of all business decisions. COVID-19 has affected many industries, including your clients, key partners, and supply chains. The best way to ensure success in the recovering economy is to revisit your growth strategies, profitability targets, and operational processes.

It is highly likely that in January 2020, your strategic goals were aligned with the high-growth economy we all experienced. Post-pandemic opportunities will not be the same and likely will require that you reconsider your target markets and stay well connected to clients and project owners. Connect with these strategic relationships to understand the challenges they are facing and how their business will change moving forward.

As you have these conversations, investigate if there are new opportunities in response to the pandemic, such as increased demand in manufacturing of health and safety products, regional distribution centers to accommodate the increase in online shopping, or necessary facility renovations to protect resident and employee health. This should not sound like a sales call, but instead a conversation about how you can provide solutions to meet their changing needs.

Fragile economic times require a focus on increasing profitability, not volume. Utilize a risk matrix to evaluate your profit potential based on completed projects. The most common criteria when evaluating risk threshold are project size, project type, owner, and geographic location. Your threshold for risk might have been greater in more lucrative and stable times. A conservative approach focuses on projects that you already have experience with and are no more than 10% larger in size than past profitable projects. (Refer to the “Recession Readiness” article for more detail on assessing profit potential.)

You cannot manage or improve profitability if you are not measuring it. Define which key performance indicators (KPIs) have the greatest impact on your profitability, implement measurement dashboards or reports, and track performance on every project. Commonly tracked KPIs include change orders, labor costs/budget, margin gain/fade, and over/under billings. Job performance analysis is always a best practice, but it will be especially critical in the post-pandemic economy as contractors are expanding into new customer and class categories to increase diversification.

Operationally, COVID-19 forced most organizations to change how they operated to maximize productivity of a newly remote workforce. Now is the time to evaluate which processes and procedures will serve you well moving forward, redefine position-specific roles and responsibilities, and invest in the appropriate technology to meet the needs of the organization moving forward.

Client Relationships and Branding

In-person interaction is what the construction industry in based upon. COVID-19 is forcing many contractors to evaluate how they will develop new client relationships and promote their company in a world that encourages limited in-person engagement. Redefining how customer transactions may be different in the future will help your employees be strategic in their communications. As discussed earlier, increasing the frequency of your meetings with key customers to understand and assess their needs is critical post pandemic.

It is also necessary to redefine how to develop new prospects during this time, when in-person networking is limited. Trade associations have always been invaluable sources for developing relationships with peers and potential customers. With budgets tightening, many organizations may have been considering not renewing their memberships, but the unique resources offered, keyed to your needs, make them more valuable than before. Trade associations provide ample opportunity for thought leadership and content pieces that can position you as a leader in the industry.

Take advantage of targeted print and digital advertising and digital engagement strategies to promote your thought leadership and educate potential and current customers with your knowledge and expertise. This requires that you commit the resources necessary to a more robust digital strategy, likely through outsourced expertise. An enhanced online presence is important for inbound, as well as outbound, messaging. Dedicate the resources to update your customer relationship management (CRM) system with your current clients and prospects to ensure both audiences receive messages. Monitor engagement of individuals through the CRM and utilize that knowledge to identify issues that create an opportunity for a conversation.

Human Capital and Succession

Prior to COVID-19, the construction industry faced many challenges related to workforce recruitment and retention. My article in the July 2020 issue addressed the ongoing need to focus on employee recruitment and retention. Now, as companies are trying to return to work, it is important to protect your most valuable asset.

Many organizations quickly adopted remote working strategies to reduce the number of employees working in the office and/or meet state and local mandates. As employees are being asked to return to the office, they may have mixed responses. Some employees are reluctant to return to the office for health reasons, childcare situations, or a developed personal preference to working remotely. For some companies, daily life moving forward might include a greater percentage of employees working from home. Whether you are remaining flexible in work arrangements or requiring everyone back to the office, you should consider the following:

- Define return-to-work scenarios based on business recovery,

- Communicate transparently with employees about scenarios and ask for feedback based on individual challenges and needs,

- Revise safety plans for office and jobsites to reflect COVID-19-related standards,

- Ensure technology is adequate to support remote workers, and

- Measure and maintain employee engagement.

Well-defined positions with transparency in performance measurements will still be important. So, as you evaluate how process and procedures will be modified moving forward, ensure that position descriptions are updated so that performance expectations and the review process support the newly defined roles and responsibilities.

Prior to COVID-19, many contractors had embarked on a succession plan to prepare and develop their future leadership. It is also important to evaluate if/how transition plans and timelines have changed. Has a decision to diversify future work created opportunities for new “critical” roles? If so, do you have that talent available internally, or is this a good time to recruit critical hires? Understand the gap in leadership that may now exist, or newly defined positions that you need now to be successful in the future. As the economy recovers, employees working for companies that are struggling or not openly communicating future direction may see this as the right time to change employers. Key talent that you had a hard time securing in the past may be willing to make a change. Are you ready?

Financial Resilience and Business Optimization

Most industries have reported a negative impact on revenue and profitability in the last 6 months from aging receivables, slow cash flow, and liquidity. Understanding and properly managing cash flow is a best practice at all times, not just during or following a pandemic. The COVID-19 pandemic forced companies to navigate new ways of doing business and dealing with cash-flow concerns.

Having a 13-week cash-flow model (see https://tinyurl.com/ybf7cdg6 on the Baker Tilly website) has proved to be an invaluable tool during this uncertain time. Why is it so critical now? A well-defined and regularly updated cash-flow model defines fixed and negotiable costs, identifies levers to trigger (if necessary) to improve cash flow, and defines non-core assets that can be divested to generate cash. Having this model available not only makes it easier for the leadership team to understand how to improve cash flow when needed, but also is helpful when seeking guidance from your accounting, financial, and legal partners.

Regular communication with your tax advisors and legal counsel on the PPP, the Economic Injury Disaster Loan, the CARES Act, or tax code changes also can provide liquidity opportunities during this time to assist with the financial impact of the pandemic.

We stress a 4-step process to building financial resilience with our clients.

- Identify: Assess the key financial risks you may face and assign management accountability.

- Respond: Define the actions you will take to manage or share the risks.

- Monitor: Measure results and evaluate effectiveness.

- Improve: Continually evaluate changing risks, actions plans, and measurements.

You can apply this process to any area of your company that has been negatively affected, such as accounts receivables (AR), loan covenants, a line of credit, payment terms, or delays. Here, we use aging AR as an example to illustrate the 4-step process. Aging receivables can have a direct negative impact on cash flow, as many companies have experienced over the last few months.

- Identify: Your company’s typical AR was around 45 days and is now approaching 60 days.

- Respond: Define an AR escalation process that assigns accountability to team members to follow-up on payment on days 15, 30, 45, and 60.

- Monitor: Monitor AR aging report on a weekly basis to measure improvement.

- Improve: Identify “at-risk” payables and develop a contingency plan, if necessary.

The effects of COVID-19 likely will continue and potentially deepen for companies that do not have financial resilience. Many businesses have focused on survival over the last few months, but now is the time to look forward, stress test the financial resilience of your organization, and establish strategies for improvement.

IT Infrastructure and Cybersecurity

When COVID-19 forced most companies to work remotely, many adapted quickly and sent employees home with the necessary laptops and monitors to remain productive. Yet, as weeks became months, many struggled with a lack of IT infrastructure, such as virtual private networks (VPNs) that were not designed to scale for a remote workforce. Cybersecurity attacks also have become a more common phenomenon, stressing the already overloaded IT systems.

While return-to-work scenarios are becoming more common, it is likely that remote workforces will remain a reality for many organizations. The COVID-19 disruption in how we used to do things has resulted in an expansion of collaboration tools to enhance team communication and productivity. Moving forward, we recommend that organizations continue to implement digital capabilities that will perpetuate the flow of information and core business processes.

The construction industry has been moving toward more cloud-based applications that require VPNs, which can support both internal and external sources. This requires that companies review their capacity management processes to account for demand expansion related to external service use. It also requires development of an IT infrastructure and protocols to support a more remote workforce.

Cyber threats are not a new phenomenon and are typically more of a nuisance than an actual threat. Most IT departments were not prepared for the increase in new and evolving threats (phishing, unsecure virtual meetings, and cyber attacks), the physical security risks for remote devices, or home network security considerations.

The remote work environment created a new opportunity for cyber attacks through collaboration tools, such as Zoom, that became a common team communication tool. Companies responded quickly by instituting password protections, waiting rooms for external parties, and user authentication.

The stress and uncertainty surrounding COVID-19 also created a “phishing lure” for employees—evident in the numerous emails that appear to be from the World Health Organization, health departments, or safety providers. Unsuspecting employees would open the emails, play the voicemails, or click on advertisements that offered “valuable information,” only resulting in credential theft or ransomware. The best solution to this challenge is to step up cybersecurity monitoring efforts internally and externally, educate employees on how to identify cyber attacks, and update your cybersecurity policy and protocol to cover remote devices.

Here is a list of recommended IT and cybersecurity practices to consider:

- Train remote workers on secure data handling from a home environment,

- Communicate remote-work cybersecurity practices,

- Validate security of web-enabled applications/systems,

- Increase use of multifactor authentication,

- Identify new COVID-19 threats through a cyber risk assessment, and

- Increase awareness of COVID-19 phishing attacks.

Stabilization of Subcontractors and Suppliers

The pandemic is disrupting both workforce and material availability. Contractors rely upon a supply-chain or subcontractors and suppliers to provide products for their operations, and it is important to understand how the supply base has been affected by the crisis. Many contractors are aware that some of their key supply chain partners are at risk because of material or workforce challenges.

An industry survey of contractors indicates that a growing number report material shortages and delays, especially from products sourced overseas. It is crucial to identify long-lead items and communicate about availability issues as early as possible to allow enough time for new options in both product selection and schedule coordination. Talk with your design professionals and subcontractors/suppliers about identifying any materials that might be delayed as soon as possible, and identify the impact of those delays to project cost and schedule. Evaluate whether there are locally sourced alternatives available that will minimize disruptions to the schedule.

If workforce availability is negatively affecting a subcontractor/supplier’s performance, it is important to consistently monitor performance, discuss their ability to meet obligations, and identify potential cost or schedule changes. One way to minimize this risk is to avoid concentration of at-risk partners on projects and regularly conduct re-qualifications of their financial and workforce stability.

Creative solutions to supply-chain challenges are becoming more common. Many contractors are embracing prefabrication right now as a way to alleviate the challenges of worker distancing and compromised schedules. Offsite fabrication of components, delivered just in time to the site and then installed, may be an effective way to minimize the number of workers on a site without negatively changing the project schedule. Some contractors are evaluating acquisition opportunities to resolve this supply-chain dilemma and are expanding into new service or product line(s).

COVID-19 has likely forever changed the way businesses operate. Every organization and every industry has been impacted in some way. Companies that emerge from this time successfully will focus on developing resilience—the capacity to recover quickly from challenges. As economies reopen, assess your preparedness, evaluate the business strategies and practices you have adopted, and focus on building resilience across your organization.

Take Baker Tilly’s Construction COVID-19 Recovery Assessment online for free at bakertilly.com/specialties/construction-covid-19-recovery-assessment.

Copyright statement

This article was published in the August 2020 issue of Insulation Outlook magazine. Copyright © 2020 National Insulation Association. All rights reserved. The contents of this website and Insulation Outlook magazine may not be reproduced in any means, in whole or in part, without the prior written permission of the publisher and NIA. Any unauthorized duplication is strictly prohibited and would violate NIA’s copyright and may violate other copyright agreements that NIA has with authors and partners. Contact publisher@insulation.org to reprint or reproduce this content.

Disclaimer: Unless specifically noted at the beginning of the article, the content, calculations, and opinions expressed by the author(s) of any article in Insulation Outlook are those of the author(s) and do not necessarily reflect the views of NIA. The appearance of an article, advertisement, and/or product or service information in Insulation Outlook does not constitute an endorsement of such products or services by NIA. Every effort will be made to avoid the use or mention of specific product brand names in featured magazine articles.