Industrial Insulation and the U.S. Energy Landscape 2.0

Shifts in the U.S. power and energy sector suggest the future is bright for the industrial insulation community. As the nation transitions from reliance on coal-powered fuels to cleaner energy sources, new methods of energy production are driving demand for insulation to support the U.S. energy infrastructure. Today’s restructuring of the energy landscape presents a window of opportunity for the industrial insulation industry to grow its footprint. In this article, we consider evolving energy consumption patterns, look at a few recent energy projects, and consider how insulation plays a key role in supporting new sources of power generation.

Let’s begin by thinking about the fundamental reason we insulate in the first place: to conserve and optimize the energy that powers our world. Remember, the cheapest energy is the energy we do not use in the first place, and insulation enables this possibility. Insulation is involved in virtually every aspect of power discovery, generation, and delivery—from the clean energy that powers homes, buildings, and today’s economy to the refineries that produce gas and oil for the transportation sector.

When it comes to sources of energy, our nation is blessed with an abundance of options including hydroelectric power, wind turbines, geothermal systems, solar power, nuclear energy, wood/biomass, coal, petroleum, and natural gas. But some forms of energy are simply more efficient, and that is particularly true of natural gas.

As we prepare to enter the third decade of the 21st Century, consumption of some long-used sources of power is declining, while demand for other power sources—specifically, natural gas—is projected to soar. Industrial insulation is playing an increasingly central role in supporting the facilities that produce and transport natural gas, and this trend is projected to accelerate through the mid-century.

An Evolution in Energy

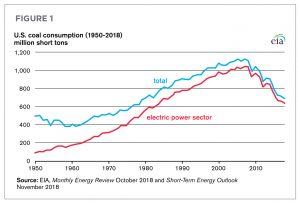

For more than a half century, at least 80% of U.S. energy has come from fossil fuels, including coal, petroleum, and natural gas. However, the types of fossil fuels used to meet the nation’s appetite for power are evolving from coal toward natural gas and other clean energy sources. Coal consumption has declined 42% since 2005; and last year, the U.S. Energy Information Administration (EIA) forecast that 2018 consumption would be at its lowest level since 1979 (see Figure 1).1 The collapse in coal-powered energy consumption can be attributed to a few key drivers including regulations such as

the Environmental Protection Agency’s Clean Air Act of 1990. Between 2007 and 2016, 531 coal-fired units (boilers) were shut down in the United States.2 Despite rhetoric to the contrary, it seems a remote possibility that coal will return as a dominant energy source in the United States. In fact, the latest shock to the coal industry was just this July when Blackjewel LLC filed bankruptcy and closed the fourth and sixth largest coal mines in the country, both in Wyoming.

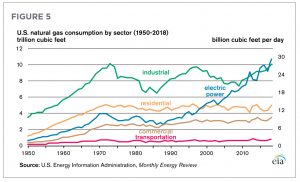

In contrast, natural gas, driven largely by the demand for electric power, has increased in 8 of the past 10 years, and consumption is up 37% since 2005. This trend is expected to accelerate as the mid-century milestone approaches and the appetite for clean energy continues to grow (see Figure 2).

What is driving the production of natural gas to power electricity and industrial applications? As with so many aspects of our economy, technology is a primary influence. In fact, the discovery and extraction technologies transforming today’s natural gas energy production may be the most disruptive in American energy history. The surge in natural gas extracted from shale (fracking) has greatly reduced natural gas prices while helping previously under-utilized natural resources create some of the nation’s most valuable real estate. Twentieth-century images of oil rigs (known as pumpjacks) as signs of wealth have been replaced by shale “Christmas trees” and royalties that transform the economies of rural landowners and communities. The shale discoveries that began nearly a decade ago in parts of Montana and the Dakotas have pushed East, with several high-profile energy projects in parts of Ohio, West Virginia, and Pennsylvania, known as Marcellus and Utica shale formations. U.S. shale deposits are redefining how the nation not only meets its own demand for energy but also serves markets around the globe.

Shifting Power Sources Mean More Need for Industrial Insulation

What does the change in energy source from coal to natural gas mean for the industrial insulation sector? Many insulation contractors that specialize in industrial and power work remember the days of flatwork insulating boilers and air pollution control equipment used in coal-fired power plants. Work that included insulating boilers, scrubbers, selective catalytic reduction, electrostatic precipitators, spray dryer absorbers, and flue gas desulfurization (see Figures 3 and 4) are being replaced by piping environments used in gas turbine combined cycle plants.

Gas turbine combined cycle plants are sprouting up to generate electricity due to power generation deregulation in certain states, abundant natural gas, and favorable economics (see Figure 5).

These cogeneration facilities allow otherwise wasted heat from electricity production off a gas turbine to be captured, and the thermal energy re-used in the process to generate more electricity.

Energy infrastructure and fuel transportation of the natural gas are also creating new opportunities for insulation. For example, compressor stations are being built to transport natural gas across the “Shale Crescent” region of Ohio, Pennsylvania, and West Virginia. These stations compress, push, and clean the gas as it travels through the pipelines. Given the massive and loud equipment in operation at these stations, the sites must be acoustically insulated to deliver performance and keep the surrounding areas quiet. For example, the compressor station building in the Millennium Pipeline Company, LLC project in Binghamton, New York, makes use of mineral wool insulation to support acoustic requirements and stay within the federal government’s decibel thresholds. The massive networks of large-diameter pipes transporting gas out of the ground and into the compressor stations also require acoustic insulation (typically mineral wool) to keep the surrounding areas quiet.

The surge in natural gas extraction is leading toward the building of massive liquified natural gas (LNG) export plants across the United States. LNG is a natural gas that has been cooled down (condensed) to liquid form at typical temperatures of -260°F. It takes tremendous attention to detail for insulation contractors to properly insulate at these temperatures, especially in the Gulf Coast, where many of these plants are being built. From Houston, Texas, along the Gulf Coast to Eastern states including Maryland and Georgia, facilities are importing and exporting natural gas (3 exporting facilities were operational in the lower 48 states at end of 2018), with more facilities being planned. Naturally, high-quality insulation plays a critical role in maintaining energy at such extreme temperatures.

A Glimpse at a Few High-Profile Projects

The scope and scale of combined-cycle facilities, while massive, are different in insulation requirements from a similar coal-fired plant or nuclear power plant. Consider the Oregon Clean Energy Center (OCEC) that opened in 2017 in Oregon, Ohio (Figures 6 and 7). The OCEC uses natural gas to power a gas turbine, and a steam turbine to efficiently power generators. Built at a cost of more than $800 million, the plant can generate 870 MW of electricity, which is enough to supply power to approximately 700,000 homes. From an air‑quality perspective, the plant emits 97% less nitrogen dioxide, 99% less sulfur dioxide, and 90% less mercury and fine-particulate material compared to a similarly sized, coal-fired facility. Much of the work involved for the insulation contractor was high-temperature piping, with some balance of plant equipment flatwork—much different work scope than if the 870 MW of power generation came from a coal-fired plant.

Shale gas is also a boon to the chemical industry, which needs low-cost input materials to produce chemicals. One chemical project worthy of attention is the $6 billion Shell Oil ethylene cracker plant near Pittsburgh, Pennsylvania, announced in 2012, with construction begun in late 2017. The plant will use ethane that will come from regional shale gas producers/processors that create what is called natural gas liquids (NGL) from gas in the Marcellus and Utica basins. Shell Chemical will use this ethane to produce primarily polyethylene. In addition, although no investment decision has been made, Thailand’s PTT Global Chemical America and South Korea’s Daelim Industrial have spent more than $100 million on feasibility studies to build a petrochemical ethane cracker facility in Belmont, Ohio, just down the river from Pittsburgh.

This petrochemical boon with pipelines, compressor stations, and NGL plants that produce ethane, propane, butane, etc., and chemical plants that use these NGLs, will transform the Western Pennsylvania area to the industrial base it once boasted. Further, all along the supply lines, these huge, aggressive projects, over many years, will provide significant opportunity for industrial insulation as they take shape in the near future.

The United States as an Energy Exporter

As natural gas boosts energy production and drives economies of scale, crude oil production and LNG also present opportunities for the insulation sector. The net positive for the U.S. energy community is independence and an opportunity to become an exporter, delivering energy to markets around the globe. In its Annual Energy Outlook (AEO) 2019, the EIA projects the United States will become a net energy exporter in 2020 and remain a net energy exporter through 2050.4 In 2018, 90% of all natural gas used in the United States was produced domestically, and natural gas production exceeded consumption for the first time since 1966.

A new generation of mechanical engineers and insulation contractors will not recall the fuel rationing days of the 1970s, when the nation was reliant upon the production policies of the nations of the Organization of the Petroleum Exporting Countries and their powerful cartel policies. But for those of us who suffered the long gas lines, seeing the United States become energy independent is a point of tremendous national pride. EIA Administrator Linda Capuano stated in a news release earlier this year that the United States has become the largest producer of crude oil in the world, producing almost 11 million barrels per day of crude oil in 2018, exceeding the 1970s record of 9.6 million barrels.

There is much talk about the “Green New Deal” Resolution (H. RES. 109) proposed by Democratic members of the House of Representatives. Initiatives described in H. RES. 109 include “meeting 100 percent of the power demand in the United States through clean, renewable, and zero-emission energy sources…” and “upgrading all existing buildings in the United States and building new buildings to achieve maximum energy efficiency, water efficiency, safety, affordability, comfort, and durability, including through electrification.”5 State-level Green New Deals also have been proposed, such as the Climate Leadership and Community Protection Act in New York. This Act calls for New York’s electricity grid to be 100% carbon neutral by 2040. A big boost to energy infrastructure development was in April of this year, when President Trump signed 2 executive orders that change the review process to help usher along infrastructure energy construction in the United States. All of this activity points to a bright future for insulation. Remember, the cheapest and best energy is the energy you don’t use in the first place!

The National Insulation Association (NIA) Thermal Insulation Inspector Certification™

Across the broad spectrum of industrial projects including clean energy, chemicals, and oil and gas, insulation delivers critical performance benefits. These benefits include promoting employee and public safety, conserving energy costs and usage, improving process output, protecting the environment, and reducing costs associated with noncompliant mechanical insulation and improper maintenance. But, like most high-value materials, insulation delivers optimal benefits only when it is properly installed, maintained, and inspected. As part of an integrated quality assurance/quality control program, NIA’s Thermal Insulation Inspector Certification can help ensure that industrial insulation matches the insulation specifications. Courses are offered at various times throughout the year, including a course to be held December 3–6, 2019, in Houston, Texas. Companies can also host the course in their own office for employees and customers. More information is available at www.insulation.org/inspector.

References

1. www.eia.gov/todayinenergy/detail.php?id=37692

2. www.forbes.com/sites/energyinnovation/2017/12/18/utilities-closed-dozens-of-coal-plants-in-2017-here-are-the-6-most-important/#47e7e35d5aca

3. www.eia.gov/todayinenergy/detail.php?id=40013

4. www.eia.gov/outlooks/aeo/

5. www.congress.gov/116/bills/hres109/BILLS-116hres109ih.pdf

Copyright Statement

This article was published in the October 2019 issue of Insulation Outlook magazine. Copyright © 2019 National Insulation Association. All rights reserved. The contents of this website and Insulation Outlook magazine may not be reproduced in any means, in whole or in part, without the prior written permission of the publisher and NIA. Any unauthorized duplication is strictly prohibited and would violate NIA’s copyright and may violate other copyright agreements that NIA has with authors and partners. Contact publisher@insulation.org to reprint or reproduce this content.