Industry Not Insulated from Supply Chain Issues

The average American probably knows little about insulation. They know it is important, of course, including in terms of reducing energy bills; but beyond that, they have little idea what inputs or processes are used to manufacture insulation and what capabilities insulation offers.

Fiber glass pipe insulation can withstand temperatures up to 1,000°F. Acoustic curtains can dampen noise generated from machinery and other equipment found in industry settings. Materials such as fiber glass and mineral wool are flame resistant, while spray foam can withstand temperatures up to 700°F.

But manufacturing products encompassing such capability requires an abundance of inputs and expertise. That abundance has been lacking in the context of ongoing supply chain disruptions and worker shortages. The result has been delivery delays, a dearth of inventory, higher prices, and occasionally frustrated buyers.

These dynamics spread well beyond insulation and include construction materials in general. The U.S. Bureau of Labor Statistics tracks price indices for a myriad of construction-related inputs. Their data indicate that during the very early stages of the pandemic, construction input prices fell sharply. During the 2 months that followed February 2020, the month prior to the undoing of the U.S. economy, construction materials prices dipped 5.5%. With the economy hemorrhaging jobs and GDP collapsing, many suppliers responded by laying off workers, shuttering factories, and generally reducing capacity.

But by May 2020, the U.S. and global economies were storming back, and by the second quarter of 2021, America’s GDP was above its pre-pandemic peak. The problem was, and continues to be, that supply capacity has yet to be fully restored. As a result, supply has tended to fall short of demand. The Delta and Omicron variants conspired to further hamper recovery of the global supply chain. Meanwhile, shifting worker attitudes and other pandemic-related factors have helped produce massive labor and skills shortages—shortages that are likely to persist through 2022.

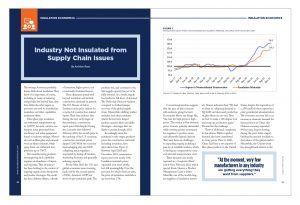

Accordingly, since the pandemic’s early stages, producer prices for construction materials, including insulation, have skyrocketed (see Figure 1). Between April 2020 and December 2021, construction input prices rose nearly 34%. Insulation materials prices expanded a bit more slowly, but still meaningfully. Over the past year for which there are data, the price of insulation materials is up more than 17%.

Conventional wisdom suggests that the pace of price increase will moderate going forward. Economists like to say things like, “the cure for high prices is high prices.” The notion is that elevated prices truncate quantity demanded while creating greater motivation for suppliers to produce more, and ultimately expand capacity. That said, there are challenges to expanding supply, including a paucity of available workers, which is driving up compensation costs, and elevated transportation costs.

These dynamics are neatly captured in a Composites World article from February 2021, which quoted Karin Demez, a Product Management Lead at Johns Manville, one of the world’s largest suppliers of insulation materials. Demez indicates that, “We had to adapt to collapsing demand in Q2:2020 and decreased production of glass fibers on our end. Then we had to make a 180-degree turn and ramp up production again.” Therein lies the challenge.

There is additional complexity to this drama. Shifts in global demand also have contributed to rising prices. Prior to 2020, China had been a net exporter of fiber glass products to the United States, despite the imposition of a 25% tariff on these inputs by a prior presidential administration. The economic recovery led to an increase in domestic demand for these products in China (the Chinese economy expanded 8% last year, despite slowing during the year’s latter stages), limiting the amount available to the balance of the global market. Meanwhile, the Chinese yuan has strengthened relative to the dollar, rendering imports relatively more expensive to American buyers. This has further helped to catapult prices higher.

Competition from Other Sources

While supply-side challenges garner much of the attention, another part of the story is embedded within a tale of demand. With respect to insulation, demand has emerged from various sources. For example, the imposition of social distancing requirements, coupled with widespread shutdowns, expanded demand for various recreational products, including boats and recreational vehicles, both of which utilize insulation. While the types of insulations utilized in the manufacture of these products is different than those typically used in nonresidential projects, they share common inputs such as glass fibers. Production and installation of pools and home spas has also created demand for pertinent inputs.

This is neatly summarized in another quote indicating that virtually everyone is doing without, at least to a certain extent. Gerry Marino, a General Manager at Electric Glass Fiber America, has been quoted saying, “At the moment, very few manufacturers in any industry are getting everything they want from suppliers.” While this example focuses on a very common material, fiber glass, other insulation materials are facing the same challenges for raw materials.

Looking Ahead

The world has become an extraordinarily frenetic place. In addition to supply chain issues and the lingering pandemic, there is geopolitical tension in Ukraine, Taiwan, and elsewhere. None of this builds confidence. What is more, federal stimulus has abated in the United States, and the Federal Reserve is set to tighten monetary policy. The result will be slower growth in the United States, perhaps in the range of 2.5 to 4%.

The implication is that demand for inputs is unlikely to climb rapidly. If one presumes that the pandemic will fade into the background at some point during 2022’s initial half, supply chain disruptions are likely to become less severe. A number of major auto manufacturers have indicated that the chip shortage that has ravaged production for many months may be over by the second or third quarter of the current year. The combination of more stable demand and more highly functioning supply chains should help to diminish shortages and inflationary pressures. There is also the expectation that more people will rejoin the labor market as stimulus payments fade more distantly into the past and as households find paying bills more challenging in the absence of employment.