The Carbon Credit Life Cycle

Carbon credits and carbon offsets have a crucial role in reaching net zero emissions goals. While all carbon credits are not created equal, they all start in the same place and go through a similar life cycle. Whether you are directly reducing footprint or are supporting projects that cut emissions somewhere else, offsets let you do both.

In this article, we will explain what happens during the entire carbon credit life cycle,1 from point of creation to retirement. We will explore where carbon offsets come from, and take a look at key players or parties involved.

Understanding the full carbon offset life cycle will help you navigate the fast-changing carbon market.

Tracing the Life-Cycle Stages of a Carbon Credit

A carbon credit is also referred to as a carbon offset in the voluntary carbon market. Individuals or firms can use the credits to voluntarily offset their carbon emissions.

Each credit represents a ton of carbon reduced or prevented from entering the air.

As such, offsets act as a means to help tackle climate crises while allowing different entities to use them, regardless of location.

The life of a carbon offset2 goes through four general stages:

- Development,

- Validation/Verification,

- Registration and issuance, and

- Retirement.

We will trace the life cycle of a carbon offset credit,3 while identifying the parties involved in each stage.

1. The Conception of a Carbon Offset: Project Developers

Carbon emission reductions4 happen all the time, but not every reduction qualifies as an offset.

Before a carbon reduction becomes a carbon offset, it has to meet a set of quality criteria based on methodologies specific to a certain kind of carbon project.

The term “methodologies” may sound complicated, but it refers to the detailed procedures that developers use to quantify a project’s emissions reduction potential.

They are also known as protocols, the blueprint for how various project metrics are calculated.

Each carbon project is unique, be it a renewable energy or agricultural project, so developers have to take several variables into account when developing them. They begin the process by designing the project and formalizing it in a Project Design Document (PDD).

Using a specific methodology,5 they then outline the project activities in the PDD. Some of the approved methodologies and protocols include:

- American Carbon Registry (ACR) methodologies,

- Climate Action Reserve (CAR) protocols,

- Clean Development Mechanism (CDM) methodologies, and

- Verified Carbon Standard (VCS) methodologies.

Understanding Credits versus Offsets

While the terms “carbon credits” and “carbon offsets” are often used interchangeably, they refer to two distinct products that serve two different purposes.

Carbon offset: A removal of GHGs from the atmosphere. Carbon offsets are produced by independent companies that pull CO2 emissions from the atmosphere. The offsets are then sold to companies that emit (or have emitted) CO2. In a sense, offset-producing companies are directly funded by those companies that emit GHGs.

Carbon credit: A reduction in GHGs released into the atmosphere. Carbon credits, on the other hand, are generally “created” by the government. Governments limit the amount of GHGs organizations can emit by placing a cap on them— a specific number of tons of CO2 the company can emit. Each of those tons are referred to as a carbon credit.

Next, project developers establish a baseline of emissions reduction, which is for assessment by a third-party body. This is the second stage of the carbon credit life cycle explained in the next section.

Once the reduction impact of a project has been assessed (via a certain methodology), the developer now holds the carbon rights to that project.

Of course, the work of a project developer, whether it is an individual or an organization, does not end there. They have to register the project with an approved registry like the Verra. This body tracks offset projects and issues their corresponding credits (more on this in the third stage of the life-cycle process).

Project developers also need to conduct regular monitoring and reporting of project activities on the ground.

Monitoring involves keeping track of the updates or progress of the project metrics, while reporting involves preparing the necessary documents about the project.

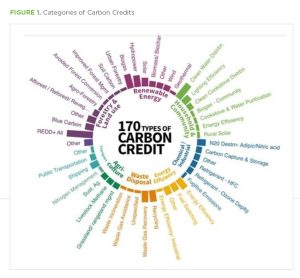

Right now, there are 170+ types of projects that produce carbon credit offsets, according to Ecosystem Marketplace.6 But they fall under eight major categories, as shown in the Figure 1.

2. The Birth of a Carbon Offset (Validation/Verification)

The second stage in the life of a carbon credit offset is undergoing a validation and verification process. Under this step are two responsible parties.

The Job of 3rd-Party Auditors

The first one is an independent, third-party auditor, also called the validation/verification body (VVB). This body comprises subject matter experts who can validate a project’s emission reduction claims, both projected and actual achievements.

Essentially, the VVB validates the following elements of a carbon offset project7 from the developer’s document:

- Baseline scenarios,

- Monitoring process, and

- Methodologies for calculating emission reductions.

For example, professional foresters, agriculturalists, or community development experts often audit/validate forest carbon projects.8 The carbon program standard (e.g., Verra VCS) must accept these auditors to process the registration.

Auditors ensure the integrity and accuracy of the data and information published by the developer on the project. Some of the widely known carbon project auditors are QAS, EPIC Sustainability, First Environment, and SCS Global.

Upon successful completion of the validation, the auditor will issue a validation report and validation statement. These documents confirm that the project has been designed and implemented in accordance with the carbon certification standard.

The Verification Process

Verification is key when it comes to ensuring that project data reported is true, transparent, and has integrity. In other words, it is verifying that the project is actually doing what it says it is doing.

Verifiers9 have to confirm that a proposed project meets a carbon program’s eligibility criteria. They can then verify by confirming that project monitoring data was collected in accordance with a program’s requirements.

They also verify that the calculations of the project’s emission reductions10 were done based on the approved methodology/protocol.

The verification process often involves a site visit while monitoring data to confirm that they are accurate.

After the project has been validated and verified, it is ready for registration.

But wait, there is another key party to consider to ensure the quality of the carbon credit11—the carbon ratings agency.

The Role of Third-Party Rating Agencies

Carbon rating agencies rate or score the likelihood that the carbon offsets issued via the project have indeed reduced a certain amount of carbon or its equivalent.

Different rating agencies use various frameworks or criteria in providing their scores. Some rate using an alphabetic scale (e.g., BeZero): AAA, AA, A. Others give their ratings by using the scale of A (highest rate) to D (lowest rate), as Sylvera does.

Projects must meet specific criteria to be eligible for a rating by an agency. While the criteria may vary, in general, projects must satisfy at least three things: carbon score, additionality, and permanence.

Rating agencies also require that the project has been audited as part of their scoring framework. Plus, there should be enough information on the project design and monitoring process available to base the ratings on.

Sylvera uses a carbon credit rating system it developed internally, rating afforestation, reforestation, and revegetation (ARR) projects according to its own proprietary frameworks, which are specific to project types. Additional information on how Sylvera rates ARR projects is available on the agency’s website (https://www.sylvera.com/blog/arr-carbon-ratings), and a white paper with details on the frameworks is available at https://www.sylvera.com/resources/carbon-ratings-frameworks-whitepaper.

Once it is officially (and proudly) born, the carbon credit offset can move on with its life.

3. Carbon Offset in Action (Registration and Issuance)

This stage in the carbon credit life cycle involves the carbon registries.

Carbon Registries

Registering a carbon offset project in an approved registry is easy if the previous steps are taken into consideration.

Projects are certified and issued carbon credits called by various names, depending on which registry they are registered in. For instance, under the Verra VCS program,12 the credits are called Verified Carbon Units, or VCUs. The Gold Standard offset program calls carbon credits Verified Emission Reduction, or VER, while Climate Action Reserve refers to them as Climate Reserve Tonnes, or CRT.

Regardless of their names, registries characterize carbon credit offsets through a number of quality assurance metrics. They are confirmed via the validation/verification tasks explained in the prior step.

Each offset represents a reduction or removal of 1 ton of CO2 equivalent achieved by the project.

The procedures to follow to get a project registered, certified, and issued with credit offsets depend on the specific registry chosen by the developer. The same goes for the rules or requirements provided.

Once the offset credits are issued to a project, they can now be in action. That means developers can look for their buyers in the carbon market.

4. Carbon Offset Retirement

Carbon offsets are bought by two parties: speculative investors and end buyers.

End buyers can be individuals, corporations, and governments. Buying carbon offsets can happen out of compliance to laws (for information on the compliance/regulatory

carbon market, see https://carboncredits.com/a-guide-to-compliance-carbon-credit-markets/), or it can be a voluntary decision to tackle emissions (see https://carboncredits.com/what-is-the-voluntary-carbon-market/).

Heavy industrial emitters are the major buyers of carbon offsets as part of their compliance requirements, but plenty of large firms are also buying because of their climate commitments (see https://carboncredits.com/vcmi-code-for-ranking-companies-using-carbon-credits/).

If you prefer to buy offsets directly from project developers, you can do so; but buyers can also get offsets from brokers, traders, and exchanges. They can then use those offsets

to address their current emission reduction measures.

But there is another way to make money out of trading carbon credits. It is via speculative marketplace/exchanges and carbon ETFs.13

Speculative investors buy offsets through futures contracts, with the intention to sell them later at a higher price, hopefully.

Top carbon exchanges include the CME Group, Xpansiv CBL, Climate Impact X, ICE, AirCarbon, and Carbon Trade Exchange.

No matter how or where the carbon offsets are bought, once they are used and reported as emission reduction, they should be retired.

Retirement of offsets also means their death. They should not be around anymore and are not for resale. They must serve their emission reduction purpose only once to avoid double counting. That also means removing them from the marketplace and labeling them as retired in any records.

A retired carbon credit offset can now say goodbye to its not-so-popular yet critical world of reducing emissions.

For More Information

If you are interested to know more about carbon offsets, see www.carboncredits.com/what-is-a-carbon-offset. Or, if you want to learn how to make money with them, read a comprehensive guide at www.carboncredits.com/how-to-make-money-producing-and-selling-carbon-offsets.

References

1. https://carboncredits.com/the-ultimate-guide-to-understanding-carbon-credits/

2. https://carboncredits.com/what-is-a-carbon-offset/

3. https://carboncredits.com/carbon-credits-vs-carbon-offsets-whats-the-difference/

4. https://carboncredits.com/canadas-2030-emissions-reduction-plan/

5. https://carboncredits.com/verra-biochar-methodology-to-generate-carbon-credits/

6. https://carboncredits.com/real-voluntary-carbon-market-value-is-2-billion/

7. https://carboncredits.com/when-to-purchase-carbon-credits/

8. https://carboncredits.com/us-forest-questionable-carbon-credits/

9. https://carboncredits.com/who-verifies-carbon-credits/

10. https://carboncredits.com/best-ways-companies-can-cut-carbon-emissions-3-tips-that-work/

11. https://carboncredits.com/what-is-the-best-carbon-credit-to-buy/

12. https://carboncredits.com/the-4-best-carbon-offset-programs-for-2023/

13. https://carboncredits.com/how-to-invest-in-carbon-credits-carbon-etfs-and-carbon-stocks/