2025 North American Engineering and Construction Outlook—Third Quarter Edition

Amid sustained economic headwinds, including elevated interest rates, a challenging labor market, and growing uncertainty around federal policy, total U.S. engineering and construction spending is forecast to increase by just 1% in 2025, down from 7% growth in 2024.

This slowdown is primarily driven by broad-based weakness in the residential sector, where affordability constraints, rising costs, and tight credit continue to limit activity. Nonresidential building and infrastructure segments are expected to deliver mixed results, with several segments—such as manufacturing—shifting from high growth to more stable or less impressive rates of expansion.

The single-family residential market remains constrained but is showing signs of stabilization, as pricing adjusts and sales volumes begin to improve in disaster-affected and more affordable regions. Residential improvements are projected to hold flat in 2025, supported by aging housing stock and targeted renovation activity. Multifamily development, by contrast, continues to decline, with vacancy rates rising, rent growth slowing, and construction starts falling in oversupplied markets, especially across the South and West.

Nonresidential building activity is holding steady, though the pipeline of new work has begun to slow in response to elevated costs and longer lead times. Public funding, while still significant, faces increased scrutiny under the newly passed spending and tax bill, which includes reductions to several long-standing federal programs. The legislation shifts more responsibility for infrastructure and energy projects to states and the private sector, while narrowing federal support for programs across various areas including clean water, housing, health care, and education.

Infrastructure spending, however, remains comparatively resilient. Segments such as power, water, sewage, and transportation continue to benefit from previously authorized funding, though new awards have slowed. Road and bridge work is holding firm, supported by strong project pipelines and growing urgency around the 2026 reauthorization of the Surface Transportation Reauthorization Act. Notable new commitments were also made this quarter in transmission, nuclear energy, and freight rail, signaling continued interest in long-term grid, transportation, and logistics modernization.

Manufacturing and data center investment remain essential contributors to future construction demand. Strategic project announcements continue in these sectors, though labor shortages, tariffs, and power availability are beginning to impact timelines and delivery. Meanwhile, emerging trends such as flexible and fractional warehousing, along with modular infrastructure design, are expanding rapidly in response to changing retail and logistics needs.

The construction industry is entering a slower and more selective phase of expansion. While advances in artificial intelligence, digital delivery, and automation are driving greater efficiency, elevated costs, political/geopolitical uncertainty, and tight credit conditions are expected to weigh on growth through at least mid-2026. Over the next several years, owners, developers, and public agencies will need to reassess project priorities, funding strategies, and long-term planning to navigate volatility and shifting market conditions.

U.S. Key Takeaways

- Total U.S. engineering and construction spending is forecast to increase by just 1% in 2025, a notable slowdown from the 7% growth recorded in 2024.

- Growth in 2025 is expected to stall, primarily due to persistent weakness in the residential sector, driven by ongoing declines in multifamily construction and limited gains in single-family and residential improvements. While both single- family and residential improvement investment are expected to see modest rebounds in activity in 2026, the overall residential sector is expected to remain under pressure over the forecast period, due to persistent affordability constraints.

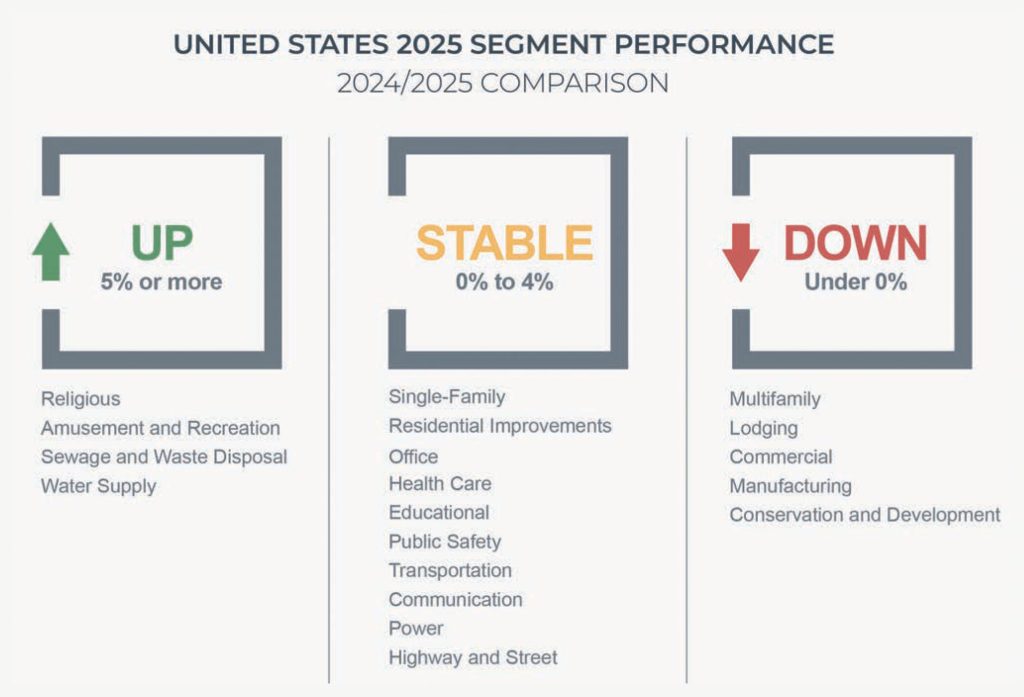

- Nonresidential segments are expected to deliver mixed but resilient performance through 2025 and 2026. Short-term growth will be supported by strength in segments such as office, amusement and recreation, religious, transportation, power, sewage and waste disposal, and water supply. Longer-term growth will be led by lodging, office, and water infrastructure, each with a 5-year compound annual growth rate exceeding 5.5%. Nonbuilding structure investment is forecast to outperform nonresidential buildings over the next 5 years, driven by a mix of public and private infrastructure-focused needs.

- The latest Nonresidential Construction Index improved to 49.8 from the previous quarter’s 43.5, signaling a rebound in contractor sentiment. This optimism reflects greater confidence in both economic and business conditions compared to last quarter, supported by stronger backlogs and improved construction outlooks. However, the index remains just below the neutral threshold of 50, suggesting stabilization rather than expansion of future engineering and construction opportunities.

Excerpted with permission from FMI’s (www.fmicorp.com) “2025 North American Engineering and Construction Industry Overview.” The full report is available for downloading at: https://tinyurl.com/ykuz4deb.