Off-site Construction Is More than a Trend

NIA’s panel of experts identified modular construction as an industry segment “poised for growth in 2020” in its State of the Industry Assessment in April 2020,1 and market research supports that assessment: Estimates put the global market for modular construction at $95.1 billion in 2020, with the U.S. market alone hitting $27.5 billion.2 A recent Dodge Data & Analytics study provides insight into what is driving the market today and into the future.

Almost exactly a year ago, the world watched in wonder as China completed construction on 2 emergency field hospitals in Wuhan in under 2 weeks to address the flood of patients ill with what was then an unknown, new coronavirus. And to say the world watched is not an exaggeration: Video of thousands of workers toiling around the clock was live-streamed on China Central Television. Would they really build 2 hospitals in 2 weeks? And could any structure like that, going up so quickly, be safe?

The first, Huoshenshan Hospital, a 645,000 square foot, 2-story building on approximately 18.5 acres, was fully functional in just 10 days. It featured isolation wards, beds for 1,000 patients, and 30 intensive care units (ICUs). One of the first patients admitted posted a video on YouTube showing his room, clearly impressed with the facility and the life-saving technology inside. The second hospital, Leishenshan, built on an abandoned parking lot about 25 miles from the first, had room for an additional 1,600 beds, also dedicated to quarantine and treatment of COVID-19 patients. Shortly after opening, both “instant hospitals” were reported to be operating at close to full capacity. By mid-April of 2020, case counts had lowered to the point where the emergency facilities could be decommissioned, although not demolished in case they need to be reactivated.

To accomplish such rapid deployment, the facilities used prefabricated units—essentially hospital building blocks—factory constructed and shipped to the sites ready to be assembled. It helped that this was not the first time China used modular construction to manage a national emergency. The approach modeled one taken for Xiaotangshan hospital, an emergency facility built in Beijing during the severe acute respiratory syndrome (SARS) outbreak in 2003; and the model certainly works for speed. As for any questions concerning building quality or safety, getting follow-up information out of China on those points is as difficult as tracing the roots of the country’s outbreak. At minimum, though, when needed, the “pop-up” facilities appear to have operated as required; and they captured the imagination of a world struggling to care for a growing number of COVID-19 patients while managing everyday health-care needs of its citizens. Could prefabricated modules be the answer? It seems to be China’s answer: In January of this year, the country again mobilized forces to construct a quarantine center in the northern Hebei province that can house more than 4,000 people.

In the past year, across the United States, modular construction has been used to provide health-care support, with projects ranging from portable emergency and temporary structures that can be relocated as needed (or stored for future use) to permanent new structures and/or additions to existing hospitals built on permanent foundations. Consider the following examples, all of which went online between May and December 2020:

- A COVID-19 testing center at the University of Denver that offers drive-through or walk-in temperature screening and virus testing out of a building 40 feet long, manufactured in a factory in Bakersfield, California, in 10 days, shipped to the university on a flatbed truck, and set up in 1 day in the fall of 2020. Similar pods are being used at other universities and at airports in and out of state.3

- Modular ICUs factory-manufactured and deployed in Maryland and Georgia over the course of weeks to months, rather than years. These are not trailers or shipping containers but fully equipped patient rooms that meet Centers for Disease Control and Prevention standards for airborne infection isolation,4 with plumbing (sinks and bathrooms) and medical systems, as well as HVAC systems rated for ICU use.5

- A temporary structure outside a California hospital built in December 2020 to replace tents, providing surge exam rooms for patient triage—including individual HVAC units—plus rooms for x-ray, EKG tests, lab draws, and utility use.

All these projects were completed in expedited timeframes compared to traditional construction methods, and all met federal and local quality and safety standards for their use, as well as applicable building codes, before being approved for operation. Pandemic-driven applications are not the only uses making prefabrication/modular construction a growth industry even as many segments of the global economy continue to struggle. The past few years have seen the approach used on projects ranging from Starbucks and Chick-fil-A branches to parts of a sports stadium, all types of housing (single-family to multi-story apartments and homeless shelters), hotels, schools, data centers—even factory-fabricated small modular nuclear reactors and geothermal units for the power industry, and “extraction pods” for the cannabis industry.

Before the pandemic, there were signs of wider adoption of prefabrication and modular construction. A survey conducted in the fall of 2019 by Dodge Data & Analytics queried hundreds of professionals in the construction industry from across the United States to get a picture of the market now and into the future. The results underscored how many in the construction industry report “significant improvements to cost, schedule, quality and safety performance, productivity, client satisfaction and their ability to reduce waste”6 from the use of prefabrication and modular construction. With assessments like that, and such range of applications already in use, it is not hard to imagine that the mechanical insulation industry will discover new opportunities, as well as challenges, as more projects use the approach. Simply put, if you think only of pre-insulated piping at liquefied natural gas facilities, or the prefabricated insulation elbows and fittings for other uses profiled in this magazine a few years back, it is time to expand your thinking—because design engineers and project owners certainly are.

Everything Old Is New Again

Off-site construction is not new, but it may be even older than you think. According to the Modular Building Institute (MBI), the first building in the United States to be constructed off-site and delivered to its final location was a prefabricated structure from England that came over by boat in 1670.7 Later, the MBI reports, more than 500 prefabricated homes shipped westward from New York factories in 1849 to keep up with demand as the population moved to California, chasing the Gold Rush. Commercial construction followed, and modular structures began to find their way into schools, government buildings, stores, and hotels in the early to mid 1900s.

These days, the National Institute of Building Sciences’ Off-Site Construction Council defines off-site construction as “the planning, design, fabrication and assembly of building elements at a location other than their final installed location to support the rapid and efficient construction of a permanent structure.”8 And as we have seen, the applications are as broad as one can imagine from that definition. Off-site construction is used across residential, commercial, and industrial markets. At one end of the spectrum are structural components (wall, roof, flooring, etc.) fabricated in a manufacturing facility and shipped for installation/integration with the rest of a project on site; and at the other are homes you can buy on Amazon.com ready for customization. Prefabricated and modular units use steel, wood, or concrete; and they may become part of a permanent structure or designed for relocation and reuse. Components may be “open,” meaning they can be inspected on the jobsite without disassembly; or “closed,” which is as it sounds—mechanical, electrical, and/or plumbing is installed at the factory, where it is inspected before it gets shipped. They may consist of two-dimensional (2D) “panels” to be put together on site or 3D volumetric units/modules/pods that work as Legos—individual units may need only to be connected to utilities and/or other units on site. While some use the terms interchangeably, prefabrication generally refers to components manufactured in a factory and transported to a project site for assembly; modular construction refers to structures that are more than 50% finished at the factory before they are shipped to their destination.

The Benefits of Off-site Construction

Before diving into the Dodge study findings, let’s consider the benefits often cited for using a building approach that uses some degree of off-site construction.

Faster project completion and increased productivity

As with the examples described earlier, with prefabrication and modular construction, components can be built off site while site work is underway. When components are prefabricated, tested, and inspected before they get to the jobsite, external factors like weather become less likely to impact schedule; and onsite set-up and pre-assembly time is reduced. Common estimates put completion of projects using off-site construction at 20% to 50% faster than those using “conventional construction.”9

Cost control/predictability

In addition to cost savings that accrue from completing projects faster, the components themselves can provide savings, as construction may be more economical at the factory’s location than at the jobsite’s. With fewer external factors affecting project costs—weather, cost (and availability) of materials/labor for on-site compared to off-site construction, storage costs, etc.—it can be easier to predict and control those costs. Turning projects around faster also means a shorter period carrying a construction loan—buildings can be occupied and used sooner, yielding quicker return on investment.

Solution to labor shortage

The U.S. Chamber of Commerce Commercial Construction Index Report for the third quarter of 2020 indicated that 83% of contractors face “moderate to high levels of difficulty in finding skilled workers,” and more than a third (36%) “report turning down work due to a shortage of skilled workers.”10 Given these figures, an approach that reduces the number of workers needed on site, and how long they need to be committed to a given project, can be a game changer.

Predictability of quality and process

Automated pre-assembly requires adherence to repeatable processes, yielding predictable outcomes. Reducing the amount of construction on site reduces opportunity for product quality variance. Components constructed off-site go through quality control before they are shipped. Additionally, modular construction and building information modeling (BIM) are frequently used together, resulting in greater agreement between what is designed (and expected) and what is built.

Increased worker safety

Performing less construction on site, and using automation for factory construction, lowers the risks of on-the-job accidents. An additional consideration during the pandemic: Off-site construction reduces the amount of time workers spend in the field, a less controlled environment than a factory in terms of maintaining social distancing.

Reduction in on-site construction waste, yielding greener projects

In addition to a reduction in trash on site from all the materials used to pack and ship individual items, off-site construction generates less waste because fabrication in a factory is more precise than that done on individual jobsites. The protected construction environment means less material is wasted because of weather damage. Factories often recycle materials, and modular components themselves can be reusable—disassembled and relocated to other sites as needed—saving energy and raw materials.

Increased client satisfaction

All the other benefits listed contribute to overall higher client satisfaction, a result reported overwhelmingly by participants in the Dodge survey.

The Survey: An In-depth Look at Prefabrication/Modular Construction Trends

In the fall 2019 online survey, Dodge queried more than 600 architects, engineers, general contractors (GCs) and construction managers (CMs), specialty/trade contractors, and builder/manufacturers from across the United States on the current and future states of the prefabrication and modular construction market. Respondents all had recent experience (over the past 3 years) working with prefabricated and/or modular components (permanent or relocatable). Results were published in the report Prefabrication and Modular Construction 2020 and presented by Donna Laquidara-Carr, Ph.D., LEED AP, and Dodge Industry Insights Research Director, in a webinar, “The Rise of Modular Construction: A Deep Dive into the Perspectives of Architects and Contractors on Its Current and Future Use.” This section provides an overview of some key findings from the study. Interested readers should review the full report for more information: www.construction.com/toolkit/reports/prefabrication-modular-construction-2020.

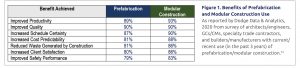

Regardless of their role in the construction process, respondents highly rated the results of using the approaches. Figure 1 shows the percentage of respondents who reported achieving “medium, high or very high levels”11 of the benefits listed from use of the method cited.

The report provides insight into how different functions—architects/engineers, GCs/CMs, and trades—experience the benefits differently, and how they see them affecting their work in the future. All participants responded to a set of similar questions for consistency but also were divided into two tracks—prefabrication and modular construction—for specific questions aimed at gaining more information on the use of each approach. (For details on survey methodology and background/experience of participants, see sidebar, “Prefabrication and Modular Construction Survey Ground Rules and Methodology” on page 16.)

Prefabrication

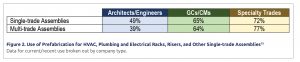

The percentage of respondents with prefabrication experience in the past 3 years was an overwhelming 94%.13 Examples of prefabrication include single-trade assemblies (e.g., behind-the-wall plumbing assemblies, used for rooms in hospitals) and multi-trade assemblies (e.g., a corridor rack). Survey participants reported more experience with single-trade assemblies, but the majority anticipate using both types in the near future. Past and forecast use among all respondent types broke down as follows:14

- Single-trade assemblies accounted for 62% of projects using prefabrication in the past 3 years, projected to grow to 75% of projects in the next 3 years; and

- Multi-trade assembles were used on 33% of projects in the past 3 years, climbing to 58% in the next 3 years.

Of note for those in the mechanical insulation industry, one of the most popular specific uses for both single- and multi-trade assemblies was the category including HVAC and plumbing—see Figure 2.

Data on use of panelized modular construction—wall modules, roof and floor panels, and structural insulated panels—showed differences in experience and projected use between the different functions. Between 80% and 84% of architects/engineers and GCs/CMs reported using prefabrication today, to go up a few percentage points in the next 3 years. Among specialty trades, however, where current/recent use was at 68%, forecasts grew to 76% when projecting over the next 3 years.16

Figure 3 summarizes current and projected drivers for the use of prefabrication reported across all roles.

Top barriers to use were “project delivery method prevents effective prefabrication planning” (96%), “prefabrication not part of project design” (94%), “our project types not applicable for prefabrication” (92%), “availability of prefabrication shop locally” (81%), and “availability of trained workforce to install prefabricated components (70%).18

For the mechanical insulation industry, the numbers speak to a need for familiarity with the processes and applications—from design through installation—as the use of prefabrication is expected to grow more prevalent.

Modular Construction

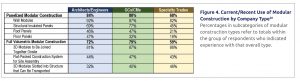

Experience with modular construction was much lower than with prefabrication: Just 38% of respondents reported experience with permanent modular construction in the past 3 years, and only 28% had experience with relocatable modular construction.19

Figure 4 summarizes current/recent use of modular construction types, by company type.

Currently, the greatest use is by the design function, with the most projected growth anticipated by the trades. In the next 3 years, trades anticipate using panelized modular construction on 76% of their projects; and full volumetric construction on 75%.

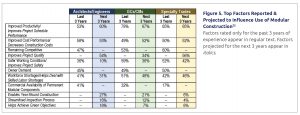

Figure 5 summarizes current and projected drivers—i.e., those with “high or very high level of influence”—for permanent modular construction use.21

The overwhelming barrier to modular construction use was reported to be the owner’s lack of interest in using the approach (90%). Additional considerations included “availability of modular component manufacturers” (66%), project types not being “applicable for modular construction” (54%), “project delivery method prevents effective modular use planning“(51%), and “availability of trained workforce” to install the components (41%).23

Past and future use of permanent modular construction broke down as follows:24

- Panelized construction (wall panels, for example) was used on 48% of projects in the past 3 years, projected to grow to 59% in the next 3 years; and

- 3D modules/full volumetric construction accounted for 44% of projects in the past 3 years, projected to rise to 61% in the next 3 years.

Use of BIM

As reported in this magazine in 2020’s “Gazing into the Crystal Ball” forecast, “One of the biggest benefits reported by contractors is the ability of BIM to improve the fabrication process. Many mechanical contractors are frequent users of off-site fabrication for their systems, and the study shows that nearly half use BIM on 50% or more of the assemblies they prefabricate, demonstrating that BIM is an essential tool for this process. Benefits from using BIM to aid prefabrication are widely reported, with over 80% of mechanical contractors who use it to prefabricate reporting that they see improvements in the amount of material waste generated, labor costs, quality of installed work, avoiding the purchase of extra pipes and fittings. and schedule performance.”25

The Dodge study supports the “Crystal Ball” assessment. Of companies who use BIM frequently for prefabrication, 64% report “enjoying high levels of…performance improvements.”26 Current use is most prevalent among the trades (38% using it on 50% of projects or more), compared to 17% for architects/engineers, and 22% for GCs/CMs. Use in all groups is expected to grow over the next few years, to 53% (trades), 31%(architects/engineers), and 35% (GCs/CMs). In some instances, use by one role is mandated by another—e.g., when an owner requires a GC/CM to use it, or a GC/CM requires it from the trades.27

Prefabrication and Modular Construction Survey Ground Rules and Methodoloy

To participate in the survey, respondents had to have recent relevant experience, defined as having “worked on a multifamily or non-residential building project in 2018, and a prefabrication or permanent modular construction project in the last three years.” *Additionally, to ensure the survey focused on commercial construction, no more than half the projects in the participant’s experience could be single- or two-family homes. In the end, the participant pool broke down as follows: 44% architects or engineers, 31% GCs/CMs, and 25% specialty trades/contractors.

From there, participants were divided into two tracks, based on their experience: prefabrication (66% of respondents) and modular construction (34% of respondents). Some survey questions addressed the same topics for both groups, but others were specific to experience of the given group. (For additional details on how participants met the experience threshold for a given track, and a breakdown of experience and survey track by respondent type, refer to the full report, which can be downloaded online at www.construction.com/toolkit/reports/prefabrication-modular-construction-2020.

Support for the study was provided by Bradley Corporation, MBI, Pinnacle Infotech, the Mechanical Contractors Assoc. of America, and Skender.

* Dodge Data & Analytics, Prefabrication and Modular Construction 2020 SmartMarket Report, 2020, page 64,

www.construction.com/toolkit/reports/prefabrication-modular-construction-2020.

Off-site Construction Is Not Without Challenges

As alluded to in survey findings related to barriers to using prefabrication and modular construction, they can present challenges, including (but not limited to) the following. (Note: Additional challenges specific to mechanical insulation are described in “How Modularization and Pre-insulated Equipment Impact Mechanical Insulation Systems” on page 20.)

- Selection of supplier(s) is critical

This is particularly important with modular construction, where Dodge survey respondents across all roles rated experience and expertise above price, location relative to the project location, and familiarity with using the company. The only criterion for selection with such impact on the decision process was owner preference—and this factor only surpassed supplier expertise in reports from the trades. If the supplier misses its deadline, uses sub-par materials or processes, does not adequately protect components during shipping, or otherwise underperforms, the entire project suffers.28 - Logistics can derail savings of time and money

If components are prefabricated in a climate-controlled factory but get exposed to the elements or otherwise damaged during shipping (or on site because they are delivered too early and sit outside), instead of saving time and money, the opposite occurs. Materials may need to be replaced, slowing the process and raising costs. Other aspects of logistics that come into play include making sure the right equipment is ready on site when the components arrive and are to be assembled. There is nothing efficient about modules languishing because the crane needed to set them into place is somewhere else. Shipping considerations also may impose design limits because it is cost-prohibitive to ship modules exceeding size or weight parameters. - Design must be locked in early

The design phase can be more intense than with conventional construction because decisions need to be made earlier. How often have you encountered situations where customers change their mind about something when they see it on site, and it sets off rippling changes (and costs) throughout the trades? Imagine if the request is to change something manufactured off site weeks ago, delivered to original specifications—for example, moving components that would affect the location of ductwork or pipes, or the amount of space around them to allow for insulation installation and inspection. - Coordination is critical, especially for insulation work

Coordination among the trades is essential, and all team members need to be involved early. It seems everyone in our industry has horror stories of projects where the schedule and budget increased because of lack of coordination, and insulation often pays the greatest price from other specialties running behind. If there is a design problem—e.g., there is not enough room to insulate pipes as specified—that needs to be identified before components are manufactured, shipped, and on site. - Approaches required a skilled workforce

While fewer workers are required to build pieces on site, those who are there must be trained in working with and integrating modular components.

There are other challenges, including some that may arise from the pandemic—such as workforce or supply chain issues—and sometimes-blurred lines when it comes to insuring, funding, bidding, and inspecting projects using off-site construction. As with conventional construction, most problems can be avoided or mitigated with proper planning.

Conclusion

Clearly, prefabrication and modular construction are more than a trend, offering both opportunities and challenges to those in the mechanical insulation industry. As owners grow more comfortable with prefabrication and modular construction, and as training and resources across the supply chain make the approaches more accessible, the industry can expect to see more widespread use.

To borrow again from “Gazing into the Crystal Ball” with a quote from Michelle Meisels, Principal in Deloitte Consulting’s Technology practice who leads the Engineering and Construction (E&C) practice:

Among the trends to watch in 2020 that can affect the current profitability and margin challenges facing many E&C firms is the move toward modularization and prefabrication of components. The rise of module assembly yards—strategically located sites for fabrication and assembling building elements that can then be transferred to a building site for rapid assembly—borrows some of the cost-efficient practices of manufacturing for the construction industry. Modularization has potential to significantly affect productivity and margins for E&C firms.

Based on activity over the past year, and the results of the Dodge survey, it seems an extension of that prediction is in order; and the mechanical insulation industry needs to be prepared.

References

- “The State of the Industry Assessment,” Insulation Outlook, April 1, 2020, https://insulation.org/io/articles/the-state-of-the-industry-assessment/.

- “Global Modular Construction Industry (2020 to 2027) – Market Trajectory & Analytics – ResearchAndMarkets.com,” Business Wire (online), November 2, 2020, https://www.businesswire.com/news/home/20201102005653/en/Global-Modular-Construction-Industry-2020-to-2027—Market-Trajectory-Analytics—ResearchAndMarkets.com.

- Aili McConnon, “Modular Construction Meets Changing Needs in the Pandemic,” New York Times, December 15, 2020, https://www.nytimes.com/2020/12/15/business/modular-construction-pandemic-coronavirus.html.

- Adele Peters, “These Lego-like Modular ICU Rooms Are Turning Hospital Parking Lots into COVID-19 Units,” Fast Company, November 17, 2020, https://www.fastcompany.com/90575406/these-lego-like-modular-icu-rooms-are-turning-hospitalparking-lots-into-covid-units.

- “Modular Hospital Design,” BMarko Structures, 2020, https://bmarkostructures.com/modular-hospitals/.

- Dodge Data & Analytics, Prefabrication and Modular Construction 2020 SmartMarket Report, 2020, page 4, https://www.construction.com/toolkit/reports/prefabrication-modular-construction-2020.

- “Frequently Asked Questions,” Modular Building Institute, accessed December 2, 2020, https://www.modular.org/HtmlPage.aspx?name=faq.

- “Off-site Construction Council: About the Council,” National Institute of Building Sciences, accessed December 2, 2020, https://www.nibs.org/page/oscc.

- Nick Bertram, Steffen Fuchs, Jan Mischke, Robert Palter, Gernot Strube, and Jonathan Woetzel, Capital Projects & Infrastructure—Modular construction: From projects to products, McKinsey & Company, June 2019, page 1.

- U.S. Chamber of Commerce Commercial Construction Index: Q3 2020, page 6, https://www.uschamber.com/sites/default/files/2020_cci_q3.final_.pdf.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 4.

- Ibid

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 7.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 5.

- Prefabrication and Modular Construction 2020 SmartMarket Report, pages 12 and 14.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 32.

- Prefabrication and Modular Construction 2020 SmartMarket Report, pages 24 and 25.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 6.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 7.

- Prefabrication and Modular Construction 2020 SmartMarket Report, pages 32 and 33.

- The Prefabrication and Modular Construction 2020 SmartMarket Report, p. 46.

- Prefabrication and Modular Construction 2020 SmartMarket Report, pages 46 and 47.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 6.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 5.

- “Gazing into the Crystal Ball,” Insulation Outlook, April 1, 2020, https://insulation.org/io/articles/gazing-into-the-crystal-ball-12/.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 18.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 22.

- Prefabrication and Modular Construction 2020 SmartMarket Report, page 43.

- “Gazing into the Crystal Ball,” Insulation Outlook, April 1, 2020, https://insulation.org/io/articles/gazing-into-the-crystal-ball-12/.