Project Delays Are Coming: Develop a Strategy Now

As uncertainty around the outlook for various engineering and construction sectors grows alongside the current recessionary environment, many leaders are beginning to worry about project delays and cancellations.

Sentiment in the industry is worsening, with the fourth quarter Nonresidential Construction Index (NRCI) sitting at 46.31, indicating most of those surveyed are expecting contraction in the coming quarters. Yet, a recession does not mean only doom and gloom. As with any form of external pressure, there will be winners and losers.

Especially concerning is the growing number of project delays and cancellations. FMI research conducted September 1 to 15, shows that 89% of respondents have experienced owner-led project start delays in 2022. Another 44% experienced supply chain-related project delays. Only 8% of those surveyed said they had not experienced any project start delays in 2022.

The key to weathering this downturn is to understand your operating environment and then create a plan that is right for your company and customers.

But simply having a plan and reviewing it are not enough. Any market research and data that serves as the basis for your assumptions should be examined and updated to consider the current environment. For example, during the last recession, construction spending declined 40%; so understanding the nuances of your markets and geographies is important when making decisions.

The Limits of Strategic Planning

To succeed in the construction industry, leadership must be excellent tacticians, skillful at the systematic management of business and project processes. Unfortunately, our industry’s process-oriented nature often relegates development of strategy to an

exercise that, once completed, has limited impact on the company’s success.

In speaking with more than 150 engineering and construction executives,2 one of the things FMI heard was that the strategic decisions companies made during the last recession were mostly the right ones—they just were not implemented fast enough.

That tells us that many organizations have the ability and people to create a strategy, but they are not necessarily integrating strategic thinking into their daily decisions and actions. Developing leaders who think strategically and implement decisions quickly versus working from documents creates long-term value.

Strategies rooted in fact-based analysis and led by leadership teams who review them on a regular basis often generate the most innovative thinking and insights. That is where market research and due diligence help define the opportunities and inform the way forward.

But it is not enough to develop a plan. The real work begins during implementation. Often, companies formulate the best plans and then do not take the time to truly put those strategies into place, failing to transform their businesses. Times of pressure, like the current recession, lead to many attempts at strategic planning, but few successes.

How Economic Softening Is Starting to Play Out in the Built Environment

As noted, project delays and cancellations are accelerating for many across the construction industry. When it comes to cancellations, the numbers are also concerning, with 47% of those surveyed experiencing owner-led cancellations in 2022.

This data indicates that the lackluster industry sentiment about the outlook for the next few quarters is warranted and reinforces the fear that more project delays will yield cancellations as the economy weakens.

Market participants are starting to send signals about an anticipated plateau, which is in stark contrast to the growth of construction put in place over the last several years. FMI’s fourth quarter outlook forecast an 18- to 24-month recession,3 with the caveat that some sectors and geographies will see opportunities, while others will decline.

Leading indicators such as home prices, interest rates, gross domestic product, and the inverted yield curve are causing many in the industry to reevaluate their prospects for 2023 and beyond, as many owners struggle with rising borrowing costs and the changing economic conditions.

The construction industry lags the overall economy; so while the effects of the slowdown are not necessarily being felt today, they are likely to hit later in 2023 or 2024. Indeed, FMI’s nationwide forecasts indicate a contraction in construction put in place spending, first in residential segments (single and multifamily) in 2023, followed by similar contractions in the broader traditional private sectors, including commercial, office, and lodging segments and beyond, starting in 2024.

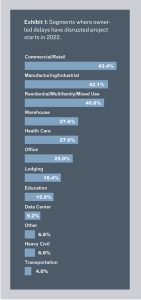

Leading segments of owner-led project delays, according to our survey (see Exhibit 1), were:

- Commercial and retail (43%);

- Manufacturing and industrial (42%); and

- Residential, multifamily, and mixed-use developments (41%).

These segments are typically privately funded and often developer led, meaning that they are much more responsive to changes in interest rates and other financing conditions.

In contrast, the segments with the least reported owner-led project delays include:

- Transportation (4%),

- Heavy civil (7%), and

- Data centers (9%).

Transportation and heavy civil are public arenas using federal, state, and local funds being spent according to a capital improvement plan released years before. Data centers are privately funded and built much like a manufacturing project. Spending on data centers is expected to stay high through the recession, given their unprecedented demand.

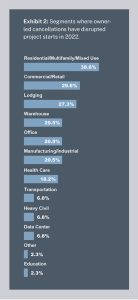

When looking at cancellations, the leading segments mirror those that are being delayed and directly relate to shifts in the economy and the way we work (see Exhibit 2). The leading segments experiencing cancellations in 2022 were:

- Residential, multifamily, and mixed-use developments (39%);

- Commercial and retail (30%); and

- Lodging (27%).

Residential, multifamily, and mixed-use developments are leading cancellations and are third in the group of segments experiencing delays, indicating how sensitive these projects are to economic conditions. Developers closely monitor their margins on these projects and are quick to delay or cancel them when they become unviable.

Again, publicly funded projects in segments like education (2%), heavy civil (7%), transportation (7%), and data centers (7%) experienced fewer cancellations.

Managing through a Recession

A common refrain heard from contractors is that they are ready for the recession due to the size of their backlogs, with many anecdotally reporting backlogs of 6 to 18 months. However, backlogs are not fully guaranteed and, depending on the sector, could be in danger of shifting or going away entirely. Additionally, consider opportunities and prospects beyond this horizon: What does your organization look like? How do you adapt

to volatility?

A healthy backlog will keep things going for some time, but contractors who think through the timing of the recession and how hard their segments will be hit will fare better as the recession ends.

The most successful firms are those that use the opportunity of a downturn to take a hard look at the geographies and markets where they operate, as well as their overall strategy, and make sure they are well positioned to execute.

The current contraction is expected to last at least 2 years, meaning that the decline will finally turn around in 2025 or 2026, depending on the focus of the construction business. Even then, some segments may experience no growth or lingering negative growth rates before expanding again. While the end of the recession is harder to predict, FMI believes the recession has begun.

What to Do about Delays and Cancellations

For the proactive firms in the industry, there are plenty of questions to consider. What happens if projects in backlog get delayed or canceled? Do you fill in with other projects or avoid taking on the risk of being double-booked? How does that impact how you select pursuit opportunities? Should your go/no-go process include an assessment of how likely a project is to start on time or at all?

You need a plan to address forthcoming change. Some things to consider beyond managing your backlog include:

- Communicating with your team early. Ask members to be part of potential solutions, and get feedback on your plans.

- Tackling processes and operational improvements4 that may have been delayed due to project work, such as refreshing your market strategy, freeing up organizational capacity, or training and development.

- Adding renovations or retrofit work to your backlog, since often businesses shift spending to improving buildings that are already in use.

- Keeping more cash on hand and remaining diligent about collections. Cash reserves will add flexibility and resiliency to your firm.

Firms that are quick to recognize a recession has started and respond appropriately tend to fare better. Those that take the time to engage their employees, find ways to train and develop their people, revisit their processes, and take advantage of the extra time to take on strategic planning are the biggest winners.

Further, builders who have confidence when they see the end of the recession approaching can find ways to get in front of key owners again as soon as possible, particularly when they are coming with a strategic refresh in hand.

Implementing a Strategic Plan

Once a plan is finalized, it is important to keep that momentum and start the work of putting it into place. It is easy to lose focus after a large project, but it is important to quickly move forward while the goals and directions are fresh.

The first step in integration is to set clear guidelines and benchmarks for measuring progress. You have already got a clear strategy written down; now it is time to be transparent on how you are going to make changes, who will be responsible for the work, and how they will be evaluated on their success.

Leaders should create timelines, assign specific areas of responsibilities, and schedule regular check-in conversations. Establishing key performance metrics and being transparent about progress toward meeting them will help everyone in the organization understand the status of the implementation.

Be sure to include regular communications and timing as part of the initial implementation planning. That way people across the organization understand if goals are being met and what is expected to continue the work.

It is also important to set up a process for continuously reviewing the strategic plan and progress toward meeting those goals. The operating environment is constantly changing; and your strategy, while not vastly different, should be tweaked to optimize your market position.

Conclusion

We fully expect the rate of cancellations to increase and the share of negative sentiment about the economy and construction where we all work to grow over the course of the next two quarters. Already, we can observe the shift from positive to cautious sentiment.

We observe this both in our own NRCI data as well as the S&P Global U.S. Manufacturing PMI falling to 47.7 in November5, pointing to the first contraction in factory activity since June of 2020. We encourage everyone to think about how to respond.

References

- Jay Bowman, Brian Strawberry, and Emily Beardall, “2022 North American Engineering and Construction Outlook Fourth Quarter,” FMI, September 2022; accessed at

https://fmicorp.com/insights/construction-outlook/2022-north-american-engineering-and-construction-outlook-fourth-quarter - Rick Tison, “Don’t Wait: Craft a Winning Strategy Now,” FMI, March 2021; accessed at https://fmicorp.com/insights/quarterly-articles/dont-wait-craft-a-winning-strategy-now

- Brian Strawberry, Jay Bowman, Ryan Foley, and Mike Clancy, “How Bumpy Is it Going to Get? Mapping Recession Scenarios,” FMI, July 2022; accessed at https://fmicorp.com/insights/industry-insights/how-bumpy-is-it-going-to-get-mapping-recession-scenarios

- Gregg Schoppman, “Preconstruction: The Foundation in Operational Excellence,” FMI, July 2022; accessed at https://fmicorp.com/insights/quarterly-articles/preconstruction-the-foundation-in-operational-excellence

- “United States Manufacturing PMI,” Trading Economics, January 2023; accessed at https://tinyurl.com/yc22mhm7.

To learn more about this topic, visit www.fmi.com.