Construction Market

Forecast: Slow and Steady 2014

By Tim Grogan and Tom

Ichniowski

It has been a long time coming, but

the construction recovery seems to be

almost here. The housing market has been

keeping up construction growth, which is

rebounding from record lows, but now

many of the nonresidential building

markets are starting to turn the corner,

making for many optimistic forecasts for

2014. The remaining drag on construction

growth for next year is the public

sector, which continues to be squeezed

by the battle over the federal deficit.

Some economists, however, see a

silver lining even there. “The

recession pushed millions of workers out

of the industry, and it is not going to

be easy to get them back, so a slow but

steady recovery might be the best thing

for helping to control inflation,”

says Randy Giggard, Chief Economist for

the Fails Management Institute (FMI),

Raleigh, North Carolina. “You

could make a similar argument for some

of the materials markets.”

Construction market fundamentals are

there for even stronger growth, but

markets are hobbled by political

uncertainty generated by chronic budget

battles between Democrats and

Republicans. All the forecasts collected

by the Engineering News-Record (ENR)

take into consideration this political

uncertainty, but if politics spins out

of control again, the rather optimistic

consensus among economists for 2014

could suddenly turn less sunny. For now,

all the forecasts suggest the industry

can look, as the Monty Python song says,

“on the bright side of

life.”

The McGraw Hill Construction (MHC)

forecast for 2014 is certainly on the

bright side, calling for a 9% increase

in construction starts next year. It

also predicts strong double-digit growth

in the dollar value of single-family

housing, multifamily housing, and

commercial buildings. MHC also is

forecasting that a 3-year decline in

institutional buildings will be checked

in 2014 with a modest 2% gain next year.

Manufacturing work is forecast to

increase 8% next year, following a 6%

increase this year. MHC expects public

works to fall another 5% next year,

while the power market drops 33%.

“Our outlook is positive, with

a few caveats,” says Robert Murray, MHC

Chief Economist. “This is another

step on the way to a more full-fledged

expansion,” he adds.

“Because this is a measured

expansion, there is a very good chance

this forecast will play out.”

Murray cautions the industry not to

get too excited about percent changes.

While MHC is seeing good growth in the

residential and commercial markets, and

many nonresidential building markets are

starting to turn the corner, most are

still below peak levels, Murray says.

Murray puts himself in the

“slow-and-steady is not a bad

thing” camp. “The way the

recovery is unfolding is beneficial for

2 reasons: It lessens the chance of

another boom-then-bust cycle, and it

allows for labor constraints to be less

severe,” he says.

Robert Denk of the National

Association of Home Builders (NAHB),

Washington, D.C., agrees that slower is

better-do not get too excited about

percent changes. “We are seeing

some great percent increases, but we are

still short of where we would like to

be,” he says. For Denk, a

“normal” market would be

about 1.3 million housing starts a year.

NAHB estimates that total housing starts

will increase a healthy 18%, to 924,000,

this year. NAHB predicts the market will

approach ”normal” next year,

with 1.15 million starts.

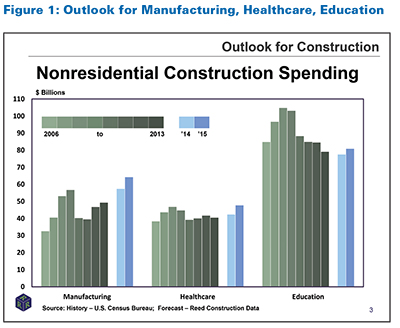

While double-digit increases in

housing are driving overall construction

growth, economists are just as excited

about some broad swings in the

nonresidential markets that they see

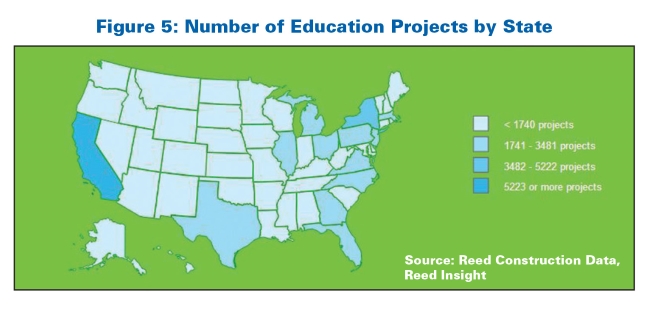

coming next year. Murray predicts that

Dodge starts for educational buildings

will swing from a negative 3.4% this

year to a positive 3.0% in 2014. He also

sees health care going from a minus 2.8%

this year to a plus 2.0% next year.

“The key for 2014 is institutional

buildings. Can [that market] stabilize,

or is there room for further declines?

” he asks. Murray’s forecast calls

for the institutional building market to

bounce back 2% next year, after falling

4.4% in 2013.

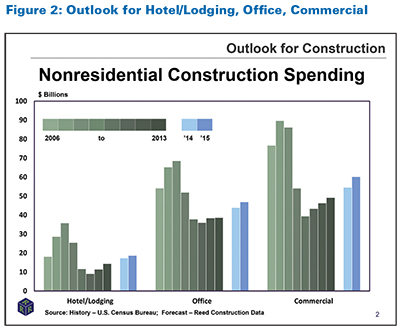

Similar Swings

FMI’s Randy Giggard predicts similar

swings. FMI’s forecast calls for the

office market to go from a minus 2% to a

plus 4%, for school building to go from

a 4% decline to a 4% increase, and

health-care work from down 1% to up 6%.

“Health care follows a natural

cycle, and it is just time to start

building more hospitals,” Giggard

says. “And people keep voting for

school building bonds, so that market is

looking good, too,” he adds.

The Portland Cement Association

(PCA), Skokie, Illinois, is predicting

an 8% increase in construction put-in-place next year, compared to an

estimated increase of just 1.3% this

year. The PCA forecast is a little more

bullish on public construction than

other forecasts. PCA predicts growth in

the overall public market will swing

from a negative 5.2% this year to a

positive 3.4% in 2014.

The Associated Builders and

Contractors (ABC), Washington, D.C., is

forecasting a 6% increase in

construction next year. “Our model

shows next year’s growth of 5% for

commercial construction, 7% for health

care, 8% for lodging, and 6% for

communications,” says Anirban

Basu, ABC’s chief economist.

The forecast for highway paving and

bridge work by the American Road &

Transportation Builders Association

(ARTBA), Washington, D.C., is mixed,

with tepid growth for paving work but

relatively strong growth for bridge

construction. “The 1.9% increase in

paving work we are forecasting for next

year barely even qualifies as a

rebound,” says Alison Black, ARTBA’s

chief economist. She estimates the

paving market fell 11.4% this year,

following a 3.3% decline in 2012.

“The pavement market looks pretty

sluggish over the next few years,”

she adds.

Bridge work, on the other hand, is

growing at a steady pace. ARTBA predicts

the dollar value for bridge work in 2014

will increase another 5.6%, after

increasing 7.1% this year and 5.1% in

2012.

“We have seen a big divergence

between the highway and bridge

markets,” says Black. “On

the pavement side, we have seen a

significant pullback in state and local

spending. But what is really holding

down our forecast is the questions over

the Highway Trust Fund,” she adds.

“There is very little money going

into new construction.”

Indeed, federal government funding

is a key issue for many construction

markets next year because of its

uncertainty. A congressional budget

standoff caused a 16-day shutdown of

much of the federal government in

October, further unsettling the

companies that pursue federal

construction projects.

During the shutdown, many agencies

did not award new contracts, and there

also was a temporary halt in the Corps

of Engineers’ processing of permits to

build in and around wetlands.

Finally, on October 16,

congressional leaders reached an

agreement to extend funding through

January 15 and brought federal workers

back on the job. The measure also

averted a government default by raising

the debt ceiling through February 7.

In addition, the deal called for

members of the House and Senate budget

committees to begin negotiations toward

a budget blueprint for fiscal year 2014.

If enacted, it would be the first budget

resolution to become law since 2009. The

joint House-Senate budget conference

committee held its first meeting on

October 30 and met again on November 13

but did not reach an agreement.

The conferees, led by House Budget

Committee Chairman Paul Ryan (R-WI) and

Senate Budget Panel Chairman Patty

Murray (D-WA), face a December 13

deadline to produce a deal. (Note: Since

printing, this deadline passed and was

not met. Budget negotiations are still

in progress).

Murray said the minimum goal would

be to set an overall discretionary-spending cap for 2014. While the House

approved a $966-billion limit, and the

Senate passed a $1.058-trillion cap.

If the budget conferees can agree on

a compromise “top line”

spending figure, the House and Senate

appropriations committees would set to

work to determine 2014 funding levels

for each line-item account, including

construction programs. Another open

question is whether the budget conferees

will replace the mandatory budget

sequester’s wide-ranging spending

reductions with some alternate formula

for reductions. The 2013 sequester round

cut construction spending by $4 billion,

according to ENR’s estimate.

Reprinted courtesy of

Engineering News-Record, copyright

McGraw Hill Financial, December 2/9,

2013, All rights reserved. The full

report (subscription required), is

available at

https://enr.construction.com/engineering

/subscription/LoginSubscribe.aspx?

cid=27158.

Construction Firms Expect

Growing Demand in 2014

Many firms plan to start hiring

again, and most contractors predict

demand will either grow or remain stable

in virtually every market segment this

year, according to survey results

released on January 21, 2014 by the

Associated General Contractors of

America (AGC). The survey, conducted as

part of Optimism Returns: The 2014

Construction Industry Hiring and

Business Outlook, provides a generally

upbeat outlook for the year even as

firms worry about growing worker

shortages, rising costs, and the impact

of new regulations and federal budget

cutting.

“Contractors are more

optimistic about 2014 than they have

been in a long time,” said Stephen

E. Sandherr, the AGC’s Chief Executive

Officer. “While the industry has a

long way to go before it returns to the

employment and activity levels it

experienced in the middle of the last

decade, conditions are heading in the

right direction.”

Sandherr noted that many firms plan

to begin hiring again, while relatively

few plan to start making layoffs. Forty-one percent of firms that did not change

staff levels last year report they plan

to start expanding payrolls in 2014,

while only 2% plan to start making

layoffs. However, net hiring is likely

to be relatively modest, with 86% of

firms reporting they plan to hire 25 or

fewer new employees this year.

Among the 19 states with large

enough survey sample sizes, 100% of

firms that did not change staffing

levels last year in Utah plan to start

hiring new staff this year, more than in

any other state.

Contractors have a relatively

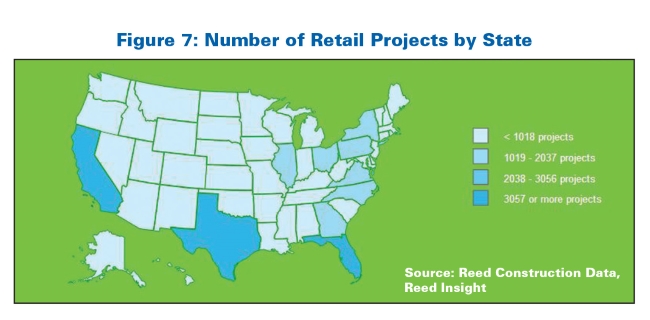

positive outlook for virtually all 11

market segments covered in the Outlook,

in particular for private-sector

segments. For 5 of those segments, at

least 40% of respondents expect the

market to expand, and fewer than 20%

expect the market to decline in 2014.

The difference between the optimists and

pessimists-the net positive reading-is a

strong 28% for private office,

manufacturing, and the combined

retail/warehouse/lodging segments; and

25% for power and hospital/higher

education construction.

Among public-sector segments,

contractors are more optimistic about

demand for new water and sewer

construction, with a net positive of

17%. Contractors are mildly optimistic

about the market for highway

construction, with a net positive of

10%. Respondents are almost equally

divided regarding the outlook for the

other 4 segments, ranging from net

positives of 5% for public buildings, 4%

for schools, and 3% for transportation

facilities other than highways, to a

negative of 2% for marine construction.

Sandherr added that contractors’

market expectations are significantly

more optimistic than they were at this

time last year. At that time, more

contractors expected demand to shrink

for highway, other transportation,

public building, retail, warehouse and

lodging, K-12 schools, and private

offices than expected it to grow.

Many contractors also report they

plan to add new construction equipment

in 2014. Seventy-three percent of firms

plans to purchase construction

equipment, and 86% report they plan to

lease it this year. The scope of those

investments is likely to be somewhat

limited, however. Forty-four percent of

firms say they will invest $250,000 or

less in equipment purchases, and 53% say

they will invest that amount or less for

new equipment leases.

One reason firms may be more

optimistic, association officials noted,

is that credit conditions appear to have

improved. Only 9% of firms report having

a harder time getting bank loans, down

from 13% in last year’s survey. Only 32%

report customers’ projects were delayed

or canceled because of tight credit

conditions, compared with 40% a year

ago.

“While the Outlook is

significantly more optimistic than in

years past, there are still areas of

concern for most contractors,”

said Ken Simonson, AGC’s Chief

Economist. “Many firms will

struggle to find enough skilled workers,

cope with escalating materials and

health care costs, and comply with

expanding regulatory burdens.”

Ninety percent of construction firms

report they expect prices for key

construction materials to increase in

2014. Most, however, expect those

increases will be relatively modest,

with 43% reporting they expect the

increases to range between 1 and 5%.

Meanwhile, 82% of firms report they

expect the cost of providing health-care

insurance for their employees will

increase in 2014. Despite that, only 1%

of firms report they plan to reduce the

amount of health-care coverage they

provide.

Simonson noted that as firms

continue to slowly expand their

payrolls, they were likely to have a

harder time finding enough skilled

construction workers. Already, 62% of

responding firms report having a

difficult time filling key professional

and craft worker positions; two-thirds

of firms expect it will either become

harder or remain as difficult to fill

professional positions; and 74% say it

will get harder, or remain as hard, to

fill craft worker positions.

Those worker shortages are already

having an impact, the economist added.

Fifty-two percent of firms report they

are losing construction professionals to

other firms or industries, and 55%

report they are losing craft workers. As

a result, a majority of firms report

they have improved pay and benefits to

help retain qualified staff. One reason

they are likely worried is that nearly

half of the firms believe training

programs for new craft workers are poor

or below average.

Adding to their challenges, 51% of

contractors report that demand for their

services is being negatively impacted by

federal funding cuts, new federal

regulations, and/or Washington’s

inability to set an annual budget.

“It would appear that Washington

is not here to help as far as

contractors are concerned,“

Simonson noted.

Association officials added that

survey respondents would prefer that

Washington officials work on other

priorities. Seventy-seven percent of

firms reported listed having Washington

find ways to make it easier to prepare

the next generation of skilled workers

as a top priority, 63% listed repealing

all or part of the Affordable Care Act

as a top priority, and 63% listed

renewing tax deductions and bonus

depreciation for construction equipment

as a top priority.

The Outlook was based on survey

results from over 800 construction firms

from every state and the District of

Columbia. Varying numbers responded to

each question. Contractors of every size

answered over 40 questions about their

hiring, equipment purchasing, and

business plans.

The Optimism Returns: The

2014 Construction Hiring and Business

Outlook report is available in full at

www.agc.org/galleries/news/2014%20Constr

uction%20Hiring%20and%20Business%20Outlo

ok%20Report%20%282%29.pdf

Nonresidential Construction

Index (NRCI) Predicts Growth, Hiring

Concerns in 2014

Nearly all components of the FMI’s

2014 first quarter NRCI report are on

the rise. The NRCI bounced back from a

drop of 2.9 points in the fourth quarter

of 2013 to register 64.9 in the first

quarter of 2014, the highest mark yet

for the NRCI and 6.8 points better than

the first quarter in 2013. FMI’s current

report and reports from other sources

and surveys are beginning to indicate a

growing industry challenge to find and

hire more talented people.

That concern will continue,

according to 49% of FMI’s panelists who

expect growth in construction to improve

from 2.6% to 5% next year, while 36%

expect more modest growth. Few expect

slower growth, and only 3% expect more

expansive growth. The forecast for

construction growth is nearly matched

with the expectation of hiring growth.

More likely, hiring will continue to lag

growth in backlog since most panelists

do not expect to hire until they

absolutely need to and current staff is

consistently maxed out. One of FMI’s

panelists explained, “We are

focused on hiring the top talent

available before we need the help.

Waiting to hire a body because you have

more work than you can handle produces

weak results and unhappy teams.”

The question as to when to hire is

something each company will have to

answer for itself, but the report notes

that hiring talented people ranks at the

top of the challenges for 2014 given by

FMI’s panelists.

The NRCI report was prepared

by FMI. The full report is available

online at

www.fminet.com/visitor/download/fre

eDownload/id/557

After a Year of Moving

Sideways, Nonresidential Building

Activity Poised to Resume Recovery in

2014

By Kermit Baker

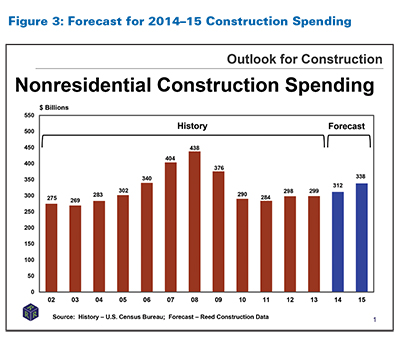

Nonresidential building activity had

a disappointing performance in 2013,

with spending levels largely unchanged

from those of 2012. However, 2014 looks

to be a better year, with building

activity increasing 5.8% overall,

including a double-digit gain for

commercial facilities. The recovery will

continue into 2015, with spending

increasing 8% overall and 6% for

institutional buildings.

These are some of the key findings

from the American Institute of

Architects’ (AIA’s) Consensus

Construction Forecast, conducted in

December 2013. Semiannually, the AIA

compiles results from the leading

national construction forecasters to

develop its consensus. The forecasters

lowered their outlook for 2014 from the

2013 midyear update, which had projected

7.6% growth for the coming year.

However, disruptions in the economy in

the second half of the year stalled the

construction recovery, modestly pushing

back growth rates.

Economy Moves Toward

Stronger Growth

After generating more than 5% growth

in spending in 2012-reversing a steep 4-year decline-nonresidential building

activity was poised to continue its

recovery in 2013. However, a few

roadblocks materialized: The popular

suspects included a federal budget

sequester that scaled back government

spending, a federal government shutdown,

credit restrictions for construction

projects, and rising long-term interest

rates motivated by concern that the Fed

was going to scale back its stimulus.

While all of these factors certainly

played a role in holding back more

building activity, the problem was more

encompassing. The U.S. economy appears

to have grown less than 2% last year,

well below the 2.8% pace of 2012.

Unfortunately, the United States was not

the only laggard. World economic growth

had its worst performance since the 2009

global financial meltdown, garnering

only a 2.9% growth rate, according to

estimates from the International

Monetary Fund (IMF). The economies of

virtually every major region of the

world either declined or saw slower

rates of growth last year, as compared

to 2012. Slower international growth

affected U.S. exports, which, coupled

with ongoing domestic concerns,

discouraged construction activity.

What will change in 2014? The

international economy is expected to

move back to more traditional growth

levels, with world economic growth

expected to increase almost a full

percentage point, according to the IMF.

But there are more improvements on the

horizon closer to home.

Home building is expected to see

strong gains. The slowdown in household

formations during the foreclosure crisis

is expected to reverse, and steady gains

in house prices will bolster confidence

that it is once again safe to buy a

home. The consensus is that housing

starts will increase 25% this year, but

even that pace of growth would only

produce between 1.1 and 1.2 million

starts, well below long-term trends.

Energy is a net positive for the

economic outlook. After decades in which

energy costs were a principal risk

factor to the economy, they have

transformed into a positive benefit. In

recent years, hydraulic fracturing has

dramatically increased domestic

production of both crude oil and natural

gas. As a result, household energy costs

have been trending down for the past 5

years.

The manufacturing sector is strong.

After a steep downturn in production

output during the recession, the

manufacturing sector has come roaring

back. In spite of relatively weak growth

in the overall economy, industrial

production has averaged gains of almost

4% per year over the past 4 years, the

strongest 4-year performance since the

late 1990s. Lower energy costs are a

major factor in making domestic

manufacturing more attractive,

particularly for energy-intensive

industries like steel and chemicals.

Consumer spending is increasing.

Consumer spending for large-ticket

purchases has been one of the bright

spots in the economy in recent years,

having grown 6% or more for each of the

past 4 years. With household wealth

levels now 10% above their pre-recession

high, consumer spending is likely to

continue. Encouragingly, a higher share

of the wealth gain now comes from home

equity, which is more broadly enjoyed

than other forms of wealth.

This is not to say that there will

not be economic challenges moving

forward. The unemployment rate remains

high, and 2013 ended with fewer workers

on payrolls than before the recession.

The United States has a large and

growing federal debt level, a situation

that is likely to be a contentious

political issue as the next debt ceiling

limit approaches in the next few months.

It is still too early to tell how the

economy will respond to the Fed’s

winding down of its bond-buying program.

Construction on a Solid

Footing

With the economy finally

stabilizing, there should be some

substantial improvement in the

construction outlook. Both design

activity at architecture firms and the

fundamentals of the commercial property

market point to healthy growth moving

forward.

Even with a modest dip last November

and December, the AIA’s Architecture

Billings Index (ABI) has risen in the

vast majority of the last 16 months.

With such sustained growth in design

activity, continued improvement in

construction activity will follow suit.

While the residential sector has led the

upturn in the ABI, firms specializing in

the commercial/industrial sector have

reported solid results for most of the

past year. Even firms serving the

institutional sector have generally been

reporting modest levels of growth over

the past year.

In recent months, sunbelt firms have

enjoyed the best business conditions.

These regions tended to be the most

overbuilt prior to the downturn. Now

that growth is returning, markets in

these regions are capturing a

disproportionate share of activity. For

example, a recent analysis of

construction employment growth in metro

areas conducted by AGC using U.S.

Department of Labor data reported that

metro areas in the West accounted for 5

of the top 10 areas in the country in

terms of construction jobs added over

the past year. Three of these top growth

markets were in California. Two

additional growth markets were in the

South. Still, in Boston, New York, and

Minneapolis/St. Paul, which have not

seen much population growth in recent

years, a strong economy has put these 3

in the top 10 in terms of gains in

construction employment over the past

year.

In addition to increased workloads

at architecture firms, indicators from

the construction sector point to

increased activity levels moving

forward. Commercial property values—which declined at a steeper rate

nationally than did house prices during

the recession—have recovered nicely. As

of late 2013, commercial property values

had gained back almost two-thirds of

their losses, according to data from

Moody’s/Real Capital Analytics

Commercial Property Price Index.

Other commercial market indicators

point to strength. Vacancy rates for

offices and retail facilities have been

declining recently, and occupancy rates

at hotels have been increasing. Over the

next 2 years, vacancy rates are expected

to continue to decline for offices and

retail facilities, and rents are

projected to increase, according to a

consensus forecast of industry experts

conducted last October by the Urban Land

Institute. These indicators reflect a

growing demand for commercial space.

Supply Conditions Still a

Concern

In spite of a weak overall recovery

to date, supply conditions for

nonresidential building are unusually

tight. Construction financing remains a

problem. Bank credit standards for

construction and land development loans

have eased modestly, according to the

October Federal Reserve Board Senior

Loan Officer Survey. However, the modest

easing does not offset the sharp

increase in demand for these loans that

many of the loan officers are reporting.

Contractors are having difficulty

finding workers. In spite of a high

unemployment rate among construction

workers, home builders and

nonresidential building contractors

report difficulties filling positions. A

survey by AGC in August found that

almost three-quarters of contractors

reported problems filling at least some

of their craft positions, and over half

were having trouble filling professional

positions. Only 12% of contractors that

were hiring reported no problems filling

positions.

Construction costs are also rising.

In a low-inflation environment with weak

levels of construction activity,

construction costs would be expected to

be stable at worst. However, the U.S.

Department of Labor reported that

producer prices for major nonresidential

building types have risen in the 3 to 4%

range over the past year. Overall

consumer inflation increased by only 1%

over this period, and producer prices

were up only 0.7%. Lumber, plywood, and

gypsum prices were up at a double-digit

pace over this period, with insulation

materials up almost as much.

Building Activity

Resumes

With less of a decline in government

spending, and with healthy fundamental

conditions in the nonresidential

building sector (growing property

values, declining vacancies, and

increasing rents), 2014 should produce

healthy gains in nonresidential building

activity. With spending stronger in the

private side of the economy, the

commercial/industrial building sector is

expected to be resurgent. In 2013, when

overall nonresidential building spending

saw almost no growth, spending on

commercial and industrial facilities

increased about 5%. Growth in this

sector will accelerate this year,

reaching 10%, according to the

consensus forecast panel, and will see

slightly stronger growth in 2015. The

hotel sector is expected to be the

strongest commercial sector this year,

but offices and retail space also should

see healthy gains.

Institutional building lost ground

last year, but 2014 should usher in the

long-awaited institutional building

recovery. Spending gains are expected to

reach 3.4% this year, and accelerate to

6.3% in 2015. Health care is expected to

be one of the stronger institutional

sectors this year and next, but the

education market should also see healthy

gains.

Article reprinted with

permission from AIA’s magazine,

AIArchitect, January 24, 2014 issue,

Vol. 21. This article and AIArchitect

can be accessed online at

www.aia.org/practicing/AIAB101318.