AIA: Even with Uncertainties Looming, Healthy Gains Projected for 2017 Building Activity

By Kermit Baker

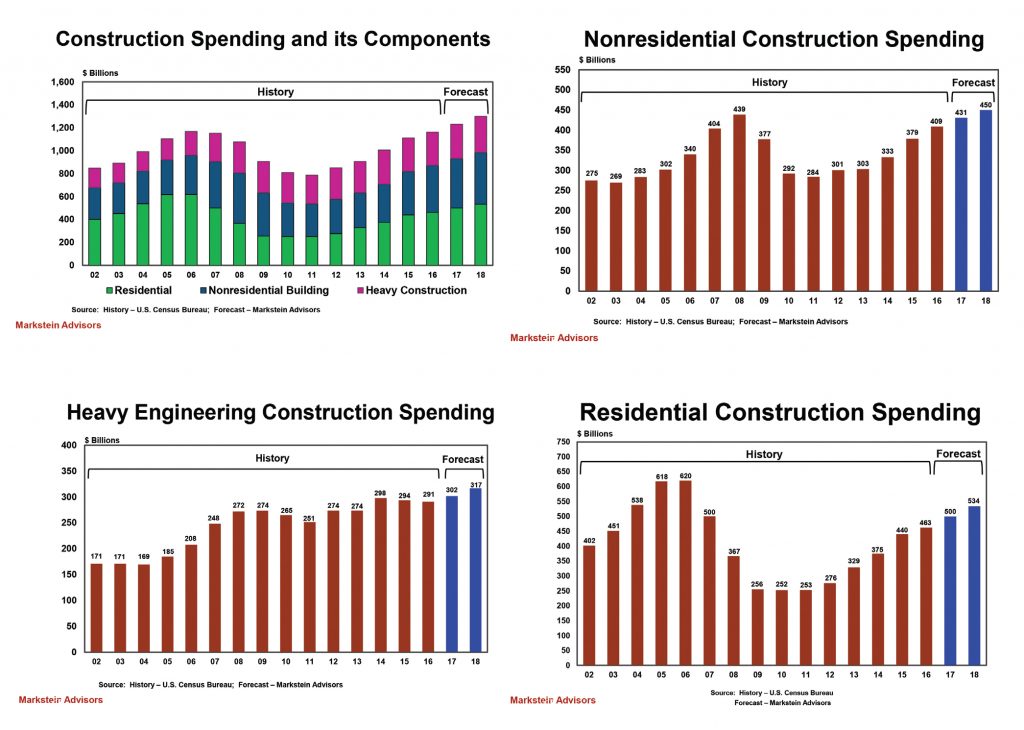

2016 was a chaotic year for non-residential building activity. For most serving this market, it turned out to be a successful year—construction spending in this sector rose almost 8%, according to current estimates—even as challenges to the industry were continually emerging. Construction labor remains a major concern. Virtually every segment of the design and construction market is reporting that recruiting and retaining qualified staff is a growing issue. Many workers left the industry during the downturn, and others left the workforce entirely. Rebuilding a competent and productive workforce is a challenge, particularly when the national unemployment rate is below 5%.

The decade-long decline in interest rates is coming to an end. Long-term rates have been edging up in recent months, and the Federal Reserve Board’s hike in short-term interest rates in December is likely to be matched by another 2 to 3 increases this year. Many feel that this current economic cycle is well past its prime, so a recession watch remains. While the imminent threat of a national economic recession seems modest, most analysts have it in the back of their minds and each new economic threat will be viewed in this context.

However, entering 2017, the industry is looking forward to another couple of years of healthy growth. The economy in general is doing well, with healthy job growth, rising wages, low interest rates, and very strong levels of business and consumer confidence. Construction levels surprised many on the upside this past year, particularly for most commercial categories. According to current estimates, spending on offices increased more than 20% in 2016, hotel spending was up about 25%, and even retail and other commercial facilities saw growth of about 10%. Industrial construction was weak, as expected. Institutional project activity was somewhat disappointing, particularly for health-care facilities.

For the coming year, the American Institute of Architects (AIA) Consensus Forecast panelists are projecting growth in overall non-residential building spending of almost 6%, virtually identical to their projection from mid-year 2016. Commercial construction activity is expected to increase in excess of 8% this year, which is slightly above the projection from mid-2016. Industrial construction looks to remain essentially flat at 2016 levels, below the growth expected as of the last forecast. Institutional construction is projected to grow at an almost 6% pace, largely unchanged from last summer’s consensus.

The Consensus Forecast panel sees the construction cycle continuing to ease moving into 2018. Overall building spending should increase by about 5% that year, with the commercial and industrial sectors growing at a slower rate than the overall building sector. Institutional building activity will pick up some of the slack, growing nearly 6%. Educational facilities are expected to see healthy gains, and even health-care spending is projected to be fairly strong.

How the New Administration’s Potential Policies May Impact Construction

The general uncertainty surrounding the construction outlook has been heightened by new policy directions being proposed by the Trump administration. Many of these policy discussions are not yet sufficiently developed to project specific implications, but there is a long list of issue areas that may have an impact.

• Infrastructure investment: The infrastructure investment proposal is the one area under discussion that has the greatest direct impact on the construction industry. With national construction spending currently running at about a $1.2 trillion a year pace, this proposal to increase spending by up to $1 trillion over the coming decade would have a dramatic impact on the industry. In all likelihood, buildings would not be much of a focus for most of these projects. However, the additional demand for labor and materials would put pressure on an already stressed industry.

• Repeal and replace Obamacare: Health-care accounts for about 10% of building spending nationally, so major changes to the health-care system, or even uncertainty surrounding the possibility of major changes, could have significant impacts on building construction levels.

• Roll back governmental regulations: A widely cited study by the National Association of Home Builders concludes that, on average, regulations imposed by government at all levels account for 25% of the final price of a new single-family home built for sale. While the federal government has limited ability to influence state and local regulations, initiatives to reduce government’s involvement in the private sector construction process would likely streamline the design and construction process.

• Tax reform: Trump administration proposals for simplifying and potentially reducing tax burdens are likely to have disproportionate benefits to the corporate sector and upper-income individuals. This would likely increase the availability of capital for investment, thereby increasing commercial and industrial construction, at least in the short term.

• Trade: Restricting trade would likely increase prices of imported construction products. For construction product manufacturers, those relying on exports could see reduced demand, as our trading partners may decide to match any U.S. restrictions on their goods. Those with import competition might see increased demand, as tariffs or restrictions likely would raise prices on these imported goods.

• Immigration: Construction is one of the U.S. industries that is most reliant on immigration for its workforce. Limiting immigration could exacerbate an already serious labor problem in the industry.

• Financial deregulation: Rolling back Dodd-Frank provisions would increase the availability capital for mortgage, real estate, and construction loans. Privatizing government-sponsored enterprises like Fannie Mae and Freddie Mac could reduce lending to the residential sector.

• Energy policy: Efforts to make the United States energy independent would unleash programs to boost fossil-fuel production. Incentives to encourage the development of renewable energy sources and promote sustainable design and construction would likely be significantly reduced with these programs.

While few of the proposals around these ideas directly affect construction, most have at least some potential impact on the industry. Some would generate more construction activity, and others less. Monitoring progress along these agenda items will help to assess how construction will fare in the coming years.

Encouraging Outlook for Construction

The prospects for the construction sector for this year and next remain quite positive. Even with all the challenges facing the industry, the expectations are that construction spending will outperform the broader economy this year and next. The AIA’s Architecture Billings Index (ABI), an accurate indicator of construction activity that leads spending in the non-residential sector by 9 to 12 months, moved up sharply in December. Firms with a commercial/industrial, as well as those with an institutional specialization, reported the strongest growth of the year in December, once seasonal adjustments are applied. New design work is coming into architectural firms at a healthy pace, and firm backlogs are at sound levels, so the industry has a lot of momentum heading into 2017.

Still, it is clear that the industry is on the down side of this construction cycle, meaning the growth rates will slow in the coming quarters. The commercial sector is typically the first building sector to see a slowdown, and that is expected to be the case again this time, with growth in construction spending on commercial buildings projected to fall from about 17% last year to 8% this year to just over 4% in 2018. Institutional construction will offset some of this slower growth, with spending growth of about 4.5% last year rising to around 6% this year and next. However, being this late in the cycle, the industry is more vulnerable to external disruptions, and the list of possibilities in this category is very long at present.

Kermit Baker, Hon. AIA, is the AIA’s Chief Economist and part of the AIA Economics and Market Research Group, which provides AIA members with insights and analysis of the economic factors that shape the business of architecture. Reprinted with permission from AIA, January 25, 2017, www.aia.org.

FMI: Failing When Times Are Good

As we like to say, “Contractors don’t starve to death; they die from gluttony.” In other words, contractors don’t fail for want of work or because times are tough. They fail because they get too much work, too fast, with inadequate resources, and then they get into financial trouble and run out of cash.

In light of today’s severe labor shortages, this problem becomes particularly acute in an environment where demand is expected to accelerate in one or more sectors of the economy (i.e., a focus on infrastructure). Furthermore, consider the fact that between 2009 and 2015, the average number of months of contractor backlogs (for all types of contractors) increased by 33%. At the same time, contractor margins are now tighter, contractual conditions and projects more complex, and 1.5 million fewer construction workers remain in the industry (compared to pre-recession levels). All this to say: Think twice before you introduce more risk variables by abandoning your core markets.

As we move further into 2017, we caution E&C firms to be wary when chasing down new work opportunities. Even though it’s a natural inclination, this strategy can ultimately lead to greater levels of insolvency, bankruptcy, and other issues for the industry. It’s almost inevitable that companies will get ahead of themselves and spend their balance sheets chasing dreams, news, and promises. To avoid these traps, companies need to focus on the facts and business fundamentals and keep their eye on the ball. Know the markets that you’re going into, the lines of business that you’re taking on, or the vertical sectors that you’re exploring—particularly if these are new to you.

“The dollars that are tied to the construction industry recently exceeded $1 trillion and are increasing. And the variance is narrowing between the percentage of GDP attributed to construction in relation to the general economy. In other words, the rate of increase for construction—which was lower up until a few years ago—is now aligned with that of the general economy. Thus, we’re seeing the convergence of construction returning to normal for the first time since 2007, while at the same time, the unemployment rate is dropping. So right now, nearly all of our clients are reporting increased business backlogs—they have more business than they even know what to do with—and their greatest challenge is the inability to procure labor to handle those projects.” —Sal DiFonzo, Managing Director FMI Compensation

Excerpted with permission from FMI’s report, “U.S. Markets Construction Overview 2017.” The full report is available at https://tinyurl.com/zf45tzu.

ABC: Construction Input Prices Surge to Start 2017

Construction input prices collectively rose by 1% on a monthly basis and 3.8% on a year-over-year basis, according to analysis of U.S. Bureau of Labor

Statistics data released by Associated Builders and Contractors (ABC). This represents the fastest year-over-year rate of materials price inflation since the beginning of 2012. Nonresidential input prices rose 0.9% for the month and are up 4% year over year.

The rise in input prices is largely attributable to natural gas prices, which expanded 23.6% for the month and are up 81.8% year over year. Crude petroleum prices slipped 5.5% for the month, but are up 77.5% for the year.

“Despite a still-strong U.S. dollar, input prices have continued to rise in recent weeks,” said ABC Chief Economist Anirban Basu. “There are a number of factors at work, including some evidence that global demand for various materials has begun to firm, including in China. Chinese economic growth was solid last year and ended 2016 on a strong note. There are also indications that U.S. economic growth is set to accelerate due in part to an expected pickup in business investment.

“While demand has been firming, certain suppliers have been taking active steps to suppress supply,” said Basu. “OPEC reached an agreement late last year to curb output, helping to bring oil prices above $50/barrel, where they have remained. Concerns regarding trade wars and tariffs may have also helped to push commodity prices higher.

“The question is whether these forces will continue to dominate,” said Basu. “They may not, as natural gas prices have been falling for much of February, perhaps the result of seasonality. U.S. oil production appears set to rise in the context of higher prices, which could also help to lower prices. Finally, the global economic outlook remains shaky despite relatively upbeat near-term projections for the U.S. economy.”

This release from Associated Builders and Contractors, Inc., can be accessed online at https://tinyurl.com/huqx59x.

ENR: 2017 Forecast: A Weak Recovery Will Gain Strength

Trump’s unexpected election is having little impact on next year’s construction market forecasts: The fundamentals are strong and already in place. The year to watch is 2018.

By Tim Grogan and Bruce Buckley

The ink barely had dried on this year’s batch of construction market forecasts when economists had to take a second look at their numbers to evaluate the impact of Donald Trump’s victory in the presidential election, which brought with it a Republican-controlled Senate and House. Most economists are holding firm to their initial forecasts, saying it is too early to sort out all the variables.

Dodge Data & Analytics is forecasting construction starts to increase 5.4% in 2017, after seeing growth fall to 1.3% this year. FMI Corp. predicts that construction put-in-place will grow another 3.9% next year, following this year’s 4.9% increase. The Portland Cement Association’s (PCA’s) forecast looks for a 3.5% increase in construction put-in-place, a slight boost over the 3.1% growth PCA estimates for this year. The National Association of Home Builders is calling for single-family housing starts to jump 12.3% in 2017 at the same time the multifamily housing starts cool off. The transportation association, ARTBA, expects to see the strong growth in some states canceled out by weakness in others.

On the downside, the election does carry some risks, says Ed Sullivan, Chief Economist with PCA. “No decision-maker likes uncertainty. Trump could have an adverse effect on overall economic activity next year, which, in turn, could affect construction activity,” Sullivan notes.

Upside from Bond Measures

On the upside, voters passed billions of dollars in construction-related bonds, which should brighten next year’s outlook, says Robert Murray, Chief Economist for Dodge. “Trump offered a wide range of proposals… but the specifics are still to come,” he says.

“Of the various proposals, there are 3 that are relatively safe to say will have some near-term impact on construction,” Murray says. He thinks Trump’s pledge to “repeal and replace” the Affordable Care Act will have a negative impact on health-care construction. Dodge was predicting that starts for new health-care facilities would increase 7% in 2017. This potential uptick could be balanced by an increase in infrastructure spending as Trump tries to make good on his promise to create jobs. Finally, Trump’s call to “lift Obama-Clinton roadblocks and allow vital energy infrastructure projects to move forward” could help to revitalize a sector that hit a brick wall in 2016, Murray says.

Dodge is forecasting increases between 5% and 8% for most non-building construction markets in 2017. The major exception is a 29% decline projected for the electric utility market, a dip that would follow this year’s estimated 26% drop.

The energy market is coming off a string of large multibillion-dollar, energy-related projects, mostly in the Gulf Coast area, in 2015 and early this year, says Murray. However, the market could not sustain that momentum, and the result was double-digit percentage declines.

If the electric utility and gas terminal projects were excluded from total construction starts, the estimate for 2016 and forecast for 2017 would look very different, says Murray. Excluding this sector, Murray estimates that total construction starts would be up 4% this year instead of 1%. Further, next year’s forecast would be calling for an 8%, instead of 5%, increase in total construction starts.

Market Swell for Offices

The Dodge forecast for the non-residential building markets is fairly optimistic. Murray estimates that office-building starts will increase 18% this year, after a weak 2015. He predicts that growth will continue, with another 9% increase in 2017. “Hotel construction has probably reached its peak with this year’s estimated 25% increase in starts,” Murray says. He forecast the hotel market to grow just another 1% next year.

On the other hand, “further declines in vacancies indicate that neither warehouses nor offices are facing an immediate imbalance of supply versus demand,” Murray says. He forecasts that, overall, the commercial markets will grow about 6% in 2017.

ARTBA is calling for a relatively flat highway-and-bridge market next year. “The passage of the FAST (Fixing America’s Surface Transportation) Act and increases in state and local funding will create real growth is some states, while others remain flat or even decline,” says Alison Black, Chief Economist for ARTBA. “The FAST Act does provide much-needed funding stability, but it does not provide a ramp up in real funding that would support market growth in each state.”

FMI also sees continued growth in the overall construction market, although at a slower pace than in recent years. Brian Strawberry, Senior Economist at FMI, notes that many sectors, including residential construction, have seen double-digit growth in recent years, but that pace is not sustainable in the long-term. “We’ve been playing catch-up since the recession,” he says. “Things are settling down now.”

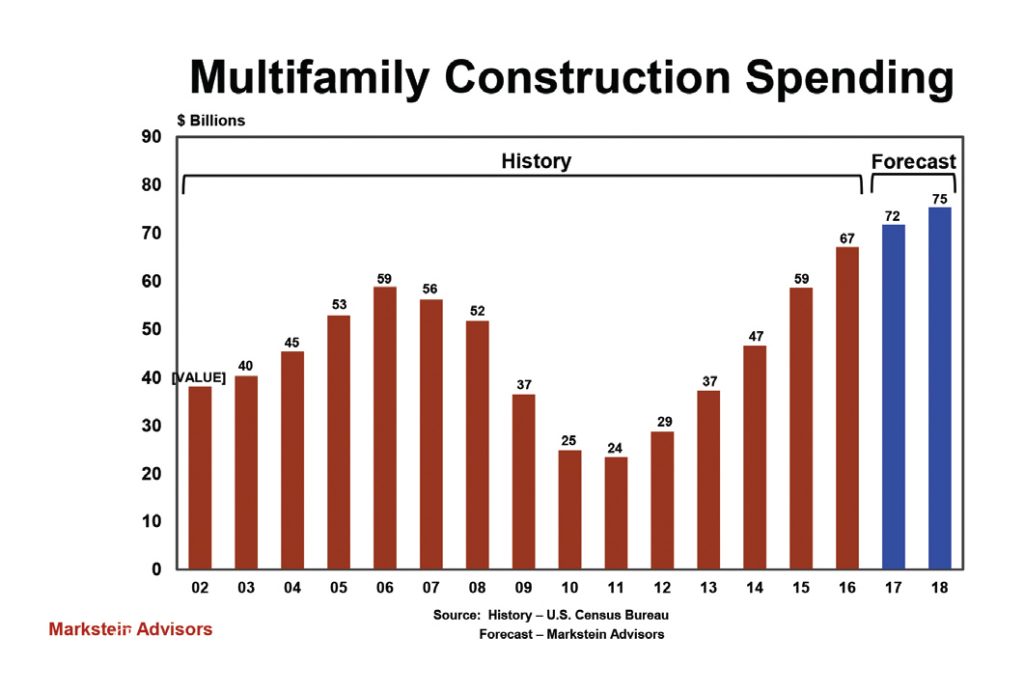

FMI reports that the single-family home market saw double-digit growth in 2012–2015, but it estimates growth will pull back to 6% in 2016, with a total value of $246.9 billion. During that time, the multifamily residential market also was hot but now has cooled. FMI forecasts a 7% rate of growth in 2016. Strawberry says he sees similar growth rates in residential in 2017.

In non-residential, FMI also sees a general cooling of activity, particularly on the private side. “A lot of private projects were in planning and are now underway or completed,” he says. One notable exception is the data-center market. Strawberry expects data-center activity, which has been strong in recent years, to continue at a high level. “There are some very large data-center projects underway, with more in planning,” he says. “That will have an impact on the overall commercial market going forward.”

As private work winds down, Strawberry believes more work in the public markets, such as institutional and infrastructure projects, will start to come on line. “If you look at 2017, 2018, and 2019, you’ll see attractive growth rates in education and health care, with health care going a touch faster than education,” he adds. Strawberry notes that many of the large higher-education projects are sports facilities and related projects. “That ties into economic growth opportunities around those developments,” he says.

PCA’s Ed Sullivan sees solid economic fundamentals in the general economy but a mixed outlook for construction heading into 2017. PCA predicts that GDP will end up at 1.5% this year and 2.4% next year. Unemployment also is likely to remain at or slightly below 5%. In addition, inflation is “not an issue.” The Federal Reserve is “taking its time ramping up interest rates,” he says.

Still, PCA sees the residential market softening in the latter half of 2016. In its summer 2016 forecast update, PCA predicted 6.7% growth in the housing market in 2017 and 2018. However, Sullivan says the market has reached a plateau. “As a result, we haven’t seen some of the growth we expected, even though modest, in starts activity—primarily in single-family homes,” he adds. “That’s a powerful statement because residential is so important in overall construction that it does create a more temperate outlook for this year and next year.” Sullivan adds the caveat, however, that PCA is still its exact forecast numbers.

Meanwhile, non-residential activity remains roughly at the pace that PCA predicted in the spring, Sullivan says. After double-digit growth in non-residential spending in 2014 and 2015, PCA expects growth of less than 5% in 2016. Annual growth could range between 3.0% and 3.5% for the foreseeable future.

Sullivan credits continued job creation as the key driver in non-residential activity. PCA predicts that annual job creation in the U.S. could slow slightly but remain above 2 million per year through 2020. “If 1 in 5 jobs are in an office, that puts pressure on occupancy rates and drives demand,” he adds.

PCA also forecasts increased and sustained government spending, particularly at the state and local levels, as tax revenue generally improves. “It may grow at a modest clip, but it will still grow,” according to Sullivan.

Tim Grogan is the Senior Editor for Engineering News-Record. Bruce Buckley is a freelance writer and photographer based in the Washington, DC, area. Reprinted with permission from www.enr.com.

Dodge Data & Analytics: President Donald Trump Likely to Be a Plus for the Construction Industry

Federal, State, and Local Infrastructure Investment Seen as Set to Grow

The election of Donald J. Trump appears to be a welcome development for the U.S. construction industry, according to forecasters at Dodge Data & Analytics. With his background and experience in construction and real estate development, President Trump understands the important role that construction plays in the growth of our economy and the vitality of our cities.

During the course of their campaigns, both Donald Trump and Hillary Clinton highlighted the need for increased federal investment in infrastructure. Under President Trump’s proposal, up to $550 billion in federal funds could be invested, presumably over a 5-year period, in infrastructure and publics works projects.

“The broad proposal for increased federal funding should support the public works sector, either directly or indirectly, by keeping attention focused on the need to upgrade infrastructure,” said Robert Murray, Chief Economist, Dodge Data & Analytics. “The ways in which the Trump proposals will affect construction will become clearer as more details come forth, including how these proposals make their way through Congress. For the moment, it’s still believed that total construction starts in 2017 will increase 5%, with some dampening for health-care related projects accompanied by improvement for public works construction.” President Trump’s emphasis on upgrading and developing public infrastructure, including roads, bridges, airports, transit systems, and ports will, with the approval of the 115th Congress, bring much needed revitalization to U.S. infrastructure and create favorable business conditions across the design and construction industries.

While the specifics of federal infrastructure investment in 2017 and beyond will become clearer in the months ahead, the ideas already proposed should help spur Congressional action on 2 existing legislative items, including the Water Resources Development Act and the 2017 Federal Appropriations Bill, which make provisions for infrastructure spending on water management, transportation, and energy

infrastructure.

The election has also already provided some clarity on likely construction at the state and local level. Voters have given their approval for several major construction-related measures in California, Colorado, Texas, and North Carolina with a combined value upwards of $136 billion for education and transportation sector construction.

This release from Dodge Construction can be accessed online at https://tinyurl.com/zlxck2e.

FMI: U.S. Markets Construction Overview 2017

Construction Forecast

As always, the construction outlook has a mixture of good signs and bad. For instance, the unemployment rate for construction workers is now in line with the unemployment rate for all workers at around 4.5%. There are still many people unemployed who aren’t in the count as job seekers anymore, and that will be a difficult problem to fix as workers are displaced by technologies or employers relocating, growing, downsizing, etc. The construction industry is in the middle of this situation as employers find it difficult to hire skilled workers at the right time and in the right place. Employment, along with the fight for higher/lower wages that goes with it, will continue to be a challenge for the economy:

• GDP is up.

• Employment remains high.

• Wages in the construction industry are up.

• The Federal Reserve managed to increase the interest rate and expects to have more increases in 2017.

• The CPI remains low.

• The price of oil and gas is working its way up again.

• Consumer confidence is high.

Even considering many good signs that the economy is tracking in the right direction, there are no signs of over-exuberance in the forecast. For construction, FMI expects a 1% increase in construction-put-in-place growth over the 5% in 2016. Our forecast is tempered by many forces, including a downtick in the fourth quarter FMI Nonresidential Construction Index, which dropped just 0.4 points to 56.9. In the fourth quarter of 2015, the Index stood at 59.5. While the trend indicates a slower outlook for non-residential construction, the Index is still solidly in positive territory as it has been since the first quarter of 2012. While most of the economic components of the NRCI slipped lower, backlogs increased from 10 months to 12 months with expectations that backlog growth will continue in the near term. Looking at markets, the outlook continues to be positive for all markets through 2017, but the 3-year outlook is less rosy.

Commercial

The solid growth rate of 8% for commercial construction in 2016 will slow to just 6% in 2017 and drop to around 3% by 2020. The expected slowdown in commercial construction is due more to a change in consumer buying habits than overall spending, which continues to edge higher. The continuing trend to shop online from a smartphone is hurting traditional big-box stores the most. For instance, after the year ended, Sears announced it will close more than 30 Sears and Kmart stores in early 2017. The move from traditional shopping venues will likely result in a merging of online and brick-and-mortar shopping with brick and mortar becoming more of a destination or event-related atmosphere. Some of the fastest-growing areas in commercial retail construction have been drinking places and food services; however, building materials and garden supply stores are currently experiencing the highest growth rate.

Trends

The Department of Commerce reports, “Retail trade sales were virtually unchanged (±0.5%)* from October 2016, and up 3.6% (±0.7%) from last year. Non-store retailers were up 11.9% (±1.6%) from November 2015, while health and personal care stores retailers were up 6.2% (±2.5%) from last year” (U.S. Department of Commerce, December 14, 2016).

The Conference Board Consumer Confidence Index, reached 113.7 (1985=100) in November. “Consumer Confidence improved further in December, due solely to increasing Expectations which hit a 13-year high (Dec. 2003, 107.4),” said Lynn Franco, Director of Economic Indicators at The Conference Board. “The post-election surge in optimism for the economy, jobs, and income prospects, as well as for stock prices which reached a 13-year high, was most pronounced among older consumers.” (The Conference Board, December 27, 2016).

The Internet of Things (IoT) will be increasingly disruptive for commercial business, presenting both opportunities for new businesses and threats to traditional brick-and-mortar markets.

Manufacturing

After a busy 2015, manufacturing construction fell 3% in 2016. We expect growth to return to 8% in 2017 to reach nearly $82 billion in construction put in place. This forecast could change depending on the plans of the next Congress and the new president. Currently, at just 74.8 for November 2016, manufacturing capacity utilization has not outpaced added capacity. Increasing energy prices may spur some capacity additions in the oil and gas sector, but price increases haven’t been that stable at this point. The completion of the Panama Canal expansion project is expected to decrease costs and increase shipments from Gulf Coast ports between the U.S. and Asia.

Trends

With little change since last quarter, manufacturing capacity utilization rates are at 74.8 of capacity in November 2016, which is well below the historical average of 78.5 (1972–2015).

The U.S. Department of Commerce reports, “Shipments of manufactured durable goods in November, up 2 of the last 3 months, increased $0.2 billion or 0.1% to $234.2 billion. This followed a 0.1% October decrease” (December 22, 2016).

“New orders for manufactured durable goods in November decreased $11.0 billion or 4.6% to $228.2 billion, the U.S. Census Bureau announced. This decrease, down following 4 consecutive monthly increases, followed a 4.8% October increase. Excluding transportation, new orders increased 0.5%. Excluding defense, new orders decreased 6.6%” (U.S. Census Bureau, December 22, 2016).

“The November PMI registered 53.2%, an increase of 1.3 percentage points from the October reading of 51.9%. The New Orders Index registered 53%, an increase of 0.9 percentage point from the October reading of 52.1%” according to The Manufacturing ISM® Report On Business®.

Regional Summary

In our regional forecast, the weakest regions in 2017 will be the Middle Atlantic and the West North Central. The Mountain and Pacific regions will both experience double-digit growth. The Mid-Atlantic region will see slower growth in manufacturing, residential, and infrastructure, while growth in the West North Central region is largely dependent on the price of oil, as the low prices continue to hit the oil fields. Residential, commercial, and education construction will be strong in the Pacific region, particularly in California, where housing prices and availability are making it hard to find a place to live near where people work. The Mountain region will continue high growth rates for residential construction and have solid growth for most construction markets in 2017.

Excerpted with permission from FMI’s report, “U.S. Markets Construction Overview 2017.” The full report is available at https://tinyurl.com/zf45tzu.

Zion Research: Global Insulation Market Will Grow at CAGR of around 8.0% between 2015 and 2020

By Caroline Kendrick

Zion Research has published a new report titled “Insulation (Plastic Foam, Mineral Wool, Fiberglass and Others) Market for Residential Buildings, Non-Residential Construction, Industrial, HVAC & OEM and Other Applications: Global Industry Perspective, Comprehensive Analysis, Size, Share, Growth, Segment, Trends and Forecast, 2014 – 2020.” According to the report, the global insulation market was valued at approximately USD 40.0 billion in 2014 and is expected to reach approximately USD 65.0 billion by 2020, growing at a CAGR of around 8.0% between 2015 and 2020.

Insulation is a method that restricts the transfer of heat and/or electricity. Insulators have the opposite effect on the flow of electrons. The R-value determines the quality of insulator—the higher the R-value, the more effective the insulator. Good insulators such as wood, plastic, rubber, and glass are widely used in different insulation processes. Insulators find widespread applications in a variety of piping and tank projects. Design considerations for insulation often include insulating value, fire safety, resistance to corrosion, and other factors.

The insulation market is segmented on the basis of key products, including plastic foam, mineral wool, fiber glass, and others. Fiber glass was the largest product segment and accounted for over 40% overall market share in 2014. Fiber glass is commonly used in various applications owing to its excellent properties and low cost. Plastic foam is another key product and is expected to witness significant growth in the near future. Plastic foams are mainly consumed in acoustic and thermal insulation in commercial, residential, and industrial application sectors.

Insulators are widely adopted in residential buildings, non-residential construction, industrial, HVAC and original equipment manufacturers (OEM), and others. The insulation market was dominated by the residential buildings segment with over 50% share of the total revenue generated in 2014. The growth of this segment is mainly attributed to increasing urbanization coupled with high disposable income. Non-residential construction, industrial, and HVAC and OEM are other key application segments.

Asia Pacific was largest regional market for insulation and accounts for over 40% share of the total revenue generated in 2014. The insulation market in the Asia Pacific region is expected to exhibit strong growth owing to rising government support and rapid growth in infrastructure. In terms of revenue, North America was the second largest market for insulation.

Some of the key players operating in this market include Duro-Last Roofing, Inc.; The Dow Chemical Company; Owens Corning; Johns Manville; CertainTeed Corporation; Rockwool International A/S; Knauf Gips KG; Atlas Roofing Corporation; and Huntsman Corporation.

Caroline Kendrick is the Senior SEO in Consumer Goods and Research Analyst at Market Research Store. The full report is available at https://tinyurl.com/gkpdrhy.

Dodge Construction Outlook: New Construction Starts in 2017 to Increase 5% to $713 Billion

Dodge Data & Analytics recently released its 2017 Dodge Construction Outlook, a mainstay in construction industry forecasting and business planning. The report predicts that total U.S. construction starts for 2017 will advance 5% to $713 billion, following gains of 11% in 2015 and an estimated 1% in 2016.

“The U.S. construction industry has witnessed signs of deceleration in 2016, following several years of steady growth,” stated Robert Murray, Chief Economist for Dodge Data & Analytics. “Total construction starts during the first half of this year lagged behind what was reported in 2015, raising some concern that the current construction expansion may have run its course. However, the early 2016 shortfall reflected the comparison to unusually elevated activity during the first half of 2015, lifted by 13 very large projects valued each at $1 billion or more, such as a $9 billion liquefied natural gas export terminal in Texas and a $2.5 billion office tower in New York City. As 2016 has proceeded, the year-to-date shortfall has grown smaller, easing concern that the construction industry may be in the early stage of cyclical decline. Instead, the construction industry has now entered a more mature phase of its expansion, one that is characterized by slower rates of growth than what took place during the 2012–2015 period, but still growth. Since the construction start statistics will lead the pattern of construction spending, this means that construction spending can be expected to see moderate gains through 2017 and beyond.”

“On balance, there are a number of positive factors which suggest the construction expansion has room to proceed. The U.S. economy in 2017 is anticipated to see moderate job growth, market fundamentals for commercial real estate should remain generally healthy, and more funding support is coming from state and local bond measures. Although the global economy in 2017 will remain sluggish, energy prices appear to have stabilized, interest rate hikes will be gradual and few, and a new U.S. President will have been elected. For 2017, total construction starts are forecast to rise 5% to $713 billion. Gains of 8% are expected for both residential building and non-residential building, while non-building construction slides a further 3%.”

The pattern of construction starts by more specific sectors is the following:

• Single-family housing will rise 12% in dollars, corresponding to a 9% increase in units to 795,000 (Dodge basis). Access to home mortgage loans is improving, and some of the caution exercised by potential homebuyers will ease with continued employment growth and low mortgage rates. Older members of the Millennial generation are now moving into the 30 to 35 year-old age bracket, which should begin to lift demand for single-family housing.

• Multifamily housing will be flat in dollars and down 2% in units to 435,000 (Dodge basis). This project type now appears to have peaked in 2015, lifted in particular by an exceptional amount of activity in the New York, New York, metropolitan area, which is now settling back. Continued growth for multifamily housing in other metropolitan areas, along with still generally healthy market fundamentals, will enable the retreat at the national level to stay gradual.

• Commercial building will increase 6% on top of the 12% gain estimated for 2016. Office construction is showing improvement from very low levels, lifted by the start of several signature office towers and broad development efforts in downtown markets. Store construction should show some improvement from a very subdued 2016, and warehouses will register further growth. Hotel construction, while still healthy, will begin to retreat after a strong 2016.

• Institutional building will advance 10%, resuming its expansion after pausing in 2015 and 2016. The educational facilities category is seeing an increasing amount of K–12 school construction, supported by the passage of recent school construction bond measures. More growth is expected for the amusement category (convention centers, sports arenas, casinos) and transportation terminals.

• Manufacturing plant construction will increase 6%, beginning to recover after steep declines in 2015 and 2016 that reflected the pullback for large petrochemical plant starts.

• Public works construction will improve 6%, regaining upward momentum after slipping 3% in 2016. Highways and bridges will derive support from the new federal transportation bill, while environmental works should benefit from the expected passage of the Water Resources Development Act. Natural gas and oil pipeline projects are expected to stay close to the volume that’s been present in 2016.

• Electric utilities and gas plants will fall another 29% after the 26% decline in 2016. The lift that had been present in 2015 from new liquefied natural gas export terminals continues to dissipate. Power plant construction, which was supported in 2016 by the extension of investment tax credits, will ease back as new generating capacity comes on line.

This release from Dodge Construction can be accessed online at https://tinyurl.com/hnkvwck.

AGC: How Technology Is Shaping the Construction Industry

By Autumn Cafiero Giuesti

An industry that remained relatively unchanged for the better part of a century has undergone an unprecedented transformation in the course of just 5 years.

Specialty contractors in particular have been on the front lines of these changes. Some changes have produced positive results, such as a greater emphasis on safety and improved efficiencies through technology and new project delivery methods. But other changes have involved hardships such as labor shortages and increased competition in some regions.

“Over the last decade, we’ve seen 2 things really change the value proposition from our side. One of them is process improvement, and the other is technology,” says Dave Moeller, Director of Customer Markets for Graybar, a St. Louis, Missouri-based electrical supply distributor and member of multiple AGC chapters that works closely with contractors.

As with most industries these days, technology rules the day in terms of progress that’s taking place among specialized contractors.

“Technology has changed every facet of our industry,” says David Gralike, Senior Vice President of Guarantee Electrical in St. Louis, Missouri, an AGC of Missouri and Southern Illinois Builders Association member. “There is nothing we do the same as we did 10 years ago—our marketing approach, estimating procedures, installation, communicating, engineering—all different.”

Contractors are doing far more electronically than they were just a few years ago. Paper blueprints have given way to tablets and laptops capable of producing 3D models of complex building plans. Whereas contractors used to wait days to have a set of drawings shipped before they could get to work, they can now have an entire set of drawings sent hundreds of miles away within a matter of seconds.

“The old adage was you need information, tools, and materials,” says John Hugins, Director of Operations for Accent Electrical Services in Denver, an AGC of Colorado building chapter member. “But the information piece has always been really slow and lagging. It used to just be a call between the project manager and the foreman, and hopefully you caught all the details. Now there are new methods for providing information and accurate updates if things change on the drawings.

One example of this tech shift is Guarantee Electrical’s use of Accubid LiveCount Construction take-off software. The company’s estimators no long work with paper drawings, colored pencils, and clickers. Instead, the estimating staff relies on a set of 3 computer monitors to display Accubid, as well as project drawings and emails. Guarantee Electrical has distributed more than 250 tablets to its supervisors to give them the ability to FaceTime their manager and electronically track employee time and labor records, work orders, and daily logs.

Autumn Cafiero Giusti is an independent writer and editor based in the greater New Orleans area. Excerpted with permission from Constructor, January/February 2017, a publication of the Associated General Contractors of America, https://tinyurl.com/zzmtff2.

Copyright Statement

This article was published in the March/April 2017 issue of Insulation Outlook magazine. Copyright © 2017 National Insulation Association. All rights reserved. The contents of this website and Insulation Outlook magazine may not be reproduced in any means, in whole or in part, without the prior written permission of the publisher and NIA. Any unauthorized duplication is strictly prohibited and would violate NIA’s copyright and may violate other copyright agreements that NIA has with authors and partners. Contact publisher@insulation.org to reprint or reproduce this content.