The state of the “NIA World” can only be described as good. Although 2006 was not without its challenges, it is hard to find an industry participant who did not have a good year and is not optimistic about 2007. Projects are plentiful, sufficient capacity of materials is available, there is a shortage of qualified labor, and margins are trending in a positive direction—all of which directly translates to improved profitability. Depending on one’s definition, in fact, “good” may be conservative.

The U.S. commercial and industrial mechanical insulation world is full of opportunities, while the challenges facing the industry are relatively small in comparison to the difficulties present in today’s complex global marketplace. The industry continues to adjust to market and competitive demands, as well as the fluctuating economy and political climates. The industry’s resilience and flexibility is taken for granted by some and baffles others. As with all industries, when business is robust, the bad times are easily forgotten; when business is slow, the whining and hoping for better times becomes the center of the universe. The good times—or the latest market recovery—for the NIA World began in late 2003 and early 2004, and it is forecast by many to continue through 2007. Some forecast a flattening of the market to begin in late 2007, and they have begun to examine its potential effects on their businesses; others are beginning to practice the art of whining.

With a market subject to cycles that are driven by factors outside the direct control of industry participants’, continual change is inevitable. The NIA World is not immune to that characterization. It is vulnerable to cycles that create opportunities and challenges that have proven to net long-term market growth and, in some cases, fundamental changes in the industry. Some of the changes are temporary in nature, while others have become imbedded in the core of the industry.

Regardless of whose crystal ball one looks into, the opportunities appear to be abundant. Projected growth rates vary by product, geographic area, industry segment, market, etc. Even the most doomsday forecast, however, does not predict any significant decline in business for the NIA World over the next several years. Of course, to some a flattening or slight decline may be seen as a catastrophe requiring defensive actions to preserve what they deem to be acceptable performance. To others, it is an opportunity to breathe and strengthen the ranks for the next surge in business. These varying opinions and positions motivate much discussion in the NIA World (some call it rumor control central).

Here are a few of the most current opportunities, challenges, and potential fundamental changes in the insulation industry.

Acceptance of Foreign-Manufactured Materials

Ever since the two catastrophic fiberglass manufacturing facility fires in 2003, import and acceptance of foreign-manufactured materials have been more amenable to all industry participants. This is true for the fiberglass segment, as well as all other material segments. Distributors who had their supply line alliances and views on demand versus supply challenged as a result of the fires are much more open to establishing alternative supply sources. Contractors who had difficulty obtaining materials certainly have a different approach to the market as it pertains to alternative materials. The end user, in many cases, does not place primary importance on “made in the United States” if the product meets the specification. Therein lies a very important question: Does the foreign-manufactured material meet the specification? It may look and feel the same—and come in a similar wrapper—but are the composition, health and safety aspects, quality, and performance standards measured on the same basis as U.S.-manufactured materials?

This discussion is not focused on manufacturers that are major contributors to the U.S. market and have plants outside the United States. They may have supplied material or supplemented their U.S. manufacturing from those plants both before and after the 2003 fire era. Instead, materials imported through a variety of other channels are the focus of this discussion.

Imports increased dramatically in the months immediately following the 2003 fires and began subsiding within a year. The estimate as to their current market share varies greatly. It is believed to be relatively small, but it still poses a continual threat.

This article does not suggest that imported materials are inferior to those manufactured in the United States. It simply raises a caution flag to individuals and companies considering the use of foreign-manufactured materials. Are the materials tested and performance measured on the same basis as U.S. materials? The burden of proof and ownership of the material ultimately lies with the end user, but all channel participants involved in the decision-making process will shoulder some degree of responsibility if a failure occurs. A failure of any magnitude, regardless of cause, is detrimental to the industry. Assumption of equivalence and warranty support could be costly.

Most materials are subject to multiple tests—including thermal conductivity, compression strength, and fire rating—to validate their performance. Do we, as industry consumers, see the test listed on a data sheet and take for granted that the material was tested in accordance with the listed standard, and that the results are current and actual? Of course we do. But what do we know about the respective standard? Does the manufacturer need to test its materials on a regular basis, or can it test the material once and continue to publish the same results even if the manufacturing process or composition has changed? Can testing be done in house, or is third-party testing required? Who polices the validity of the published data? All of these are interesting questions, and their importance is potentially compounded with foreign-manufactured materials.

What is the role of the organizations that have established the standards by which the materials should be tested? What is the role of the manufacturer? What is the role of competitive manufacturers? Should they be the police and challenge the results of their competitors? What is the role of the distributors or contractors? Should they ask for copies of the actual test reports? The NIA World has been basically self-policing and trusting the published information. That is not a bad model. However, the world has changed. Industry members operate in a complex, competitive, and legalistic global market that requires all companies to have greater knowledge than ever before on a variety of subjects, including material standards, test procedures, and test results.

Manufacturers are generally more knowledgeable about testing procedures and standards than distributors and contractors. Many specifiers and end users rely solely upon channel participants for knowledge on this subject or simply request assurance that all materials comply with the listed standards. Given the importance and the varying degrees of knowledge on testing procedures and standards, the industry may need to look at an educational initiative on the topic. Perhaps the organizations establishing the standards or testing procedures should take the lead. It would be beneficial to all direct and indirect industry participants. Business is just not simple anymore.

Product Innovations

Manufacturers have improved—and will continue to improve—the materials they offer to the industry. They are addressing the quality of their materials, packaging, delivery, administrative processes, and a host of other initiatives to improve quality and customer service, and to lower cost. The industry needs that commitment to improvement. To those committed to that end, on behalf of the industry, thank you.

True product innovation has not been one of the cornerstones of the industry over the last few decades. Many great improvements have been introduced; but truly new products, finishes, and application methods have been limited or slow in coming. In the last several years, however, there appears to have been a surge of new products and approaches—from nanotechnology insulation systems to finishes and application techniques that are intriguing and may offer significant advantages.

Product innovation and continual rollout of new products and systems add excitement to the industry and give everyone a renewed opportunity to sell. What a novel idea: Sell new products and systems, emphasize the values of reliable customer service, and differentiate your company from the competition. That sure sounds more motivating and rewarding than the old price game.

To those manufactures driving product and application innovation, more power to you! To those who are not, we will “leave the light on for you.”

The industry may want to consider being more diligent in examining and educating industry participants about new products or possible crossover products from other industries. If warranted, the industry may want to take a more active role in embracing the introduction and use of these crossover products in the NIA World, pointing out the differences in testing procedures, standards, and properties. These products may be great, but their performance may be highly reliant on specific installation procedures, and it may be measured by different standards that are not traditionally recognized in the mechanical insulation industry.

Too many new products or choices could lead to market confusion. That is a real-world problem in a competitive market, especially when an industry does not have a governing body. Education is a real positive.

Erosion of the Mechanical Insulation Knowledge Base

The knowledge base of mechanical insulation systems at the engineering, architectural, and facility-owner levels over the last 15 to 20 years has, in many cases, eroded. The root cause can be summarized as a by-product of the corporate world’s drive for profits, right sizing, multitasking, etc. Regardless of the cause, the fact remains that mechanical insulation is not a field that is currently attracting specialization in the engineering, architectural, or maintenance arenas. This reduced knowledge base has led mechanical insulation to be improperly used (or not used at all) and undervalued in many applications.

For years, insulation manufacturers were the educators of the industry. They had specialists who focused on the engineering, architectural, and facility-owner communities, and they did a good job. They fell victim to the same root cause as the engineering and architectural communities. While some manufacturers have now returned to their education efforts, it is more difficult than it was just a few years ago. The electronic age, time pressure, and the need to contact so many more people have made it difficult to spend quality time with influential individuals in the specifying community.

Awareness and education need to be major focal points of the industry. Improved awareness of the benefits of properly specifying, installing, and maintaining mechanical insulation systems is more important to the industry today than it ever has been. As the proper and additional use of mechanical insulation improves, everyone—including manufacturers, contractors, distributors, and, most importantly, end users—benefits.

Increased knowledge and use of mechanical insulation can provide an unrivaled return on investment (ROI) opportunity in both the new construction and maintenance markets. It can also help reduce dependency on foreign energy sources, improve the environment, and grow the economy. But how many specifiers and end users understand this and can quantify the ROI?

Awareness of and education about the benefits of mechanical insulation at all rungs on the ladder are essential to the growth and prosperity of the industry. The challenge is to accomplish that objective in a reasonable time period, in the most efficient and cost-effective manner. One thing is clear: The responsibility for this rests on all industry participants. No one segment or company can or should be asked to bear the total burden. All industry participants will benefit, so they should all bear the moral, ethical, and financial responsibility. This is not something that can be solved overnight or by a one-time financial contribution. This is an ongoing opportunity to improve and grow the industry. What an opportunity it is! Now is the time to think about mechanical insulation, the industry, and the role of your industry association differently.

The Changing Investment Within the Industry

For many years the contractor and distributor segments of the mechanical insulation industry have been characterized as a group of small, family-owned and -operated businesses. That same characterization applied to many of the smaller manufacturers. There are several second- and third-generation companies in the industry. Some companies have executed a successful transition of ownership to management, while others sold their companies to other industry participants (industry consolidation). Does this characterization still apply today? Will it apply 5 years from now?

Consolidation over the last 10 to 15 years certainly has changed the industry’s profile. It is more evident in the distributor and manufacturer segments than in the contractor segment, but it has still affected contractors. With only a few exceptions, consolidation has so far been driven by industry participants rather than outside investors. Is that changing?

The mechanical insulation industry is now attracting more investment banking firms to invest in the industry. The building products industry, and especially the mechanical insulation segment, traditionally has not been a primary target or attraction for investment. That could be changing. How will this affect the industry?

Investment banking firms normally take a hands-on approach with their investments by providing financial, advisory, and/or management services where needed, or assisting the company in executing its strategic plans (such as mergers, divestitures, acquisitions, and restructuring). They bring a fresh approach by examining traditional ways of doing business and looking for ways to improve performance. The biggest difference is potentially the long-term view of ownership or investment in the business.

Investment firms are in business to make money on their investments for the benefit of their shareholders. Why else would they be investing? Their view is normally shorter term than many “inside” or “family” investors. There may not be a magic formula, but it certainly is perceived that investment banking firms pursue some form of significant financial transaction on their investments within 3 to 7 years. There are many types of potential transactions that could occur, not just selling the business.

Investment firms may have a different view of acceptable financial performance and a company’s worth than that of an inside or family investor. The investment firm continually seeks to raise the bar, challenging the logic that “this is how we have always done business.” Examining and exploring new avenues to improve performance can only be viewed as a positive direction for the industry. No one will ever object to increased profitability and value for a company. Unfortunately, that success sometimes comes with a price that can create individual hardships. The “good old boy” ideals and family atmosphere of a company could take on a different perspective. Change sometimes can be difficult. Change is not always wrong, though—just different.

The dynamics that investment banking firms could, and probably will, bring to the industry will be well received by some and dreaded by others. (“Beauty is in the eye of the beholder.”) History will be the judge and jury of their contribution to the industry. One thing is for sure: It will be exciting, while challenging, and will present many opportunities to all industry participants.

Field Labor Shortage

A shortage of qualified labor in any industry creates its own set of unique challenges. The question—about which there are varied opinions—is this: Will the shortage in the mechanical insulation industry be a short-term or a fundamental, long-term challenge?

The mechanical insulation industry is represented by both union and non-union labor forces. The problem appears to be universal to both segments and varies greatly by geographical area. Each segment has its own approach to recruiting and training personnel. However, if the shortage is expected to be long term, both segments should accelerate investment in their programs.

Immigration laws and their enforcement can affect recruitment efforts, but that should not be the only recruitment avenue pursued—nor should it be hidden behind as a barrier to recruiting personnel. The opportunities available in the mechanical insulation industry are not well known in high schools, trade schools, or colleges. Many people do not understand the insulation trade. They do not understand that mechanical insulation is a major contributor to the country’s energy independence, to protecting the environment, and to helping U.S. manufacturers compete in a global market. They do not understand the opportunities that are available, or that working in the industry could offer them a source of pride. Maybe the industry needs to examine some grassroots approaches to a long-term recruitment program and reduce its dependence on short-term migrant labor. That is something to think about.

The Need for Financial Benchmarking and Industry Information

How does your company’s performance compare to the industry average? Is revenue up or down? Maybe your revenue is up 2 percent, but the industry’s is up 8 percent. Say you are looking to sell your company, and the potential buyer asks for information on the industry. Where do you send them to get the information? There are many reasons the mechanical insulation industry would benefit from performance benchmarking and industry data.

In the past, many participants from all industry segments have reacted negatively to participating in surveys that contained information pertaining to their companies’ performance. The reaction has been, “My company’s information is super-secret stuff.” Whether that reaction is driven by trust-related matters or not understanding the value of having meaningful comparative data, or both, remains a mystery.

There are many key factors that influence the need for new data, including the following:

- The industry has grown.

- The profile of the industry has changed.

- Outside investors are looking more closely at the industry.

- Insulation is and is destined to be a larger part of the country’s energy conversation and environmental protection strategy.

- Internal and external shareholders want more information.

Is it time to revisit the value of and process for obtaining timely and meaningful company performance benchmarking and industry data?

The value of this type of information is different to each industry segment. Different questions apply to manufacturers, contractors, and distributors. Participants from each industry segment would view the information from different perspectives, but it would be beneficial to all. Amassing the information could be accomplished by a reputable third-party firm that specializes in gathering, analyzing, and publishing data in a process that maintains the confidentiality of “super-secret stuff” and does not offer an advantage to any one reader or group. The mechanical insulation industry is overdue for this information. Yes, some industry participants may be unique in many aspects; but other industries have unique areas and casts of characters, and they have developed performance benchmarking and industry data that is updated on a regular basis. Is the mechanical insulation industry that different?

Other Challenges and Opportunities

Subjects for another day—or areas that warrant monitoring as either opportunities or challenges—include the following:

- Vertical integration for certain product lines

- Importers circumventing the distribution channel

- Importers and/or brokers using price as their market-entry strategy

- Manufacturers exploring new approaches to attract and retain customer or product loyalty

- Continual consolidation of the industry in all segments

- The “backslide” of price increases in some product lines over the last year, which may drive the need for larger or smaller, more frequent increases in the future

- The world market possibly driving price escalation in certain product lines (like aluminum and stainless steel)

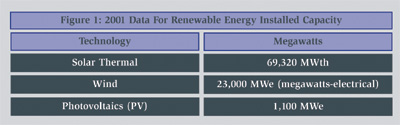

- Sustainable design (thinking green) gaining more momentum

- The nuclear industry (new plants) possibly returning to the United States as the need for additional power generation continues to increase

- Succession planning taking center stage at many companies

- The industry possibly approaching the “post-asbestos litigation” era, as more companies successfully emerge from bankruptcy protection

- The potential for increasing imports of more accessory-type products

- Efforts by the European insulation association (Fédération Européenne des Syndicates, or FESI) to establish a foundation to support market awareness and education initiatives similar to NIA’s Foundation for Education, Training, and Industry Advancement

- Product innovation and new application techniques continuing to influence the market

- Project scheduling becoming compressed, compounding labor-shortage challenges

- A decrease in the rate of new insulation contractors entering the market (a normal occurrence when work is abundant and there is a labor shortage)

- Asset management continuing to be a major focus in all segments

- The importance of safety being emphasized throughout the industry

- Abatement beginning to reach a normal level of activity

- An increase in insulation maintenance activities

- Electronic education, distance learning, Webinars, etc., increasing as employers seek to provide affordable education and training to more people

The Bottom Line

The NIA World is alive and well. It is stronger today than it has been in years and is continuing to grow. The mechanical and industrial insulation industry is not without its challenges, but the opportunities are far greater than the difficulties.

The need to communicate and educate specifiers and end users about the benefits of properly specifying, installing, and maintaining mechanical insulation has never been greater or more timely. Consider the following topics: energy conservation, process control, condensation control, mold prevention, corrosion under insulation (CUI), reduction of greenhouse gas emissions, safety, workplace environment, sustainable design, and ROI. Any of these is vital in today’s business environment. Mechanical insulation receives little respect and is taken for granted. While insulation is a powerful resource when designed, applied, and maintained properly, this technology is often forgotten or put on the bottom of the list and ignored. This valued technology is misunderstood by many, and is underutilized and undervalued. Now is the time to change that by thinking about insulation, the value of insulation, and the role of your association differently. Now, possibly more than any other period in recent history, is the time to invest in industry initiatives.

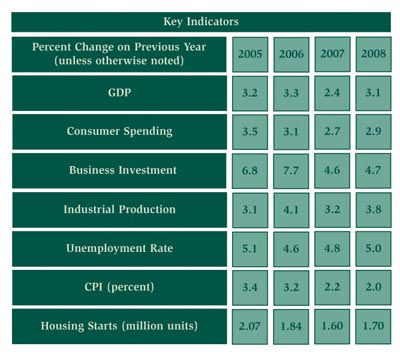

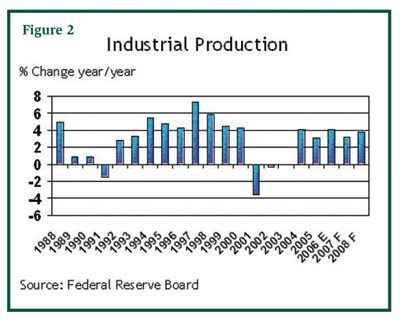

The industry is continually changing, opportunities are developing in all segments, and the challenges are not insurmountable. A recent report by an international research group forecast that the total world market for mechanical insulation would increase by 3 to 5 percent annually through 2009. The North American market, depending upon the segment, would experience annual growth rates of 2 to 5 percent during that same period. Adding up all of the components yields a great formula for success. This is an exciting time for the industry, its participants, and the National Insulation Association. The NIA World is a good place to be.