What Does 2013 Hold in Store for the Construction Industry?

What Does 2013 Hold in Store for the Construction Industry?

“A goal without a plan is just a wish.” – Antoine de Saint-Exupéry

With the economic challenges faced over the past few years, uncertainty over the effects of the November elections, and the threat of the “fiscal cliff” looming, the end of 2012 left many of us with the sense that while we may not like where we are at the moment, we are glad to have the last year behind us and look forward to the future. The quote from author and pilot Antoine de Saint-Exupéry is empowering, as it focuses us on taking action and preparing to achieve our objectives, rather than passively hoping things will fall into place for us. To help you actualize your goals in 2013, NIA reached out to sources in other industry organizations and compiled this report of expert opinions on the state of the market today and forecasts for the new year. Where are the challenges, and where can you see opportunities? We hope you will be able to use this information as you hone your business strategies for 2013.

The Current Construction Market Analysis

October Construction Falls 14 Percent

The value of new construction starts retreated 14% in October to a seasonally adjusted annual rate of $434.9 billion, according to McGraw-Hill Construction, a division of the McGraw-Hill Companies. Much of the decline was due to a sharp pullback by the electric power and gas plant category after a robust September. If this volatile project type is excluded from the month-to-month comparisons, total construction starts in October would register a 3% gain. Greater activity was reported in October for the public works sector, while both nonresidential building and housing settled back. Through the first 10 months of 2012, total construction starts on an unadjusted basis came in at $390.4 billion, a 4% gain relative to the same period a year ago.

The October statistics brought the Dodge Index to 92 (2000=100), down from the 107 reported for September. Over the first 10 months of 2012, the Dodge Index fluctuated within the range of 85 to 116, averaging 97 during this period. “This year’s pattern for total construction has been shaped to some degree by the swings for the electric utility and gas plant category, which is still on track to achieve a new annual high in current dollar terms, even with its weak October performance,” stated Robert A. Murray, vice president of economic affairs for McGraw-Hill Construction. “Leaving out electric utilities and gas plants, the amount of construction starts in 2012 would be up 3% through the first ten months, which reflects a mixed pattern by project type. For housing, the emerging recovery for single family housing is joining the strengthening trend for multifamily housing that’s already underway. For nonresidential building, commercial building is seeing modest growth in 2012, but this has been offset by declines for institutional building and manufacturing plant construction. Public works year-to-date has been basically flat, beginning to stabilize after its 14% downturn in 2011. While the pattern of overall construction activity does seem to be moving towards more broad-based expansion, the persistent uncertainty affecting the U.S. economy continues to pose a downside risk. The degree to which policymakers in Washington, D.C. are able to agree on the steps necessary to avert the fiscal cliff will determine whether the nascent upturn for construction continues to grow in 2013 or slides back.”

Nonbuilding construction in October dropped 32% to $133.4 billion (annual rate), retreating after the prior month’s 68% jump. September had been lifted by a 335% surge for the electric utility and gas plant category, as a $4.8 billion liquefied natural gas plant (the Sabine Pass Liquefaction Project) was included as a September start, along with six power plant and transmission line projects valued each in excess of $100 million. For October, the largest electric utility and gas plant project was $88 million for transmission line work in Massachusetts, contributing to a 93% decline for the category. In contrast, the public works sector in October climbed 19%. The miscellaneous public works category, which includes such diverse project types as site work, mass transit, and pipelines, soared 52% in October. The boost to miscellaneous public works came from $2.0 billion related to work on the Keystone Pipeline Gulf Coast Expansion, located in Oklahoma and Texas. The large increase marked a departure from what has been a declining trend in 2012 for highway construction, which on a year-to-date basis was still down 11%. Sewers and water supply systems dropped a respective 16% and 5% in October.

Nonresidential building, at $131.6 billion (annual rate), decreased 4% in October. The manufacturing plant category plunged 73%, continuing to pull back from the improved activity that was reported earlier in 2012. Murray noted, “As the result of the uncertainty created by the looming fiscal cliff, manufacturers have increasingly held back on investment as 2012 has progressed.” Warehouse construction also weakened substantially in October, falling 33%. Office construction in October slipped 3%, although the month did include the start of several noteworthy projects?the $216 million Tower at PNC Plaza in Pittsburgh, PA, the $110 million Energy Center III office tower in Houston, TX, a $76 million municipal office building in Boston, MA, and a $50 million corporate headquarters renovation for TJX in Marlborough, MA. On the plus side, hotel construction in October grew 7%, helped by the start of a $189 million hotel in Austin TX. Store construction also registered a gain in October, rising 3% with the help of the $101 million retail portion of the $250 million City Point Residential Retail Development Project (Phase 2) in Brooklyn, NY.

On the institutional side, the educational facilities category continued to lose momentum, dropping 3%. Even with the decline, several large education projects reached groundbreaking in October, including a $95 million facility for the University of Tennessee in Knoxville, as well as two large high school projects in Massachusetts. More considerable October declines were registered by amusement-related work, down 22%; and transportation terminals, down 50%. The public buildings category posted a large October gain, climbing 92% due to the start of a $524 million military facility at Offutt Air Force Base in Nebraska. Healthcare facilities also registered a large October gain, advancing 37% with the help of five hospital projects valued each in excess of $100 million. These hospital projects were located in Virginia ($215 million), Iowa ($150 million), Florida ($111 million), North Carolina ($104 million) and Ohio ($102 million). Church construction in October edged up 1%, although activity continues to be very depressed.

Residential building in October dropped 2% to $169.9 billion (annual rate). The downward pull came from multifamily housing, which retreated 7% from September. During 2012, multifamily housing fluctuated around an upward trend, and the pace for multifamily housing in October was still 23% above the level reported at the start of the year. Large multifamily projects that reached groundbreaking in October included the $200 million Insignia Residential Towers in Seattle, WA and $149 million for the multifamily portion of the City Point project in Brooklyn, NY. Single-family housing in October was unchanged from September, maintaining the enhanced activity established over the course of 2012. The October single-family amount was up 25% from the level reported at the start of the year, and this project type had earlier shown gains in seven of the nine preceding months. During the January?October period of 2012, the regional pattern for single family housing showed the largest increase in the West, up 39%; followed by the Midwest, up 28%; the South Atlantic, up 26%; the South Central, up 22%; and the Northeast, up 14%.

The 4% pickup for total construction on an unadjusted basis during the first ten months of 2012 was the result of increases for two of the three main construction groups. Residential building advanced 28%, with year-to-date gains of 27% for single family housing and 30% for multifamily housing. Nonbuilding construction grew 3% year-to-date, the result of combining an 11% increase for the electric utility and gas plant category and “no change” for public works. Nonresidential building continued to be the one major construction group to register a year-to-date decline, falling 14%. The nonresidential building decline was due to this behavior by segment?commercial building, up 2%; institutional building, down 15%; and manufacturing building, down 47%. To a large extent, the nonresidential building decline in dollar terms comes from the comparison to several massive projects that reached groundbreaking during the first 10 months of 2011, including a $3.0 billion coal-to-gasoline plant in West Virginia, a $1.5 billion semiconductor plant in

Arizona, a $1.2 billion airport terminal in New York, and a $1.1 billion government data center in Utah. On a square footage basis, nonresidential building in the first 10 months of 2012 was up 1% compared to a year ago.

By geography, total construction starts during the January?October period of 2012 showed a large gain for the South Atlantic, up 24%, with much of the upward push coming from the start of two massive nuclear power projects in Georgia and South Carolina. If these two projects are excluded, then total construction starts in the South Atlantic would be up only 1%. Year-to-date gains for total construction were also reported for the Midwest, up 6%; and the South Central, up 5%. Year-to-date declines for total construction were reported for the Northeast, down 6%; and the West, down 8%.

For more than a century, McGraw-Hill Construction has

remained North America’s leading provider of project and product information;

plans and specifications; and industry news, trends, and forecasts. To learn

more, visit www.construction.com.

The 2013 Construction Market Forecast

FMI Releases Q3-2012 Construction Outlook Report

“Contrary to election-year rhetoric, the economy is inching its way to improvement, and the construction industry has not stopped working,” according to the third quarter 2012 Construction Outlook report by FMI, the largest provider of management consulting and investment banking to the engineering and construction industry. Released in December, the industry forecast is calling for an 8% increase in total construction put in place for 2013. Contributing to this positive forecast is more robust growth in residential construction, as well as a few strong markets in nonresidential and non-building construction.

The focus for 2013 will be on the movement of private money back into the markets. For the economy to grow at a faster rate, with the fiscal cliff looming and state and municipal budgets still in repair mode, it will be the private markets that must lead the way. Total construction put in place for 2013 is forecast to be $892 billion, a solid improvement over the last few years, but still just edging out 2003 levels of construction activity.

Health care construction will see a solid recovery, along with power construction. Both markets are expected to grow by 8% in 2013. Lodging, office, educational, and commercial markets will continue to struggle to get out of the doldrums. However, growth for all will be in line with or ahead of expected Gross Domestic Product (GDP) growth.

Residential construction housing starts rose to 603,000 units a year as of September 2012. Single-family permits also rose to a 545,000-unit pace, or 6.7%, returning to levels not seen since July 2008.

Nonresidential Construction Trends and Forecasts by Sector

- Lodging: Hotel developers will renovate before building new properties. Bank loans will be hard to justify until occupancy and room rates remain consistently high.

- Office: Through the first 2 quarters of 2012, the U.S. office sector absorbed 10.4 million square feet, 100,000 square feet less of net absorption than was generated over the first 6 months of 2011. (Source: Jones Lang LaSalle, “Office Outlook United States, Q2 2012”). This is not yet enough activity to compare with prerecession highs, but we expect Construction Put in Place (CPIP) to improve 4% in 2013.

- Commercial: Expect more rethinking of commercial construction space to accommodate smaller stores and combining in-store sales with online shopping. Look for increasing multiuse projects.

- Health care: New health care construction will include a growing number of renovation projects to update current facilities for modern hospital design, using more technology in the rooms as well as for improving air quality and reducing energy usage.

- Religious: The lending environment continues to be a challenge for many congregations.

- Public safety?Despite overcrowding in prisons, we expect public safety construction to remain slow

for the next couple of years, at least with only 1% growth in 2013 to $10.2 billion. - Transportation: This remains a strong sector for construction. CPIP is expected to grow 6% in 2013 to a total of $38.2 billion for the year. This is due in part to The FAA Modernization and Reform Act, which will provide $63.6 billion for the agency’s programs between 2012?2015.

- Manufacturing: Manufacturing construction is starting to make a comeback with both new growth in manufacturing output and with some companies repatriating their manufacturing capacity.

- Power-related: Power construction will continue to be one of the strongest growth sectors for construction. Worthy to note: The U.S. Army Corps of Engineers has a proposal out for $7 billion in locally generated renewable energy through power purchase agreements.

- Sewage and waste disposal: Waste-to-energy may be one of the best bets for future work in this sector if more municipalities can find ways to work with private investors.

- Water supply: Expect this sector to struggle to find funds for necessary remediation and construction. Strength in water supply construction will be found in pockets for industrial projects like the mining sector, power, and industrial plants.

- Conservation and development: The 2012 annual budget for the Department of Agriculture eliminates funding for the Resource Conservation and Development (RC&D) and Watershed and Flood Prevention Operations programs. New projects in this sector, like water system projects, will likely come from cleanup for the mining and energy sector to comply with regulations.

For more information, contact Sarah Avallone at 919-785-9221 or savallone@fminet.com.

ABC Predicts Moderate Construction Recovery Will Continue in 2013

Associated Builders and Contractors (ABC) released its 2013 economic forecast for the U.S. commercial and industrial construction industry, and it shows the continuation of a modest recovery for nonresidential construction next year.

“ABC predicts nonresidential construction spending will expand 5.2% in 2013,” said ABC chief economist Anirban Basu. “Given the remarkably deep reductions in nonresidential construction spending since the onset of the downturn, one would expect more robust growth during the fourth year of broader economic recovery.

“Thanks to a handful of segments experiencing more rapid economic recovery, much of the construction expansion next year will be in categories heavily associated with private financing,” Basu said. “Due largely to constrained capital budgets at state and local government levels, as well as ongoing turmoil in Washington, D.C., publicly funded construction spending is expected to be flat next year, and perhaps worse.

“The fastest growing major U.S. industry during the last year in terms of absolute job creation was professional and business services,” said Basu. Because many firms in this category use office space, office-related construction spending is expected to rise 10% in 2013.

“Consumer confidence also has progressed,” Basu said. “Accordingly, ABC predicts total commercial construction will expand roughly 10% next year. Other industries positioned to experience rising levels of investment include power, up 10%; lodging, up 8%; health care, up 5%; and manufacturing, up 5%.

“Nonresidential building construction employment is expected to expand 2.1% in 2013, slightly better than the 1% performance estimated for 2012,” said Basu. “Construction materials prices should rise a bit more rapidly in 2013 than they did in 2012, with substantially more volatility to be experienced from month to month next year.

“Despite ongoing slowdown in many of the world’s largest economies, ABC anticipates many investors will opt to invest in hard assets as a way to avoid volatility in equity and bond markets,” Basu added.

ABC’s Conclusion

“Whether or not the nation falls off its fiscal cliff?a collection of spending cuts and tax increases that kick in at the end of the year?certain taxes likely are headed higher,” said Basu. “ABC predicts higher marginal income tax rates to reach pre-Bush levels, as well as an increase in tax rates on capital gains and dividend income. In addition, ABC expects the payroll tax credit to sunset in the first quarter of 2013.

“The U.S. economy is presently expanding at a 2% rate,” said Basu. “Even in the absence of a dive off the federal precipice, the nation will struggle to achieve 2% growth next year as certain tax rates rise and as federal spending growth slows and perhaps turns sharply negative.

“GDP has expanded for 13 consecutive quarters,” Basu said. “ABC’s forecast for GDP growth next year is between 1%-2%. If the nation falls off its fiscal cliff, recession will follow, with GDP falling between 2% and 3% for the year.

“With the elections now behind us, the hope is the White House and Congress will be able to successfully navigate the nation past its fiscal cliff,” Basu said. “If that happens, the latter half of 2013 could be surprisingly good for nonresidential activity given the large volume of construction projects that were put on hold during the course of 2012. However, the baseline forecast calls for only moderate expansion in nonresidential construction spending next year.”

Associated Builders and Contractors (ABC) is a national association with 74 chapters representing merit shop construction and construction-related firms with nearly two million employees. Visit them at www.abc.org.

McGraw Hill’s 2013

Dodge Construction Outlook

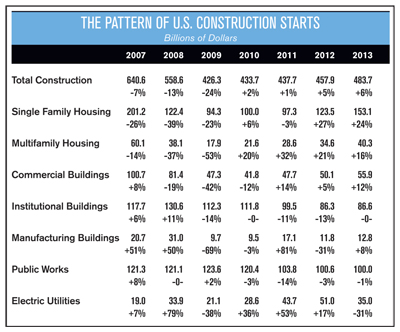

After the steep decline of 2007?2009, the construction industry has shown a few glimmers of recovery, but overall there’s not yet been sufficient traction to say that renewed expansion has taken hold. As reported by McGraw-Hill Construction, new construction starts in 2010 edged up 2%, followed by another 1% gain in 2011; and the current year is headed for a 5% increase to $458 billion. This still leaves the volume of total construction starts 32% below the 2005 peak on a current dollar basis, and down about 50% when viewed on a constant dollar basis. The modest gains experienced during the past 2 years have in effect produced an extended bottom for construction starts, in which the process of recovery is being stretched out.

The pattern of construction starts seems to be in a “balancing act,” where gains for a few project types are offset by declines for other project types. The upturn for multifamily housing has been joined in 2012 by a strengthening single-family market. Several commercial project types, notably hotels and warehouses, have picked up the pace; and electric utility construction will reach a new record high. However, the institutional building sector has weakened considerably during 2012, adversely affected by tight federal, state, and local budgets; while public works construction has experienced further erosion.

The backdrop for the construction industry remains the fragile U.S. economy. Real GDP in the second quarter of 2012 grew just 1.3%, and for all of 2012 the GDP increase is estimated at 2.1%. The employment statistics have reflected this hesitation, as growth in the second quarter fell to just 67,000 jobs per month, before bouncing back in the third quarter to 146,000 jobs per month. The main obstacle to stronger growth for the U.S. economy is the pervasive sense of uncertainty, which has dampened business investment and hiring. Earlier in 2012, at least some of this uncertainty was related to concerns over the potential spread of the European debt crisis, but by midyear the anxiety about the impending “fiscal cliff” (the expiring tax cuts, combined with reduced federal spending) became dominant. Along with the uncertainty created by the 2012 presidential election, many firms have placed plans for investment on hold.

The fiscal cliff poses a significant downside risk to the near-term prospects for the U.S. economy and the construction industry. In May, the Congressional Budget Office warned that allowing existing policies to take effect in early 2013 could cause the U.S. economy to slide 1.3% during the first half of 2013. For the purpose of this forecast, it is assumed that policymakers will be able to reach agreement in early 2013 to soften the impact of the spending cuts as well as maintain some of the Bush-era tax cuts. The U.S. economy will be shaky at the outset of 2013, but it is hoped that efforts to cushion the fiscal cliff will allow some of the uncertainty to diminish. Real GDP growth for all of 2013 will still be a tepid 2.2%, but the economy should improve after a weak start to the year.

A U.S. economy that avoids recession in early 2013 will allow several positive factors to benefit construction. Interest rates are very low, and lending standards for commercial real estate loans are easing. Significantly, market fundamentals for several project types are strengthening. This includes rent growth for multifamily housing, increases in revenue per available room for hotels, and retreating vacancy rates for warehouses and offices. In this environment, it is forecast that new construction starts for 2013 will climb 6% to $484 billion, a rate of growth not much different than the 5% gain estimated for 2012. The following are the main points, by sector, for the 2013 construction market:

- Multifamily housing will rise 16% in dollars and 14% in units, marking healthy percentage gains, yet slower growth than what took place during 2011 and 2012. Improved market fundamentals will help to justify new construction, and this structure type continues to be viewed favorably by the real estate finance community.

- Commercial building will increase 12%, a slightly faster pace than the 5% gain estimated for 2012. Both warehouses and hotels will benefit from lower vacancy rates, while store construction will feature more upgrades to existing space and the derived lift coming from gains for single-family housing. The increase for office construction will be modest, as new privately financed projects continue to be scrutinized carefully by lenders. Next year’s level of commercial building in current dollars will still be more than 40% below the 2007 peak.

- Institutional building will level off, following the steep 13% drop estimated for 2012. For educational facilities, K-12 construction will slip further, while college and university construction should at least stabilize. Health care facilities are expected to make a modest rebound after this year’s downturn.

- The manufacturing building category will grow 8%, showing improvement after its 2012 decline.

- Public works construction will slide an additional 1%, as federal spending cuts in particular restrain environmental projects. The new 2 year federal transportation bill should help to limit the impact of spending cuts on highways and bridges.

- Electric utility construction will drop 31%, after reaching a record high in current dollars during 2012. This year was boosted by the start of two very large nuclear power plants, and projects of similar magnitude are not expected for 2013. The expiration of federal loan guarantees for renewable energy projects would also dampen construction in 2013.

For more than a century, McGraw-Hill Construction has remained North America’s leading provider of project and product information; plans and specifications; and industry news, trends, and forecasts. To learn more, visit www.construction.com.

Conclusion

The companies who will succeed in 2013 and beyond will be those who effectively process the lessons of the past, adapting and targeting their efforts based on current and forecasted market conditions. Information and education are key to ensuring that goals are realistic and the path to reach them is well considered, built on a solid foundation of understanding. While conditions will evolve?historic storms will hit, or other events will catch us off guard?one thing is certain: As Benjamin Franklin noted, “By failing to prepare, you are preparing to fail.”