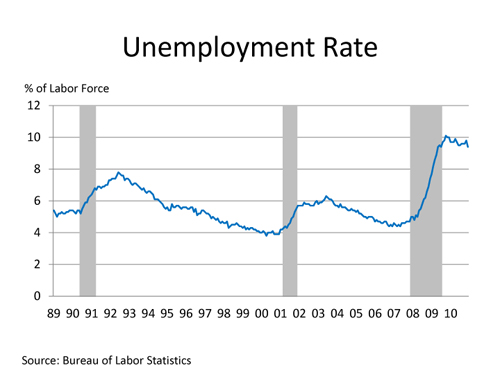

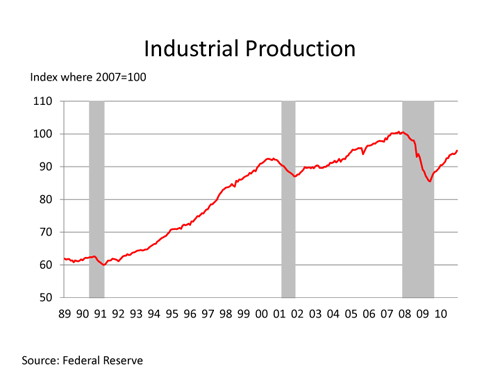

The mechanical insulation industry certainly felt the impact of the sluggish, recessionary economy in 2010, which did not produce any significant rebound from 2009. National unemployment hovered around 10 percent, while the rate for the construction industry, including the mechanical insulation industry, ranged between 20 and 25 percent. Confidence in the economy recovering in the short term was weak. The low confidence level and fear of what the future holds resulted in companies sitting on large cash reserves. Securing financing remained difficult, which resulted in a low level of new construction starts and retrofits, and a decrease in maintenance activities. The gridlock on Capitol Hill did not help and may even have hindered our nation’s recovery efforts.

It is not possible to discuss the State of the Industry without including the economy and politics. However, there are so many moving parts to the equations, and “expert” opinions, that it is wiser to focus on what we can influence. Our industry should continue actively participating in influencing positive changes in Washington, D.C., as well as state capitals and local jurisdictions. Change sometimes is slow and challenging, but without it tomorrow could look like yesterday. Most industry participants want to see 2009 and 2010 through the rear view mirror, not the front windshield.

When thinking about the economy and its complex components, it is easy to be pessimistic. However, I prefer the optimistic view that the momentum is growing to deliver a slow, steady recovery for the general economy and the mechanical insulation industry.

Finding the Exit

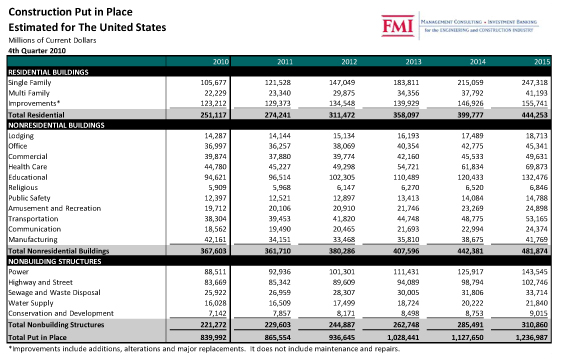

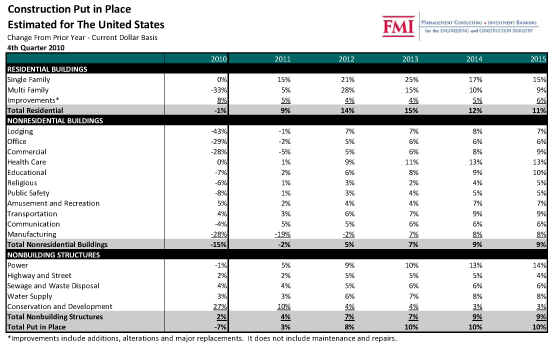

The economy is showing signs of recovery. Many forecast commercial and industrial construction activities to increase by moderate double digits in 2011. While that is great news, remember that those projections are based on current levels obtained after 3 years of decline.

Where does the mechanical insulation industry fit in the recovery cycle? The industry is historically one of the last sectors to feel the impact of a downturn and, unfortunately, one of the last to reap the benefits of a recovery. With a slow recovery, the industry may only notice substantial benefits from a longer-term perspective versus year-over-year comparisons. That said, some areas—and certainly individual companies—may enjoy bursts of recovery driven by project securement, mix of business among market segments, specific stimulus activities, and an array of other unique or localized events.

The mechanical insulation industry is not without its challenges. But it is also uniquely positioned, and the future is filled with opportunities. We need to go after them, not wait for them to come to us.

With national and international efforts focused on increased energy efficiency and improving the environment, the mechanical insulation industry should continue to educate all direct and indirect channel participants and promote the benefits of mechanical insulation. Providing local and industry-specific practical data and case studies that outline potential energy savings and emission reduction opportunities provided by mechanical insulation installations is vital to that education effort.

Mechanical insulation has the potential to greatly reduce energy intensity and emissions. However, the lack of data to support the case for increased use and maintenance of mechanical insulation has penalized the industry. Policy makers in the industrial and commercial sectors need hard data to make their case. The industry must gather this data and make it available.

In addition, the industry should participate in the development of new processes, such as building information modeling, to ensure our role in future projects. That will require change, and the challenge of change can be difficult.

The following are a few of the developing areas the mechanical insulation industry should pursue.

Energy Codes: A Path Forward

In the past several years, energy codes have moved from the fringes of energy efficiency policy to center stage. Policy makers, energy agencies, and environmental groups have realized that energy codes are one of the simplest, most effective tools to reduce building energy use. That realization has resulted in a push for faster adoption of code increases through both state-level legislation and formal policy initiatives of the U.S. Department of Energy and other major organizations. However, there is apprehension that unrealistic expectations—”stretch goals”—are being set without addressing some basic changes in code implementation and transition, not to mention measurement and enforcement processes.

There are numerous efforts in the United States and internationally to develop comprehensive, performance-based energy metrics. According to a draft of a National Institute of Building Sciences Consultative Council (NIBS-CC) report, “If we are to achieve net-zero-energy performing buildings, it will be important to arrive at a greater understanding of the cost/benefit variables that will allow the building community to make informed decisions regarding which technologies to prioritize, develop, and implement. The transition away from prescriptive-based specifications towards performance-based metrics should also include goals for the incorporation of systems that allow for real-time user monitoring of building energy and water use that will work to ensure ongoing performance. Such systems will provide a built-in feedback system for continuously improving actual performance and informing the underlying metrics.”1

Where does that leave the mechanical insulation industry? The industry has long touted the energy benefits of mechanical insulation on a prescriptive basis. Prescriptive codes or strategies generally describe specific components or features required in a building. Most codes focus primarily on prescriptive compliance strategies, considered the simplest and easiest to implement and enforce. However, history has proven that individual prescriptive codes may not be indicative of holistic building performance.

For new construction, performance-based compliance typically means that energy modeling software is used to show that a building’s predicted energy consumption or cost is equal to or lower than a specified baseline or target. The baseline targets are generally a combination of prescriptive requirements that may or may not be covered under existing or proposed codes.

For existing buildings, performance normally implies comparison to historical holistic building energy usage. That sounds simple, but many facility owners are not willing to share historical energy usage/cost data, which—without mandated compliance—may make performance codes difficult to enforce.

The focus on reducing energy consumption in new and existing buildings and manufacturing facilities is increasing in virtually all circles. The opportunities for mechanical insulation in this arena are clear. The question is how the industry will respond to ensure mechanical insulation is at the core of the code development and implementation process.

The industry should take an active role in establishing the value of mechanical insulation with both individual prescriptive and holistic performance codes, including building simulation and modeling. This is clearly an area where adopting a “wait-and-see” approach, or assuming someone else is addressing these areas, will be a mistake. All facets of the industry—manufacturers, contractors, and distributors—need to contribute in a unified effort. This opportunity may be comparable to the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) program. The industry did not have a seat at the table with the initial development, and now we are playing catch up. Let’s not make that mistake again.

Insulation and the Energy and Water Nexus

In addition to saving energy, mechanical insulation can also play a role in saving water. The term “water-energy nexus” is increasingly used to indicate the relationship between water and energy due to how society uses water. Water efficiency in many respects is more important than energy efficiency. Put energy and water together, and you have a topic that is vital to our nation’s economy and security. According to the NIBS-CC:

“Energy is consumed in the conveyance of water from the source to the point of treatment, the treatment process itself, the distribution of water to the point of use, the heating of water during use, and the wastewater treatment process. Water heating alone accounts for an average of 13 percent of the total energy consumed in U.S. residential buildings. These values indicate the huge potential of achieving significant energy efficiencies through improved water efficiency measures.

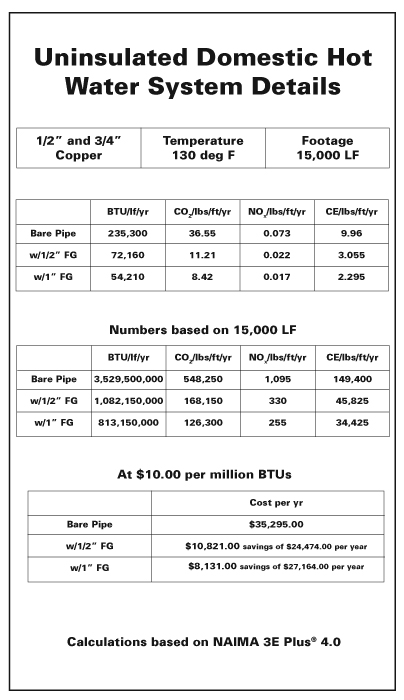

“Plumbing distribution systems within buildings need to be designed with a greater focus on water and energy efficiency in residential, commercial, and industrial sectors. The distance between the sources of hot water, generally the water heater and the various points of use within a building, should be minimized in the design phase. Where this is not possible, the use of on-demand or timer-controlled hot water circulation systems and increased use of pipe insulation materials on hot water lines will greatly improve both water and energy efficiency levels within the building.

“The need to improve indoor and outdoor use of water in buildings is profound. The U.S. Environmental Protection Agency reports that 36 states expect to experience local, regional, or statewide water shortages by 2013….”2

Water is, and will continue to be, a precious resource. This is clearly an opportunity for the mechanical insulation industry. While it is generally accepted that increased use of insulation on hot water piping reduces energy costs, how much water could be saved is not normally considered. Our industry needs to understand the relationship and develop data on the energy and water nexus from the mechanical insulation perspective.

Making Mechanical Insulation

a “Core Competency”

Buildings and facilities are the result of a complex system of ideas, experiences, technologies, and practices brought together by different disciplines, users, and needs. To achieve high-performance buildings or facility objectives, we must understand the cost/benefit variables that the building community uses to make decisions about which technologies to prioritize, develop, and implement.

Education and training in the building professions should be aimed at facilitating the entire life cycle of buildings, including concept, design, construction, commissioning, occupancy, modification/renovation, and deconstruction. In each phase of the building’s life cycle, particular segments of the building community must have the requisite knowledge to address needs specific to that phase. Historically, the primary education has been in universities, colleges, and trade schools (although in the case of mechanical insulation, those efforts have been minimal).

Mechanical insulation is a proven technology key to achieving high-performance objectives. It should be nationally recognized as a “core competency” in the design and management phases. For years, a deficient understanding of what mechanical insulation is and how it could be utilized has impeded policy makers, design professionals, facility management, and other participants in industrial and commercial sectors in making a supportable case for increased use and maintenance of mechanical insulation. To those in the industry it is a “no-brainer,” and the frustration level with others’ lack of understanding or appreciation continues to increase.

The only way to change that is by educating all individuals and groups that have an impact on the performance of the building or facility during its life cycle, including:

- owners

- commissioning agents/code authorities

- general and mechanical contractors

- engineers and architects

- installation and service contractors

- facilities management

- users/occupants.

While initial education in a particular career or trade is essential, education must be continual. Best practices go stale; equipment systems and processes change; and new regulatory requirements are enacted.

Without doubt, an increased focus on mechanical insulation in higher learning institutions and the facility management field will provide long-term benefit to the industry. In addition, certification or similar programs on core competencies required in building operation will be the wave of the future for building/facility management. How can one expect facility owners, whether in the public or private sectors, to achieve high performance levels if those managing and operating the facilities do not have a good understanding of their building’s core competencies and their interrelationship?

The industry must step up and support educational efforts, such as the Mechanical Insulation Education and Awareness Campaign (see “Mechanical Insulation in the Spotlight”) and efforts to include mechanical insulation as a core competency under the Federal Buildings Personnel Training Act of 2010.

The Road Ahead

The world in which the industry competes is much different today than it was 10 years ago—or even 1 or 2 years ago. This article has discussed just a few of those changes. Many more could be added to the list of future trends or changes, including insulation contractor state or local licensing requirements; the need for federal and state or local incentive programs to support energy, environment, and education initiatives; and continual technology improvements.

All of these create opportunities. The mechanical insulation industry must accept and embrace whatever the economy provides, but we can also positively influence the industry’s role in the future economy.

Implementing and maintaining an aggressive, meaningful, and sustainable education and promotional campaign in today’s economy is not easy, given bottom-line and resource demands. But if the industry wants to influence positive change and long-term sustainable growth, it cannot afford to sit on the sidelines. We can easily predict the outcome if we simply take whatever the economy allows us to have.

The industry’s time to influence the increased use of mechanical insulation is now. Your participation has never been more critical. Watch for calls to action and check

Insulation.org for ways you can make

a difference.

Notes

1. National Institute of Building Sciences–Consultative Council Topical Committee pre-publication draft report.

2. Ibid.