Introduction

Plastic piping for domestic hot and cold service water systems, and for HVAC systems in buildings, has been in use for many years and has become the dominant piping material for residential construction. One source1 estimates that plastic pipe systems are currently used in 75% of the potable piping systems in new residential construction, and this number is predicted to rise to 80% by 2015. Plastic piping is also used routinely in commercial and industrial applications.

Compared to metallic piping systems, plastic piping materials have a significantly lower thermal conductivity, which translates to lower heat transfer between the fluid and the ambient air. For some piping applications, this can be advantageous. For example, city water lines entering a building will often sweat due to the relatively cold temperature of the water entering the building. Depending on the ambient conditions, plastic piping may minimize or eliminate the surface condensation and associated dripping from cold water pipes. However, when insulation is required by energy codes, the impact of the pipe wall material on the overall heat transfer is generally small. For this reason, energy codes do not differentiate insulation requirements based on pipe wall material.

How much insulation is needed on plastic pipe? As is often the case, the answer depends primarily on the design objectives. There are a number of reasons to insulate piping. The Mechanical Insulation Design Guide lists seven design objectives: Condensation Control, Energy Conservation, Fire Safety, Freeze Protection, Personnel Protection, Process Control, and Noise Control.2

Often, designers are faced with multiple design objectives (e.g., energy conservation and fire safety). The amount of insulation required depends on the design objectives and the specifics of the application. In some cases (e.g., condensation control or freeze protection) plastic piping may need no insulation. In other situations, additional insulation may be required, relative to metallic piping. Requirements need to be determined on a case-by-case basis by analyzing the expected operating conditions. Significantly, when the objective is energy conservation (i.e., compliance with energy codes and standards), plastic piping generally requires the same amount of insulation as metallic pipe.

Plastic Piping Materials

A number of different plastic materials are used in piping systems, including:

- ABS (Acrylonitrile Butadiene Styrene)

- CPVC (Chlorinated Polyvinyl Chloride)

- PB (Polybutylene)

- PE (Polyethylene)

- PEX (Cross-linked Polyethylene)

- PP (Polypropylene)

- PVC (Polyvinyl Chloride)

- PVDF (Polyvinylidene Fluoride)

These plastics have various properties that make them more or less appropriate for various applications. A key property for hot systems is maintaining strength at high temperatures. Since all plastics lose strength as temperature increases, the use of plastic piping is limited to operating temperatures less than 220°F. For domestic hot and cold water piping systems, CPVC and PEX are the most common materials. For chilled water distribution piping, many different materials may be used.

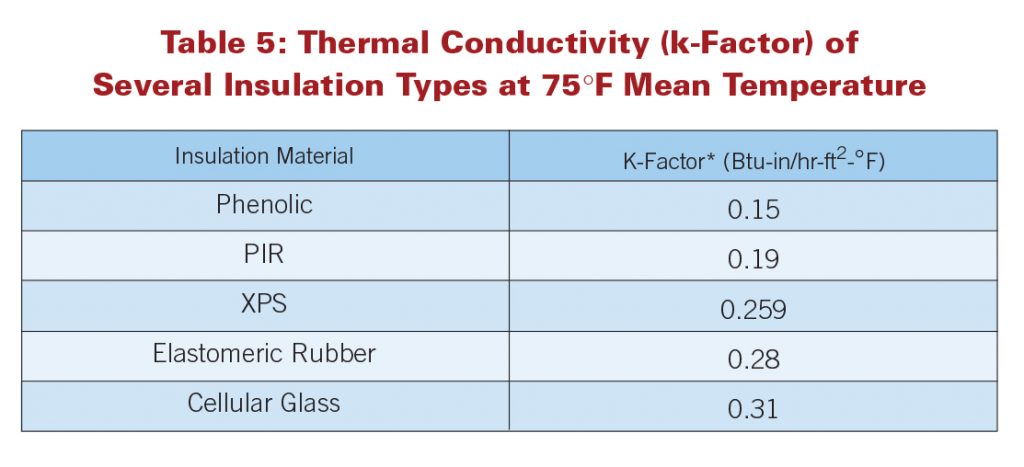

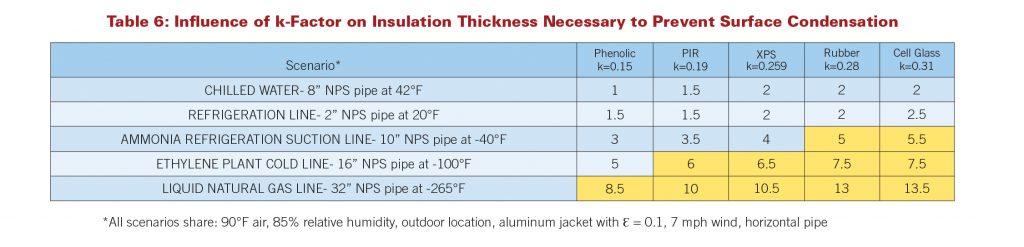

When it comes to limiting the transfer of heat, the key factors are thermal conductivity and the wall thicknesses of pipe products. As expected, the thermal conductivity of plastic pipe materials varies. Table 1 is extracted from various sources and shows the range of conductivity values reported in the literature. Values range from a low of 0.8 Btu?in./(h?ft.2?°F) for PVDF to a high of 3.2 Btu?in./(h?ft.2?°F) for PEX. For comparison purposes, the conductivity of copper is approximately 2,720 Btu?in./(h?ft.2?°F) at a temperature of 75°F; while steel has a conductivity of approximately 314 Btu?in./(h?ft.2?°F).

Plastic piping is manufactured to a number of different size standards. CPVC is available in either nominal pipe sizes (NPS) from ¼” to 12″ or in copper tube sizes (CTS) from ¼” to 2″. NPS sizes are available in either Schedule 40 or Schedule 80 wall thicknesses. CTS sizes for wall thickness have a standard dimension ratio (SDR) of 11 (i.e., the outside diameter is 11 times the wall thickness).3

PEX is available in CTS sizes from ¼” to 3″ with SDRs of approximately 9. Dimensions used in this study were taken from the National Association of Home Builders (NAHB) Research Design Guide “Residential PEX Water Supply Plumbing Systems.”4

Heat Transfer Calculations

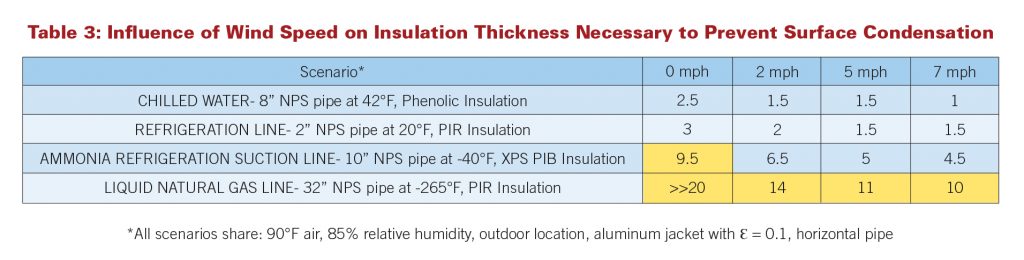

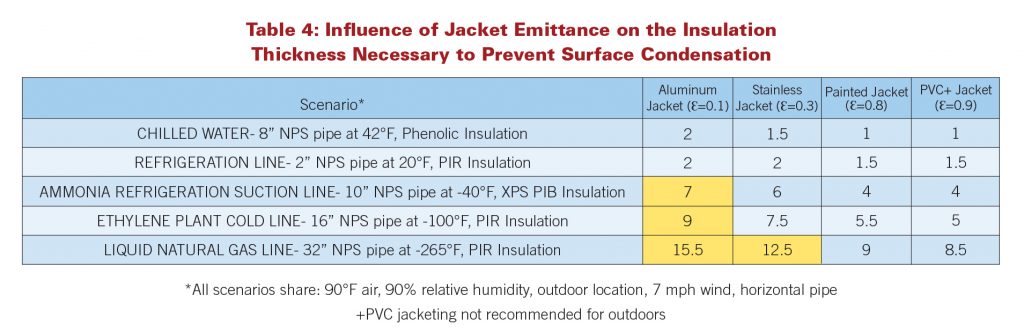

The data from Table 1 demonstrates that the thermal conductivity of metallic piping is 30 to 3,000 times higher than typical plastic piping materials. However, the impact on heat transfer to or from the fluid will depend not only on the relative thermal resistances of the pipe wall, but also on the other thermal resistances in the system. For bare piping, the air surface coefficient normally represents the largest thermal resistance in the system. The wind speeds at the surface, along with the thermal emittance of the surface material, are dominant. As insulation is added to the system, the resistance of the insulation layer begins to dominate and other resistances become less important. Figure 1 compares the heat loss from a horizontal 2″ tube containing water at 140°F in still air at 75°F. For the bare case, the heat loss from the CPVC tubing is significantly less than the copper tubing. At insulation thicknesses above ½”, the difference in the heat loss becomes small. Flexible elastomeric insulation was assumed for this example.

The relative magnitude of these effects will vary according to the situation, but they can be estimated using well-established calculation procedures. The procedures for these calculations are outlined in ASTM Standard C 6805 and in many heat transfer textbooks.

A few example applications were selected to help illustrate the relationships. All of these examples compare thin-walled (Type M) copper tubing to standard-size CPVC and PEX tubing. These materials were chosen because, together, they represent the largest share of products in the marketplace and because they effectively span the range of thermal conductivities for piping. Table 2 shows the conductivities and surface emittance used in this analysis.

Example 1 assumes a 2″ CTS domestic hot water (DHW) line located within a commercial building. The operating temperature of this line is 140°F and the ambient conditions are assumed to be 75°F with 0 mph wind speed. For calculation purposes, the insulation material is flexible elastomeric insulation (ASTM C 534 Grade 1). The 2012 International

Energy Conservation Code (2012 IECC) Energy Code requirement for this application calls for 1″ of insulation. Calculated heat losses per foot of piping run are summarized in Table 3.

Example 2 involves a 1″ CTS heating hot water (HHW) line in a commercial building. The line operates at a temperature of 180°F and runs through a return-air plenum with an air temperature of 75°F and an air velocity of 3 mph. For this example, we will use fiberglass insulation (ASTM C 547 Type I). The 2012 IECC insulation requirement for this application is 1 ½.” Results of the calculations are shown in Table 4.

Example 3 is a 2″ CTS chilled water supply (CWS) line operating in a mechanical room of a commercial building. The operating temperature is 40°F; the ambient temperature is 80°F; and the wind speed is 1 mph. The insulation material is flexible elastomeric insulation

(ASTM C 534 Grade 1). The 2012 IECC insulation thickness requirement for this application is 1″. Results from this example are shown in Table 5.

Results for all three of these examples are similar and reveal the following important points:

- As expected, the heat loss or gain depends on both the thickness of the insulation as well as the choice of the pipe material. However, the effect of insulation thickness is considerably more significant than the choice of pipe material. In Example 1, adding 3/8″ of insulation to the bare copper line reduces the heat loss by 61%; while changing the “bare pipe” material from copper to CPVC reduces the heat loss by

21%. - For bare piping, the effect of base pipe material on heat flow is significant. The largest effect is for the CPVC cases (as CPVC has the lower thermal conductivity). Compared to the copper case, the CPVC cases show reductions of heat flow of 21%, 34%, and 27% for the three examples, respectively. Reductions for the PEX case have a smaller effect and average an 8% reduction of heat flow. For the still air case, the lower emittance of the copper surface (Ɛ=0.6) contributes some thermal resistance relative to the plastic cases (Ɛ=0.9).

- The impact of the base material decreases as the amount of insulation increases. In Example 1 with 1 inch of insulation, the heat loss for the CPVC material is 7% less than the comparable copper case. At 2″ of insulation, the difference is below 5%. Considering all three examples, the impact at 2″ of insulation averages 4.4%

- Based on these examples, trading insulation thickness for lower conductivity pipe material would not work. In Example 1, at the code-required insulation thickness of 1″, the heat loss for the copper pipe system is 12.2 Btuh/ft. The alternate design of CPVC with ¾” of insulation (the next smaller increment for this insulation material) yields a higher heat loss of 12.9 Btuh/ft. Examinations of the other cases yield a

similar conclusion: Plastic pipe lowers the heat flow, but not enough to

justify removing an increment of insulation.

Energy Code Requirements for Piping

All of the current model energy codes contain insulation requirements for domestic hot water and HVAC piping. Although the details vary somewhat, the requirements are generally given as a minimum insulation thickness without regard to pipe material. As an example, requirements for service water heating from the 2012 IECC are given in Section C 404.5 and read as follows:

C404.5 Pipe insulation. For automatic-circulating hot water and heat-traced systems, piping shall be insulated with not less than 1 inch (25 mm) of insulation having a

conductivity not exceeding 0.27 Btu ?inch/(h?ft2?°F).

The first 8 feet (2438 mm) of piping in non-hot-water-supply temperature maintenance systems served by equipment without integral heat traps shall be insulated with 0.5 inch (12.7 mm) of material having a conductivity not exceeding 0.27 Btu?in./(h?ft2?°F).

The only qualifier here is that the insulation has a conductivity not exceeding 0.27 Btu?in./(h?ft.2?°F). Insulation thickness requirements are the same whether the base material is copper, schedule 40 steel, schedule 80 stainless steel, CPVC, or PEX. While the choice of base material will impact the heat loss or gain of insulation systems, the effect is relatively small for insulated piping.

The 2012 IECC requirements for piping for HVAC systems in commercial buildings are summarized in Table 6. The thickness requirements here are differentiated by operating temperature and by nominal pipe or tube size. As before, the thickness requirements are not differentiated by pipe base material or wall thickness.

Thickness requirements are again independent of the insulation material, as long as the conductivity of the material falls within the specified range. If the conductivity of the insulation layer is outside the specified range, the required insulation thickness must be adjusted based on the equation in Table 6’s footnote b. Note that since the emittance of the outer surface is not addressed in Table 6, the thickness requirements are independent of the outer jacket material as well.

The code requirements for piping do not address some other system variables known to impact thermal performance. For example, thickness requirements are independent of location within the building. While it can certainly be argued that hydronic piping to a reheat coil routed through a return air plenum, where moving air is increasing heat loss, should have more insulation than a similar line run through a closed cavity in still air, energy codes do not require different insulation thicknesses.

When considering these energy code requirements, they may appear to be overly simplistic. However, one of the goals of code writing organizations is to state the requirements as simply as possible, while still meeting the intent of the code. Buildings are complicated, with literally thousands of code requirements subject to verification. A good code requirement must be simple and easily verifiable.

While the 2012 IECC minimum thickness requirements for pipe insulation are not dependent on pipe material, it is recognized that code officials may be receptive to alternatives based on a technical analysis demonstrating that the thermal performance of an alternative design is as good as or better than a baseline case meeting the code. For

example, the ASHRAE 90.1-2010 Standard (which formed the basis for the 2012 IECC requirements) has a footnote to the requirement table:

The table is based on steel pipe. Non-metallic pipes Schedule 80 thickness or less shall use the table values. For other non-metallic pipes having thermal resistance greater than that of steel pipe, reduced insulation thicknesses are permitted if documentation is provided

showing that the pipe with the proposed insulation has no more heat transfer per foot than a steel pipe with insulation shown in the table. This specifically provides flexibility to designers to use thick-walled plastic piping with reduced levels of insulation, provided the alternative design has no more heat transfer than the baseline design.

A number of “Green Codes” or “Stretch Codes” have been developed with the intent of going beyond the minimum requirements in base codes. These model codes are available for jurisdictions or owners who desire improved building performance. Examples include the International Green Construction Code (IgCC), the International Association of

Plumbing and Mechanical Officials (IAPMO) “Green Plumbing and Mechanical Code

Supplement,” and ASHRAE Standard 189.1-2011 “Standard for the Design of High-Performance Green Buildings.” While none of these model codes specifically call out exceptions for insulation on plastic piping, alternative designs are generally allowed if justified by technical analysis. The wording in section 102.1 of the IAPMO Green Supplement is typical:

102.1 General. Nothing in this supplement is intended to prevent the use of systems, methods, or devices of equivalent or superior quality, strength, fire resistance, effectiveness, durability, and safety over those prescribed by this supplement. Technical documentation shall be submitted to the Authority Having Jurisdiction to demonstrate equivalency. The Authority Having Jurisdiction shall have the authority to approve or disapprove the system, method, or device for the intended purpose.

Conclusion

All current building energy codes and standards require pipe insulation on service hot water and HVAC piping. Requirements vary, but none of the model codes differentiate pipe insulation requirements based on pipe material.

For uninsulated or bare pipe, the higher thermal resistance of the plastic pipe walls can significantly reduce heat flow (by roughly 30%) compared to copper piping. As insulation levels are increased, the impact of pipe wall resistance decreases significantly. At the insulation levels required by current energy codes and standards, the impact of pipe wall material on overall heat transfer is small.

In some applications (e.g., condensation control or freeze protection), the lower conductivity of plastic compared to metallic piping materials could be advantageous and may obviate additional thermal insulation. For other applications, additional insulation may be required, depending on the design objectives and the specifics of the situation.

Thermal insulation for mechanical systems has proven to be a simple and cost-effective technology for reducing heat losses and gains in building systems. As energy codes and regulations (both prescriptive and holistic), become more stringent and building owners, operators, and tenants strive for higher performing and more sustainable buildings, designers should be focusing on how and where to use more, not less, insulation. For example, some designers are considering using pipe insulation to conserve scarce water resources, as well as energy, in domestic hot water delivery systems.6 Since the expected useful life of buildings can be 50 years or more, it is significantly easier and more cost-effective to plan for and install proper mechanical insulation systems at the time of

construction than to retrofit or upgrade the insulation systems later. Likewise, when facilities are being renovated or repaired, the opportunity to upgrade mechanical insulation systems should not be overlooked. Efforts to sacrifice mechanical insulation levels to minimize initial costs are counterproductive, and building owners would be better served to focus on examining the long-term performance of building systems.

This article was developed by the National Insulation Association (NIA) and the North American Insulation Manufacturers Association (NAIMA).

References:

- Barrett, Stephen R. “Potable and Process Pipe and Fitting Advances Utilizing Radio

Frequency Fusion Welding.” IAPMO Emerging Technologies Symposium, May 1, 2012

- National Institute of Building Sciences, “The Mechanical Insulation Design Guide,” www.wbdg.org/design/midg.php

- Plastic Pipe and Fitting Association, “Installation Handbook: CPVC Hot & Cold Water Piping,” 2002.

- NAHB Research Center, “Design Guide: Residential PEX Water Supply Plumbing Systems,” November 2006.

- ASTM C680-10, “Standard Practice for Estimate of the Heat Gain or Heat Loss and the Surface Temperatures of Insulated Flat, Cylindrical, and Spherical Systems by Use of

Computer Programs.” ASTM International, West Conshohocken, Pennsylvania. 2010.

- Klein, G., “Hot Water Distribution Research,” Insulation Outlook, December 2011.

Copyright Statement

This article was published in the September 2012 issue of Insulation Outlook magazine. Copyright © 2019 National Insulation Association. All rights reserved. The contents of this website and Insulation Outlook magazine may not be reproduced in any means, in whole or in part, without the prior written permission of the publisher and NIA. Any unauthorized duplication is strictly prohibited and would violate NIA’s copyright and may violate other copyright agreements that NIA has with authors and partners. Contact publisher@insulation.org to reprint or reproduce this content.