Economic analysis and the

30,000-foot view are valuable ways to assess the state of the mechanical

insulation industry, but for this issue, Insulation Outlook wanted to get the

perspective of those who work in the industry on a daily basis: National

Insulation Association Members.

The following interviews

will give you a glimpse into the challenges and changes they are seeing in the

industry, as well as what they expect to happen in the coming year.

The views represented here

span the different categories of NIA Members: commercial and industrial

insulation manufacturers, distributors, fabricators, and contractors. We think

you’ll find these perspectives valuable.

1. In your opinion, what is the current state of the

industry?

I think

that the industry is in a solid position to reduce energy costs, show savings,

and have an impact on the environment; so we should continue to grow in terms

of awareness and opportunities. Growth may be slower than what I would like to

anticipate, but steady. The industry still needs to work together more, and all

of our NIA Members need to be more involved. [Beyond the industry], I wish I

had more confidence in the current business environment in the United States.

2. What do you see happening in the insulation industry

over the next year?

I think

things will remain steady and constant, with some minimal growth. The economy

is still stalled for the most part?although sectors and certain markets are

showing some moderate growth?as we wait to see what happens in November. There

is significant opportunity for growth and energy independence, but the attitude

in Washington has to change. Our industry can be at the forefront in terms of responsibly

helping energy independence and energy cost reduction/savings moving forward,

but? the political environment in D.C. has to be more business friendly, and we

are not there or even close to being there.

3. What were your biggest challenges in 2011, and what do

you foresee as the main challenges in 2012?

Our

biggest challenges were maintaining margins while growing. We were able to

further diversify our offering, which was great, but the outside pressures

related to margins were a daily fight. Discipline was a key factor in our

success.?

For 2012, we will continue with our business plan and stay on

task and remain disciplined. The challenges will be the factors that we cannot

control, which are related to the government? like excessive taxation and

deficit spending.

4. What changes would you like to see in local, state, or

federal regulations or energy policies related to mechanical insulation in the

commercial and industrial markets?

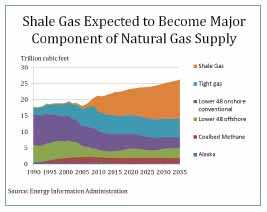

[Changes related to] energy independence,

specifically:

1. Development of the Keystone Pipeline.

2. Development of further oil and gas opportunities in

Alaska.

3. Further off-shore drilling within U.S. waters.

4. Further research on alternative energy sources.

5. Nuclear plant development.

6. A 20-year plan for infrastructure has to be developed

across the country.

All of the above can be done responsibly and safely

for the environment. This will create jobs, help our industry grow and give our

industry the opportunity to participate in a meaningful way toward energy

independence. The oil industry can have a huge impact on our economy and

economic stability. We can have energy independence with a good environmental

policy.

Related to alternative energy solutions, we

need to spend the time to develop these options over time. It is very

concerning to watch the amount of waste that goes into research in the effort

to win the race to be first. Washington, D.C. needs to set up the proper

business climate and not attempt to be in the development business. The federal

and state governments need to set up a business environment that will allow

business to grow and become healthy so that research and development dollars

can be put back into business. In the current business environment of tax and

regulate, we are locked up.

5. What are the products or insulation systems of the

future? When can we expect to see them?

In a more business friendly climate, there would be

further energy development and then I truly believe that you would see our

manufacturers, both domestically and abroad, begin to develop and release new

products.

A major benefit is that we have products

currently available that can have an immediate impact on energy savings and the

environment.

6. What initiatives would you suggest the industry undertake

to promote the perception of mechanical insulation as an important energy

efficiency initiative?

We need to stay on the current track to eventually

get tax incentives in place for mechanical insulation. NIA has worked very hard

to position us for the future; unfortunately, we cannot control the political

environment. Patience and persistence is the key.

7. How can the industry better educate facility owners

about the advantages of proper and timely maintenance, as well as the risk of

not having an effective maintenance program?

We need our membership to take the tools and

information that are available and begin to sell again. Most of us are caught

in our daily routine, dealing with all of the details that require basic

business to be accomplished day in and day out. If every NIA Member would

present the benefits of mechanical insulation to three facilities per month, we

would be on our way. What I would stress is that you need to be on your game,

understand our products, and last of all have the right audience.

8. What potential events do you foresee over the next two

years in the construction industry?

There

will be demand for more environmentally friendly buildings. There are pockets

of interest now. Water conservation will move to the forefront. I believe that

the overall operating cost of a building and/or facility will come under severe

scrutiny ? to reduce cost and become much more efficient.

Modeling a plant or building before it’s built, or reviewing

it in terms of how it is to be maintained in the future, will also become much

more visible.

All of that said, if we don’t change the business environment

in the United States, we will fail in our efforts to reduce and conserve

energy. We will not be able to grow and develop as a country with excessive

taxation and continued deficit spending.

For more information, call

425-228-4111 or visit www.ejbartells.com.

1. In your opinion, what is the current state of the

industry?

I can really only speak to the industrial market, and

we are seeing a slight decline after several years of solid performance and

steady growth. The decline should only be temporary, as the engineering firms

seem to be loaded with projects that will come on line in the next few years.

In the South and Southwest, we have not been impacted as much by the economic

downturn that some other parts of the county have. There are several power

plants that are in pre-construction or the early stages of construction, and

insulation will play a key part in the success of these plants. For the first

time in decades a new nuclear power plant is being built, and this, too, should

be good for the future of our industry. If lending institutions begin to loosen

up, the commercial market should begin to gain traction.

2. What do you see happening in the insulation industry

over the next year?

Hopefully, getting the tax initiatives program

passed. Realizing this is an election year, that may not happen; but we have to

keep trying and we will. We must continue to educate the end users on the value

of energy conservation and the role our industry plays. Recently, I went online

to a state energy center for studies website and nowhere on the site was

insulation mentioned. That tells me we may still be, as Ron King says, “the

forgotten industry”?although through NIA it is being promoted. Insulation has

to become a forethought rather than an afterthought.

3. What were your biggest challenges in 2011 and what do

you foresee as the main challenges in 2012?

It is not just a challenge for the upcoming year but

the future as a whole, and that is the demographic of our workforce. Insulation

is a wonderful field to work in and truly is a learned skill. Our craftsmen can

make a good living for themselves and their families. The most difficult part I

see is encouraging young people to come work in our industry and the

construction industry as well. Throughout the country, training programs are

available if they are ready to learn.

Another challenge is getting more of the

engineering firms, architectural firms and even the end users to think about

insulation during the pre-engineering and/or design process and perhaps get us

involved on the front end of projects. We have a wealth of knowledge that can

be beneficial in most cases. If they would seek input from us, we might be able

to assist in a better design and save them money.

4. How can the industry better educate facility owners

about the advantages of proper and timely maintenance, as well as the risk of

not having an effective maintenance program?

I think with the tools and information available

through NIA, many members are attempting to do this every day. This past fall

several NIA Members made a presentation to the National Association of State

Energy Officers (NASEO) at their annual convention on the role of insulation

with regard to energy conservation, and I believe it opened many of their eyes.

Rather than just talk about how insulation can affect energy efficiency, an

actual example was used where the savings were significant with a quick return

on investment. Additionally, when we discussed the reduction in greenhouse

gases, it really got their attention. We must continue to take advantage of

these types of opportunities to get in front of groups like NASEO to present

our message.

Facility owners are looking for ways reduce costs and we have

the products that can produce almost instantaneous results. Now when I speak to

facility owners, I use concrete examples of how proper insulation can save them

money and reduce their carbon footprint. Some are beginning to listen. Just

about every state in the country has a budget deficit and is looking for ways

to reduce expenses. We are on the cusp of helping them toward that endeavor.

For more information, call

225-343-0471 or visit www.pentrincorp.com.

1. In your opinion, what is the current state of the

industry?

The state of the industry is good?not strong, but

good. Those of us in the insulation industry are encouraged by improvements in

the industrial sector, where some large construction and renovation projects

are starting. In the commercial sector, we are

seeing growth with smaller one- and two-story commercial projects.

Institutional

sectors like hospitals, schools and government projects remain a mainstay for

this industry. They helped us weather the recession. Serving these industries

well is very important for companies in our industry.

In the residential industry, housing starts

are slow but are expected to increase as 2012 progresses. When this market

increases, we will see growth of consumer confidence, which impacts all types

of businesses to a degree.

There is growth in the retrofit and

renovation side of our business. There’s a lot of uninsulated pipe and duct out

there. This represents a huge opportunity for the insulation industry.

2. What initiatives would you suggest the industry undertake

to promote the perception of mechanical insulation as an important energy

efficiency initiative?

Education is and always has been the key. We have to

continue to tell the story of how insulation is a great investment and how, in

many cases, it will pay for itself in months and not years. It is an investment

that pays greater dividends the more expensive energy becomes; and I don’t

think anyone expects energy?at least not petroleum-based energy?to become

cheaper long term. Our industry needs to champion energy efficient

construction. We have to remind our customers that energy efficiency doesn’t

happen without mechanical insulation! As energy costs go up, the savings from

installation of adequate insulation will pay back even quicker. It’s an easy

story to sell, and it bears repeating again and again.

Telling the story of the energy-saving benefits of insulation

will also help to reduce the instances of insulation being

“engineered out” of projects for the purpose of cost savings. As Building

Information Modeling (BIM) takes hold in the building community, engineers and

architects will continue to do more pre-construction analysis. This analysis in

the pre-construction phases holds the potential for validating insulation

products?perhaps even one day demonstrating to owners and engineers what the

exact value is. When that happens, engineers and owners will begin to see

insulation as a non-negotiable mechanical component.

For more information, call

919-304-3846 or visit www.armacell.us.

1. In your opinion, what is the current state of the

industry?

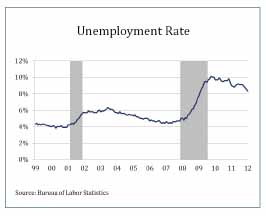

Indications are that the economic downturn, which

started over three years ago, has just about run its course; and that activity

in the construction industry is beginning to grow. However, that growth is slow

at best.

2. What do you see happening in the insulation industry

over the next year?

As the economy grows, there should be more

opportunities for all insulation in the coming year. As the awareness of the

value of insulation increases, our industry should be in a favorable position

to expand at a more rapid pace than the general economy.

3. What were your biggest challenges in 2011 and what do

you foresee as the main challenges in 2012?

We had difficulty controlling healthcare costs in

2011 and we expect that to continue through 2012 and beyond as the new

healthcare legislation begins to take effect. Price increases in almost all of

our raw materials and finished goods expanded at a rate that was difficult to

keep up with. Our customers, especially contractors, were hard pressed to

estimate what material costs would be for jobs they were asked to quote. That

trend is continuing in 2012. The recent rise in fuel prices also will affect

us.

4. What changes would you like to see in local, state, or

federal regulations or energy policies related to mechanical insulation in the

commercial and industrial markets?

Anyone who listened to the State of the Union heard

the president use the word “insulation” when he was discussing energy savings.

That is a very positive sign. NIA has been in the forefront of the effort to

get energy legislation through Congress. There is a good story to be told about

the value of insulation, and we are telling it.

5. What are the products or insulation systems of the

future? When can we expect to see them?

While it is difficult to predict the future, there

have been several new products that have come to market in the past several

years: Aerogels and fiberglass with non-organic binders being two of them. I

would anticipate that this trend will continue.

6. What initiatives would you suggest the industry

undertake to promote the perception of mechanical insulation as an important

energy efficiency initiative?

As I drive to work each day, I pass several

billboards along the interstate highway extolling the virtues of insulation.

These ads are paid for by Local 17 of the Heat and Frost Insulators of Chicago.

I would not have guessed 5 years ago that I would be seeing this. We, along

with many others, are doing lunch-and-learn presentations to engineers and end

users and we are having an easier time getting past the gate keepers! These are

some of the things that we, as suppliers, are doing; and I know that the

contractors and manufacturers are engaged in similar activities.

7. What potential events do you foresee over the next two

years in the construction industry?

There has

been some consolidation in our industry, and I would expect that would

continue. We have been in an unsettled political climate for some time now, and

that will continue at least until the election in November.

For more information, call

800-775-4485 or visit www.insulationfabricators.com.