This Series Features the Participants of NIA’s Insulation Project Art Gallery Showcase and Competition

PROJECT SNAPSHOT

Insulation Contractor: Insul-Tech Inc.

Industry Segment: Commercial

Type of Plant/Facility: Mission Critical Data Center

Project Goals: Freeze Protection, Condensation Control, and Process Efficiency

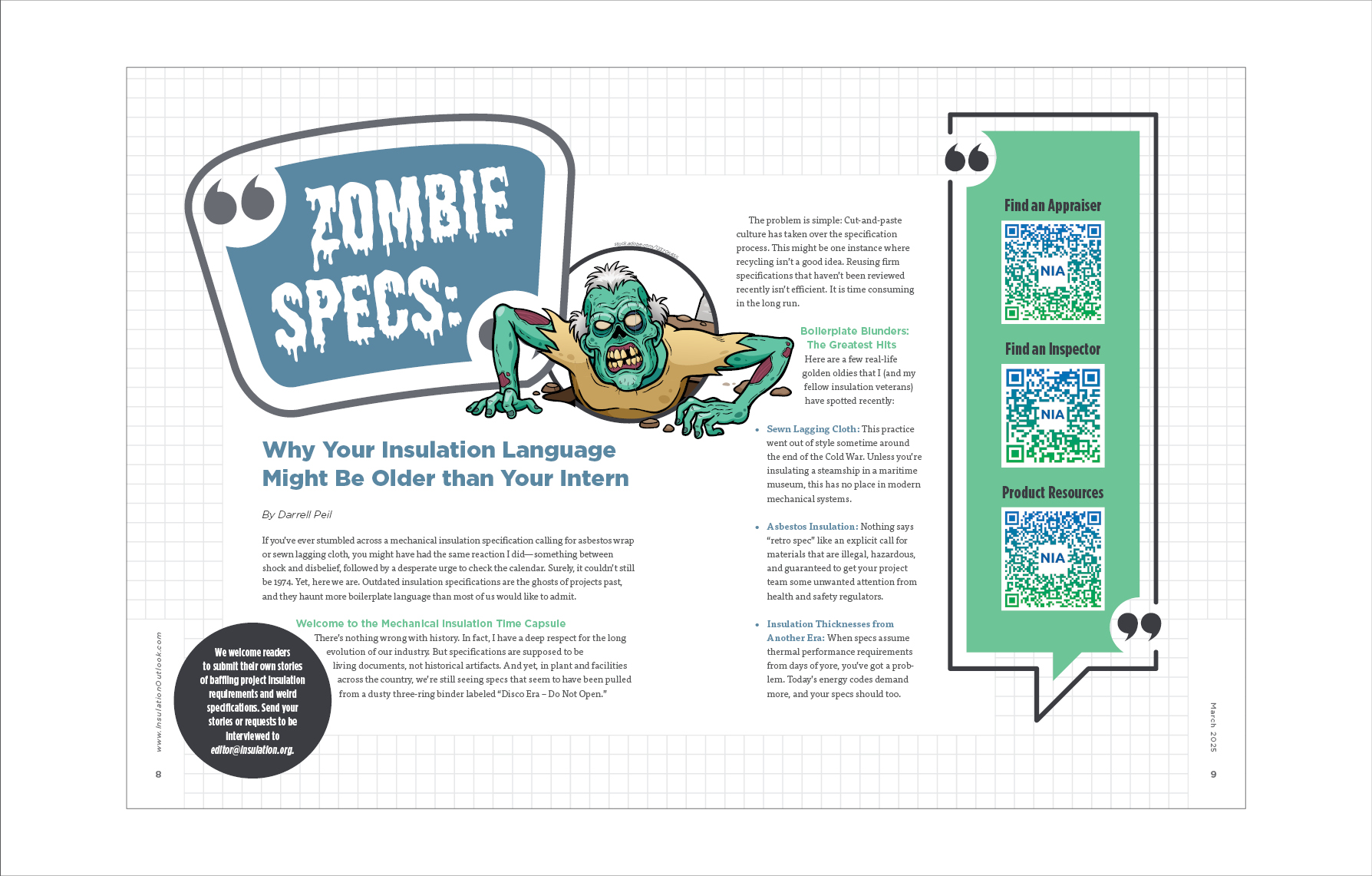

Type of System/Application: Chilled Water, Condenser Water, and Thermal Energy Storage (TES) Tank Pipe

Temperature Range: Below Ambient

Region: Northeast

Insulation Materials: Owens Corning Fiber Glass

Jacketing: Ideal Metal Jacketing

Vapor Barrier: CP33 (Childers)

Tape/Jacket Adhesive: ASJ Tape (Ideal Tape), FSK Tape (3M Tape)

Fittings: Proto Corporation Pre-Molded PVC Fitting and Flange Covers

Other Adhesives & Sealants: Everkem Trusil 100 Caulk (used on inside equipment only)

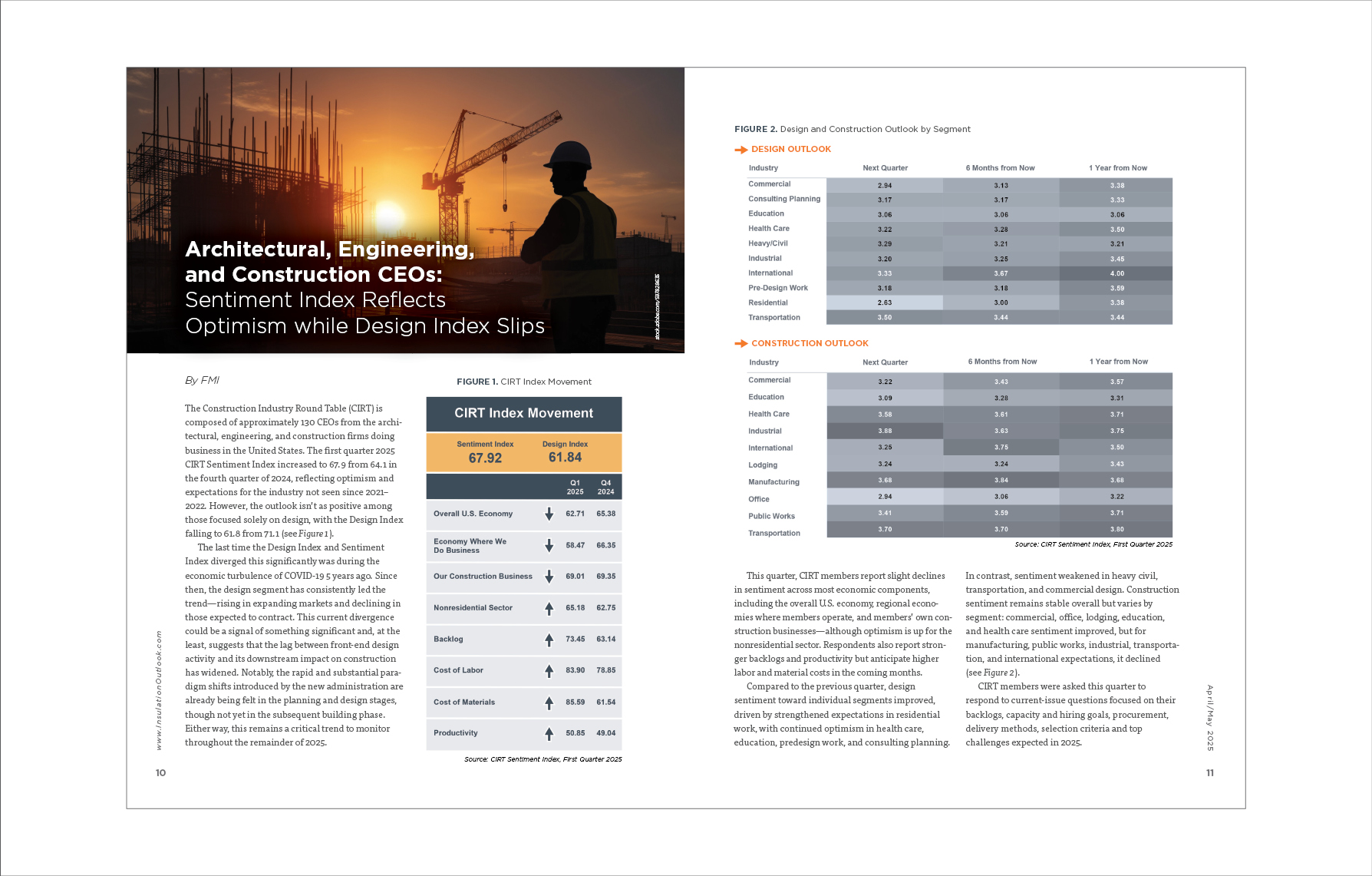

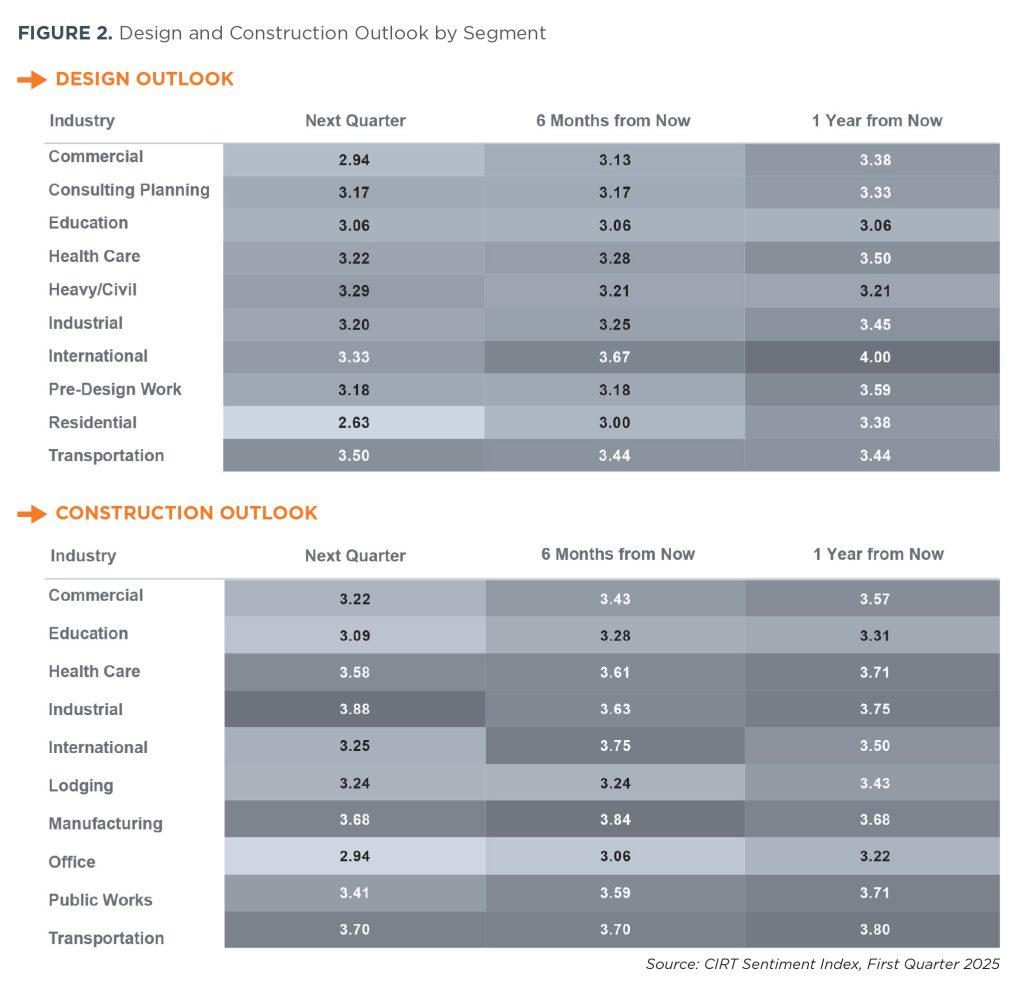

Project Description and Goals

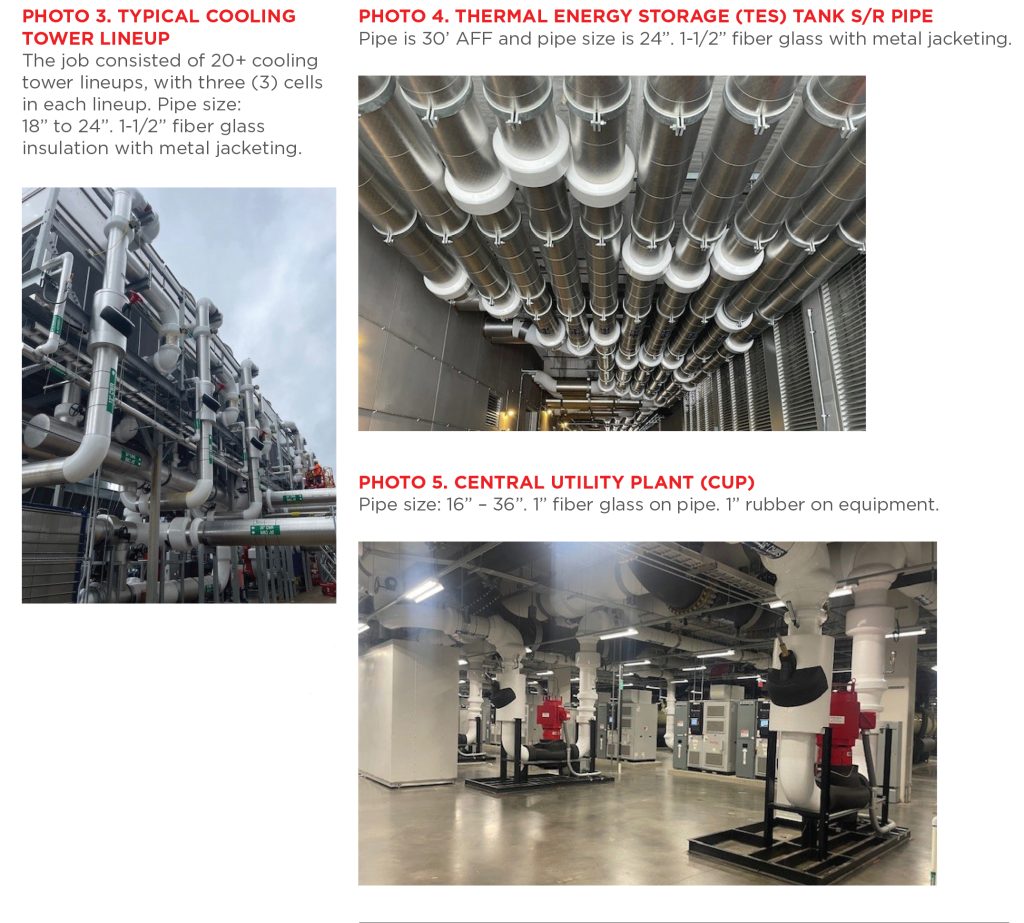

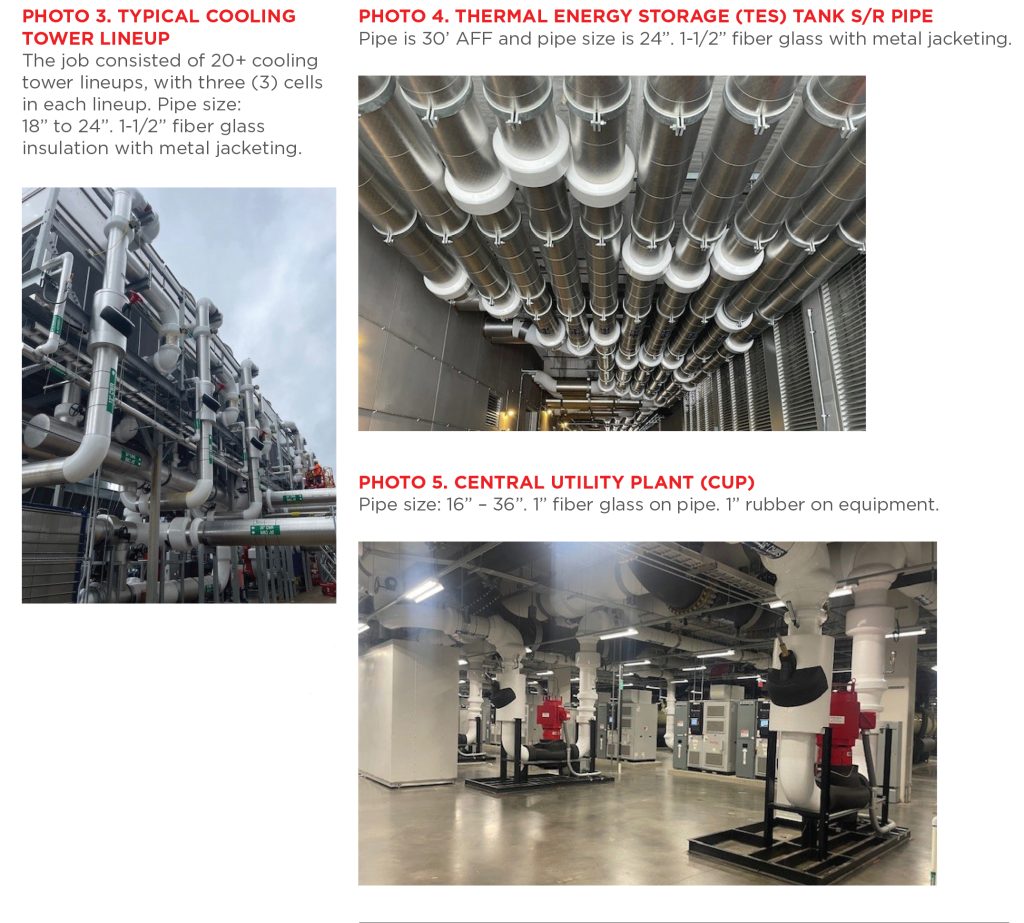

This enormous $7 million new construction project located in Northern Virginia is part of “Data Center Alley.” It involved insulating nearly 10,000 feet of pipe, including 3,000+ feet of 36″ pipe, and 6,500+ feet of 24” pipe that needed to be completed within 12 months of contract award. That meant insulating the extremely large-diameter piping outdoors working through the harsh elements of winter and the heat of summer. The owner of the facility had three main goals for the insulation system: freeze protection, condensation control, and process efficiency.

Challenges

Aside from the project’s size, this job had many challenges that all stemmed from the aggressive 12-month overall construction schedule. For example, the final design was still being finalized post contract award. With the 12 month clock ticking, completing the insulation specifications with engineers was imperative. Vice President Matt Stillitano says, “Insul-Tech assisted our mechanical partner, as well as the design engineer, to ensure that the insulation specifications were adequately constructed. Engineers are typically tasked with solving problems, and we assist with that. You have to make a case for being part of the process and justify taking up their time. Once you explain your knowledge of the project, they understand that you can be a trusted source. We are willing to engage on any mechanical insulation topic, large or small, and they recognize that Insul-Tech puts in the time, energy, and effort into our projects, and it is rewarding.”

Once the specifications were finalized, Insul-Tech could begin placing the made-to-order (MTO) large diameter pipe covering. Insul-Tech worked closely with their distribution and manufacturer partners to ensure all of the special-order large-diameter fiber glass and PVC jacketing lead times stayed on schedule. Stillitano says, “Communicating with our partners, Metro Supply, Owens Corning, and Proto Corporation was incredibly important. Although nothing will ever go perfectly, especially when purchasing this volume of material, we worked in lockstep with all of them to ensure we knew the lead times, as well as the setbacks.”

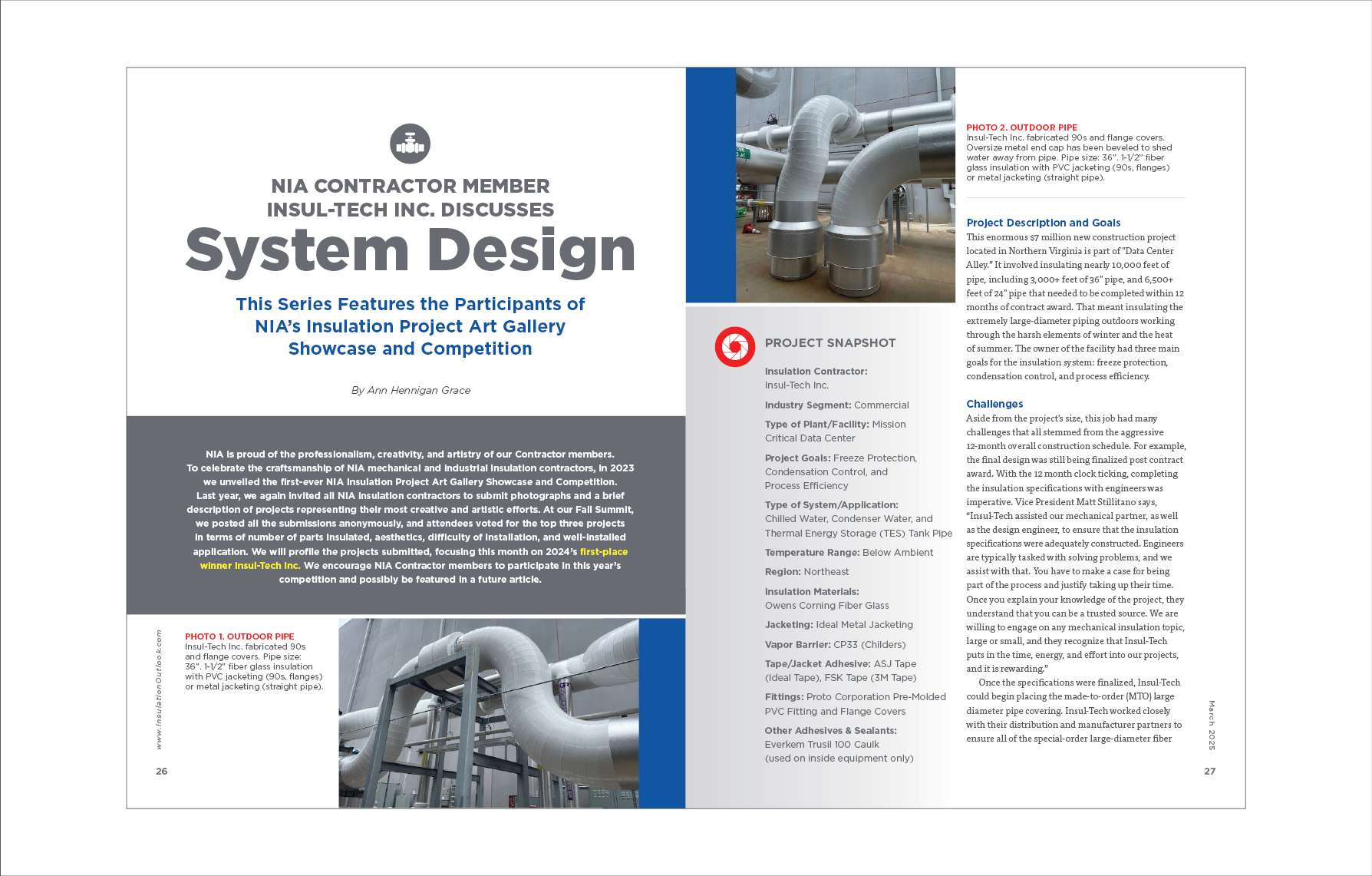

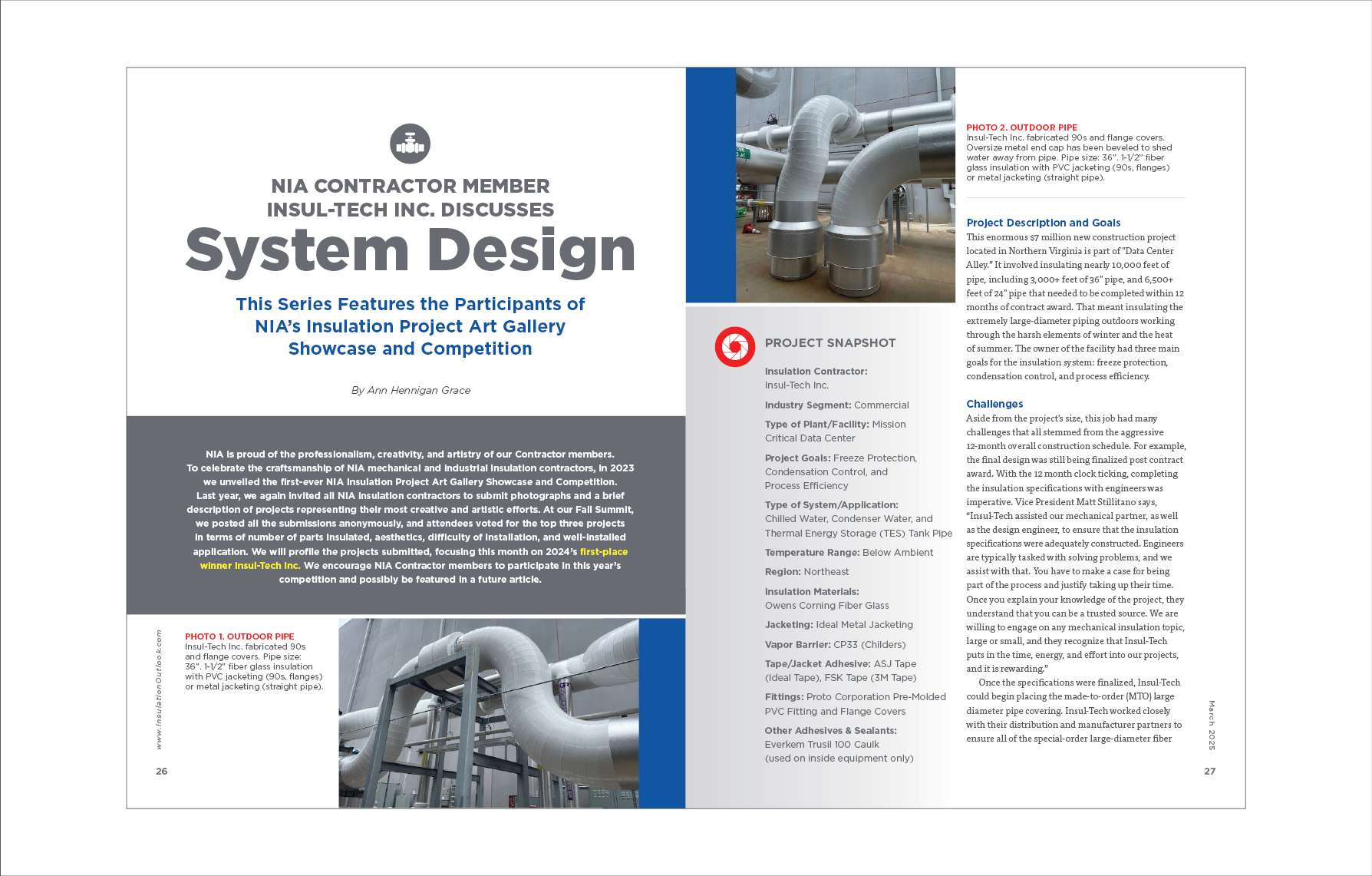

The mechanical piping layout of the mission-critical facility had numerous challenges for field installation, with curves and large, irregular shapes (see Photos 1 and 2). Project Manager Sean McLaughlin explains, “Due to the large diameter size of the chilled water and condenser water piping, factory fittings were not available, and therefore our employees were tasked with customizing many of the fittings and flange covers. We had dedicated crews fabricating custom fittings for months ahead of testing to ensure that they were available for installation once testing was complete.”

Stillitano says one of his goals was for Insul-Tech’s employees to always bring a healthy attitude to these types of situations. He elaborates, “On a blueprint, you are not able to foresee how everything will be installed by a mechanical partner. Because of that, you have to be flexible and adjust your install accordingly to ensure a high-quality product.” He stresses, “I can guarantee that in my 16+ years, mechanical companies do not willingly install pipe to make our life harder. They install pipe, fittings, and valves per their own set of specifications and per the design engineer. They, like us, are held to a high standard for installation. Knowing this and having this perspective is invaluable to our overall company culture. We preach this mindset daily to our Superintendents and Field Personnel.” So, while the curves and irregular shapes “created extra work that we could not foresee up front,” Stillitano observes, “if you always do the same type of project, your knowledge will never learn and evolve. Our insulators took this in stride and enjoyed it. They were up to the challenge.” Insul-Tech Superintendent Felix Calderon underscores that point, saying, “The most interesting and exciting part of this project was facing the challenge of being able to customize the large insulation products, given lead time, availability from the manufacturer, and the project schedule. Insul-Tech had to adjust to a new experience. We had to coordinate a separate team dedicated to fabricating the necessary parts. Our crew did a tremendous job, demonstrating what is possible with a committed, competent team.”

One aspect of the job that was less enjoyable was insulating 3,000+ feet of 36” pipe outdoors in temperatures ranging from high humidity and heat to freezing rain, snow, and ice. Project Manager Sean McLaughlin described the conditions: “Insul-Tech employees were faced with working through all four seasons, from an extremely cold environment in the winter months to extreme heat in the summer. The big push to the completion of Phase A landed in July and August, when it is the hottest and most humid.” Rain, snow, and ice also resulted in the shutdown of exterior work. During one particularly cold snap, where temperatures fell to the single digits, the mechanical yard was covered in ice and shut down for a few days before crews were allowed to resume work.”

As mentioned earlier, McLaughlin and Stillitano continued to emphasize that completing this project on time would not have been possible without the company’s partnership with its distributor and manufacturers. Insul-Tech needed to minimize material procurement lead times as much as possible. The company’s relationships with manufacturers and distributors—many formed within NIA—allowed them to obtain materials quickly. (See sidebar, “NIA [Manufacturer] Members’ Products Helped Make the Project a Success.”) Stillitano notes, “Early in the project, Owens Corning visited the jobsite to gain an understanding of the project scope. It really stood out to me how committed they were, listening to us and wanting to understand what was needed not by phone but by being present on site. When you have the manufacturer and distributor wanting to put forth that kind of effort, it gives you more peace of mind for the overall project success.” McLaughlin says their partners “worked tirelessly through the logistical challenges of keeping material stocked and ready for us when we needed it.” They all worked together to make this project a success.

NIA Associate (Manufacturer) Members’ Products Helped Make the Project a Success

- 3M—FSL Tape

- Ideal Products—Jacketing

- Ideal Tape—ASJ Tape

- Owens Corning—Fiber Glass Insulation

- Proto Corporation—Pre-Molded Flange Covers, PVC Fitting Covers

Always Emphasize Safety

On a large, fast-paced jobsite, with so many trades putting in long hours to meet an aggressive schedule, there can be pressure to cut corners. Beyond regular safety training, Stillitano emphasizes, “We tell our employees, if you ever feel uncomfortable, don’t do it! We work hard with our customers to ensure proper safety practices are followed daily by our employees. Safety is a very serious, never-ending job that we take pride in.”

On a project like this, with so many people and so much equipment in the field, and all the environmental challenges, the issue of safety is magnified. Stillitano notes, “We had over 30 insulators working 6 to 7 days a week for 3+ months.” To make sure everyone stayed safe, he adds, “Our Foreman takes on a larger safety role. They fill out daily safety reports, they have toolbox talks, and they reiterate to everyone to make smart decisions to ensure everyone goes home safely to their families each night.” Superintendent Calderon says that message flows throughout the company: “Insul-Tech puts high priority on safety and accident and risk prevention at all times, in every project. Our crews are dedicated to preventing injuries and accidents on the job, and the company always provides the necessary support to ensure our crews have all the safety equipment and training required, including water/hydration, and extra food on occasions where we had to work for long periods of time to meet the aggressive project schedule.”

Insul-Tech’s Insulation Solution

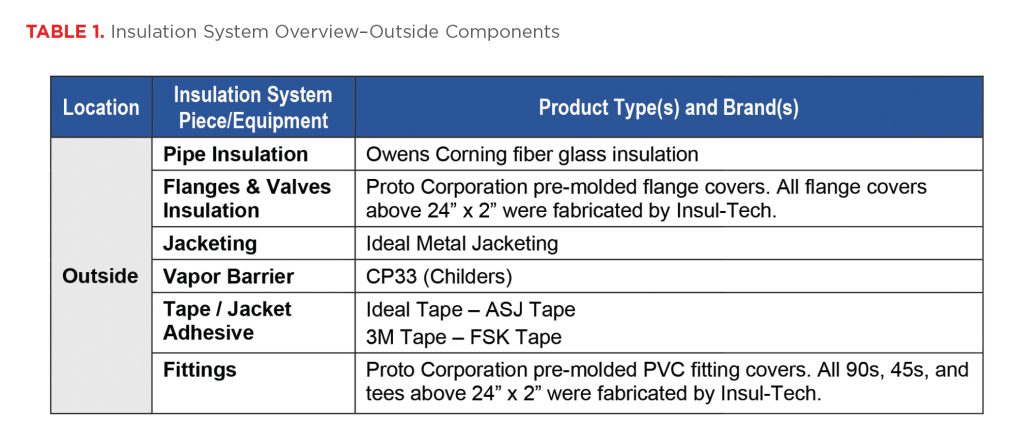

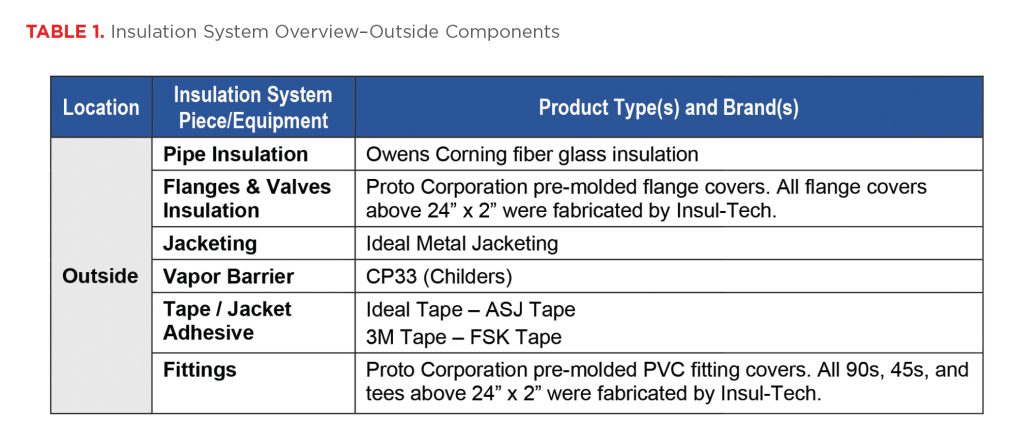

The new construction involved both outdoor and indoor system components. Table 1 provides an overview of insulation system product types and brands used on the exterior pipes and equipment.

Fiber glass insulation was selected as a cost-effective solution to support the customer’s objectives. The product offers the thermal protection needed, and it is durable, cost effective, and relatively easy to install. Given the large diameter of the pipes, and the quantity of material required, Insul-Tech needed to coordinate with Owens Corning to fabricate the pipe covering at the appropriate size since they produce fiber glass in sizes larger than 24 inches.

Metal jacketing was selected to protect the fiber glass insulation (and the pipes underneath) from physical damage, environmental threats like UV exposure and weather conditions, and the ever-present enemy—water. Both jacketing and vapor barrier materials are vital to preventing corrosion and ensuring the insulation system performs as expected.

For the flanges and valve covers, the company turned to another long-standing partner, Proto Corporation. Insul- Tech fabricated all flange covers above 24” x 2” at its fabrication facility.

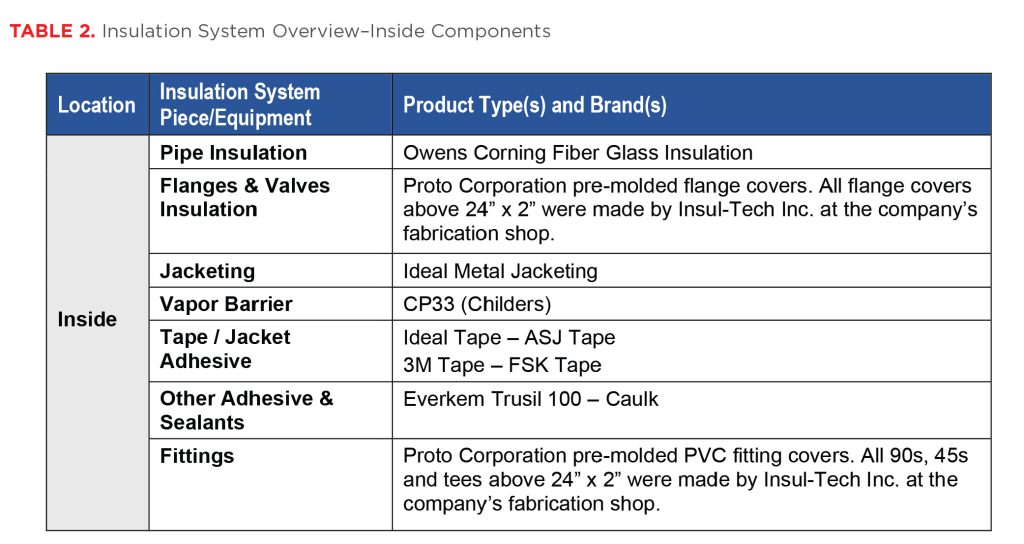

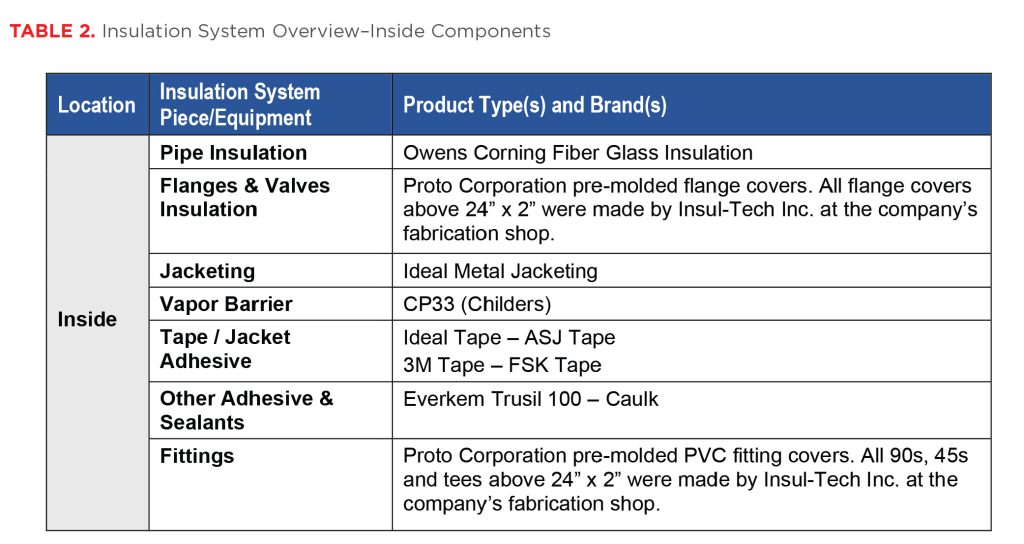

Owens Corning fiber glass insulation, as well as Proto Corporation parts, were used for indoor applications.

Under each large fitting are mitered pieces of Owens Corning pipe and tank wrap, with mitered PVC jacketing pieces installed over/on top. Each mitered PVC piece ran through a beader and crimper prior to installation, for both functional and aesthetic purposes. Functionally, this process created a proper seal/edge. At the same time, the approach resulted in a final appearance that the customer was pleased with.

Table 2 offers an overview of insulation system components used on the interior pipes and equipment, including product types and brands used.

What Made the Project a Winner

Matt Stillitano emphasizes that with all projects, but especially one as large as this, education, communication, and collaboration are vital. He observes, “When you’re voting on a project or looking at pictures of quality insulation [at Fall Summit], very seldomly does anyone realize what you did to get there—especially at this scale. There’s so much preparation, planning, communication, consideration of efficiencies, and an extreme level of coordination involved.”

The collaboration began with the owner and design engineers bringing in Insul-Tech to discuss the proper materials to use and the best installation techniques to meet each of the design objectives. “We work with engineers to be part of the conversation and design. We are trying to pull insulation into the 21st Century and not to just install insulation as directed. We are forward-thinking and try to show engineers that we exist for a purpose. We solve problems and work hard to simplify the process. Our goal is to give them the best possible mechanical insulation system,” Stillitano explains, adding that the company’s success on other projects for this customer gave them credibility. “We are typically involved at some level in design conversations, which has created value to our customers. With a repeat customer, they feel comfortable with our level of expertise as it pertains to their design.”

Once construction was underway, Insul-Tech was not the only contractor laser-focused on getting its work done on time. The jobsite was enormous, bustling with activity. As Stillitano describes it, “There are tractor trailers, 18-wheelers coming in and out constantly. We are just some of people on the project among hundreds and hundreds on the jobsite. Every day, coordination with other trades was necessary to keep making sure the material and personnel are in the right place at all times, ensuring everyone has space to do their work and keeping everyone on the jobsite safe.” With new construction, the list of participants includes sheet metal, pipefitters, plumbers, project managers, general contractors, lift operators, infrastructure support personnel, and more. Insul-Tech alone had a project manager, superintendent, multiple foremen, and crew team members on site. Just as it sounds, Stillitano concludes, “The amount of teamwork and collaboration required for a successful project is staggering.”

Project Takeaways

Work with People You Can Trust

It all starts with quality people. For facility owners/managers and others with decision-making authority, Stillitano emphasizes “hiring a vetted, qualified insulation contractor with a proven track record should be priority number one. Even a quick conversation with a competent mechanical insulation contractor could save an owner, GC, or mechanical company dollars and headaches in the long run.”

Build on Your Relationships

“I have always used any situation in this business as an interview for the next. I was raised to never know who is watching and to always put your best foot forward, to help people, give everyone a chance, and be patient with others. I have met great people in the construction industry, people that want to help you succeed. In return, they want you to learn, grow, and evolve so you can be an asset to them as well—a true partnership.” Furthermore, Stillitano says, “Not everyone understands that’s really what it’s about in this business—partnerships. We are the insulation contractor, we have the stress and the headaches, but we also get the award. Metro Supply, Owens Corning, and Proto are not eligible to win this contractor award [NIA’s Insulation Project Art Gallery Showcase and Competition win], but we know we could not do it without them.” The importance of teamwork and long-standing relationships cannot be overstated. “In today’s world of lead times and procurement struggles,” Stillitano says, “having positive relationships with distributors and manufacturers can be the difference between meeting a deadline or not.”

Educate Yourself So You Can Educate Others

Underscoring a theme many NIA members voice, Stillitano says, “getting input from insulation professionals is a very underappreciated aspect of what we do. I have never had issues with specifications for a project when we assist an engineer. However, I have had many issues when not involved in that process. There is simply a lack of knowledge about what we do and how important it is to get it right the first time. I have seen lots of time, energy, and dollars wasted over the years when the specifications are incorrect.”

Bring Initiative to Every Project

Along with education, initiative goes a long way in delivering a top-notch insulation system. Stillitano says, “You’re not just contracting us to perform the work, but to guide you every step of the way and speak up if needed.” He recognizes that it takes a lot of work. Thinking back on how they insulated the large, irregular shapes and curves of this project, he says, “Putting in the time and effort to develop a solution is part of how Insul-Tech has earned repeat customers. It also keeps our employees engaged and developing as industry-leading insulators.”

Closing Thoughts

Stillitano says, “The size and speed at which this project was constructed made it challenging. I am proud of our team and the level of execution they maintained throughout. It takes constant communication to ensure a quality project is delivered on time.”

NIA congratulates Insul-Tech on a job well done!

In addition to Sean McLaughlin and Felix Calderon, Insul-Tech recognizes the following employees, who each played a vital role in this project.

- Jack Vogt, Pre-Construction/Estimating

- Sabrina Sweeney, Accounting

- Jonathan Ramos, Superintendent

- John Adkins, Superintendent

- Carlos Gonzalez, Foreman

- Ociel Carranza Ambriz, Lead Mechanic

- Gabriel Carranza Ambriz, Lead Mechanic

- Juan Gonzalez, Lead Mechanic

- Emerson Melendez, Mechanic

- Gerson Ortiz, Mechanic

- Jose Armando Ambiz, Mechanic

- Henry Argucia, Mechanic

Calderon adds, “We also want to thank our office staff for their incredible support. They are always a part of our successful experience too.”

About Insul-Tech Inc.

Founded in 2003, Insul-Tech Inc. is a family owned and operated commercial and industrial mechanical insulation contractor headquartered in Frederick, Maryland and serving Washington, DC, Maryland, and Northern Virginia. With insulation requirements and specifications continuing to evolve, the emphasis at Insul-Tech remains on the customer, with energy efficiency and conservation constantly in mind. The company values the importance of staying up to date on the latest materials, designs, and proper installation of all insulation products.

In addition to mechanical insulation, Insul-Tech offers additional services in fire stopping, mold and mildew control, and mechanical insulation energy appraisals.

The Insul-Tech team is well equipped to provide the necessary information for planning and completing your next mechanical insulation project. For more information, visit www.insultech-inc.com.